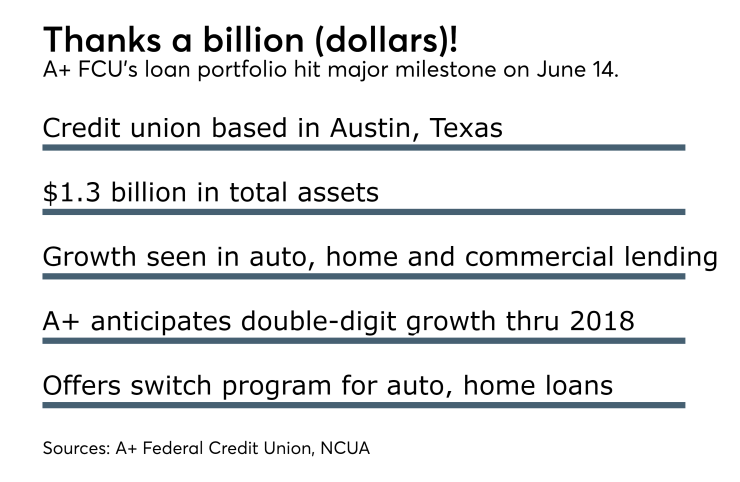

A+ Federal Credit Union on Wednesday reported it reached $1 billion in loan balances on June 14.

The Austin, Texas-based credit union, which has $1.3 billion in assets, said its loan portfolio grew 16%, annualized year-to-date, as of June 30.

A+ FCU said the increase in loan volume has come from auto lending, mortgages and commercial lending. The credit union said it anticipates “strong, double-digit growth” through 2018, despite “challenges” in the lending industry, which it noted includes competition from fintech companies and a slowdown in auto sales.

Part of the growth is attributed to efforts to make it easier for members to move all of their lending business to the credit union and rewarding them for doing so.

“We launched a new auto loan and mortgage program that reduces the member's loan rate with no fees when they move their loan to the credit union," John Demmler, A+ FCU’s chief lending officer, said in a statement.

Kerry A.S. Parker, A+ FCU’s CEO, said of the milestone, “Reaching $1 billion in loans is a great testament of our members' faith in us to serve their financial needs. It is also a demonstration of the commitment our entire team has to providing both exceptional service and extraordinary value to our members. We want our members to think of us first when they consider buying a new home or upgrading with a new auto purchase, because together we are stronger.”

In 2016 A+ FCU reported more than $8.9 million in net income. Its net worth ratio as of Dec. 31, 2016 was 9.19 percent (“well capitalized”).