-

With regulators and policymakers studying their every move, financial institutions need to put more focus on preventing mistakes in the first place.

March 15 Ludwig Advisors

Ludwig Advisors -

Readers debate the merits of activist pressure on bank business, discuss the Trump administration's influence on the CFPB, consider Wells Fargo CEO Tim Sloan's performance before Congress and more.

March 14 -

James Hubbard will replace Stuart Alderoty, who left CIT earlier this year to join the fintech Ripple.

March 14 -

House Financial Services Committee Chairwoman Maxine Waters said the CEO's 2018 bonus was "outrageous and wholly inappropriate" and called for his removal.

March 14 -

East Windsor, N.J.-based McGraw Hill Federal Credit Union will merge into PenFed, the latest in a series of growth moves from the nation's third-largest credit union.

March 13 -

Brett Martinez, president and CEO of a Redwood Credit Union, has become an expert in disaster preparedness after wildfires ravaged the California communities he serves. Those efforts have earned him an Anchor Award.

March 11 -

It took less than six months to hammer out the biggest bank merger in more than a decade, and the price was one of the last things discussed, according to a new federal filing.

March 11 -

Wells Fargo CEO Tim Sloan said that the megabank has worked to address past issues and is equally committed to preventing new problems from arising, despite reports suggesting otherwise.

March 11 -

The San Diego-based credit union’s membership grew at double the national average.

March 11 -

Six senior executives at Chemical and TCF will move into similar roles when the merger closes later this year. Chemical Bank's current CEO, Tom Shafer, will become president of the combined bank, reporting to CEO Craig Dahl.

March 8 -

John Quill, a former deputy comptroller, had a key role deciding which banks could participate in the Troubled Asset Relief Program.

March 7 -

Banks once again are finding themselves in the political crosshairs over customers they finance, but this time it’s community activists, not the government, leading the charge.

March 7 American Banker

American Banker -

The Mississippi company will pay more than $200 million for the parent companies of Texas Star Bank and Summit Bank.

March 6 -

Vince Liuzzi previously served as chief banking officer at DNB First in Pennsylvania.

March 5 -

Jared Wolff, a former PacWest executive, had been the general counsel at City National Bank.

March 5 -

The company will open its first office in Iowa after buying the business from Bankers Trust.

March 5 -

The Illinois-based credit union has broadened its field of membership to include two Missouri counties and issued another dividend.

March 5 -

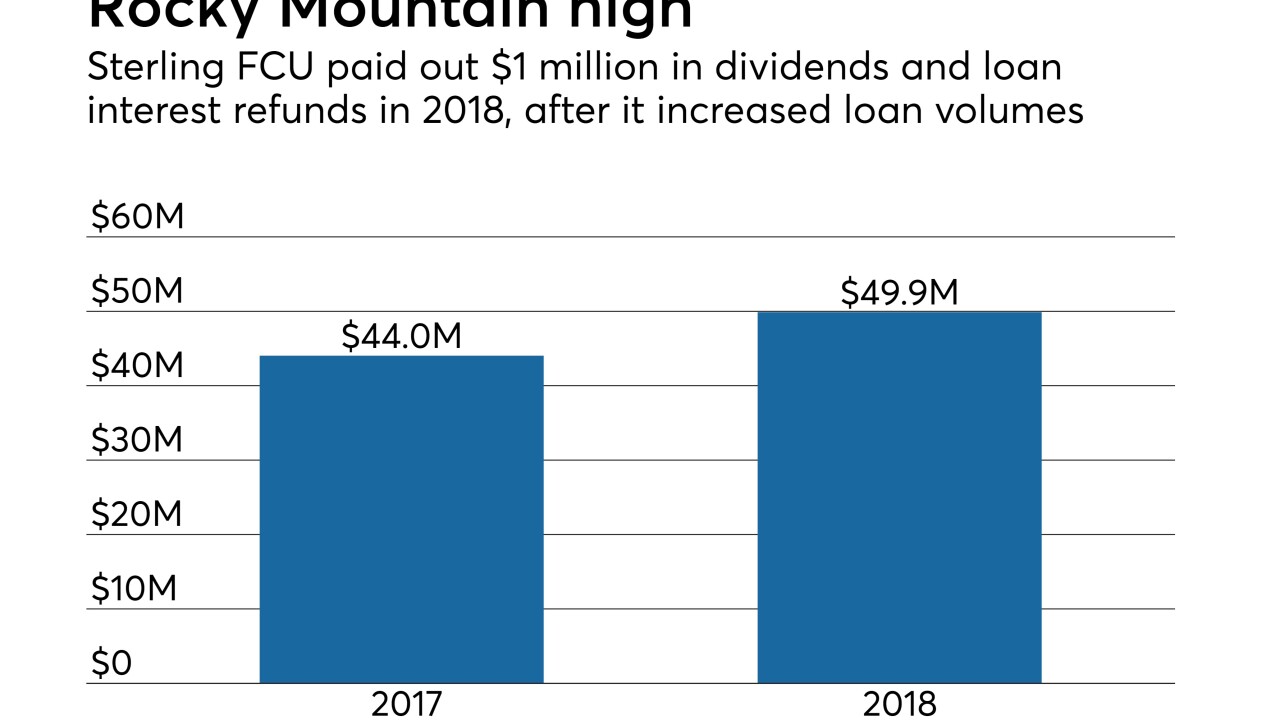

The payout included bonus dividends and a 7 percent refund of loan interest paid by members.

March 5 -

Two Iowa CUs had to come up with new names after a 2018 law prohibited them from using state universities as part of their brand identity.

March 3 -

The settlement would mark a rare instance where the bank stands to benefit monetarily from a scandal that has severely damaged its reputation and cost it hundreds of millions in penalties.

March 1