Credit unions enter the new year with a higher profile than ever before. Despite continued consolidation, membership is at its highest level ever – and so, arguably, is the industry’s profile in Washington. With all eyes already on the November election, however, credit union advocates will have to fight hard for relevant issues to cut through the noise.

From data security to third-party vendor oversight, pot banking and more, there is plenty that Congress could do in the coming year that would have a wide-ranging impact on the industry lasting long beyond 2020. The bigger question is whether lawmakers in D.C. will be able to work together well enough to get legislation passed and to the president’s desk.

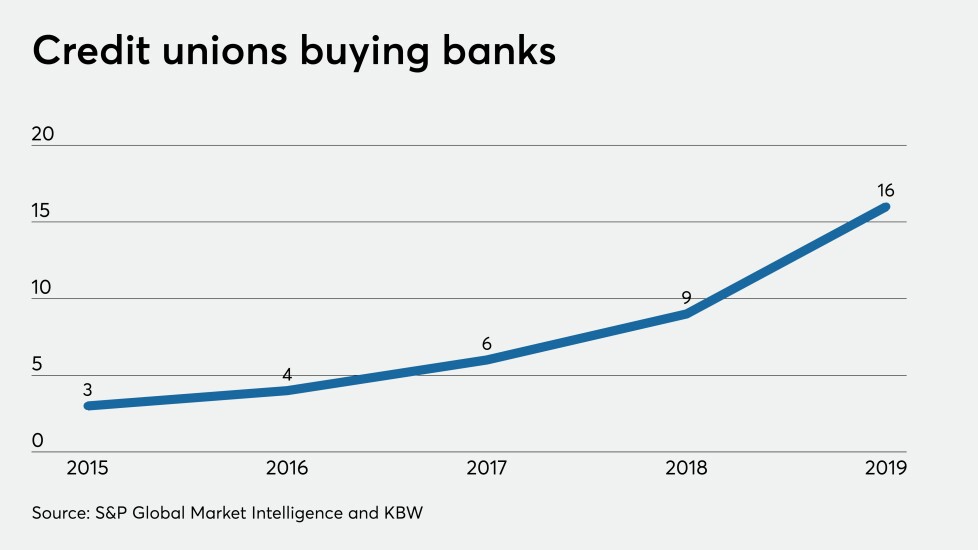

As in recent years, Congress’s inability to move quickly – if at all – puts an added emphasis on the actions of regulators, and the National Credit Union Administration has already outlined a host of topics to be addressed in the coming months that will have a lingering impact, including guidance on bank purchases, capital reforms and more.

There’s also the matter of several pieces of litigation that impact the industry, including an upcoming Supreme Court case examining the constitutionality of the Consumer Financial Protection Bureau and a possible Supreme Court appeal for NCUA’s field-of-membership rule. Individual credit unions may also find themselves wondering if this is the year they may finally be hit with a lawsuit regarding overdraft practices or alleged violations of the Americans with Disabilities Act, both of which have been a major trend for CUs in recent years.

What follows is an outline of some of the major stories the industry will be watching throughout 2020 and beyond.