Want unlimited access to top ideas and insights?

Altura Credit Union recently revamped its online banking, bill pay and mobile banking platforms – and in the process it had to determine when and how to notify members of the coming disruption, and then how to handle the inevitable complaints.

The $1.2 billion CU, headquartered in Riverside, Calif., gave Credit Union Journal an exclusive look behind the curtain of what goes into such a massive undertaking.

Telling members their access to online bill pay would be shut down for two whole days – an eternity in this age of instant gratification – was a tricky task. Then came an influx of telephone calls during and after the transition from people who wanted to vent or needed assistance with the new interface, or both.

Sevan Yakinian, vice president, member services, who led the conversion team, said Altura members “use mobile and online banking 10 times more often than our branches, so it made sense for us to devote resources to these upgrades.” He said the twin goals of the change were to make the platforms more secure, and to expand functionality to give members more self-service and other tools.

More than 70 percent of Altura’s digital banking members are mobile users, adding to the complexity and the importance of the upgrade. Yakinian said Altura’s previous digital banking systems were from two different vendors, the CU’s online banking app needed more security and functionality, and there was “little consistency” between the platforms.

“The mobile app look was dated and was clunky to use. Members told us we were behind the times,” he said. “We were looking to create a big win for our members. It was not just about a conversion of our existing services, but also laying the groundwork for what we can offer going forward. We want this to be dynamic and to keep pace with member expectations.”

Planning started 1 year in advance

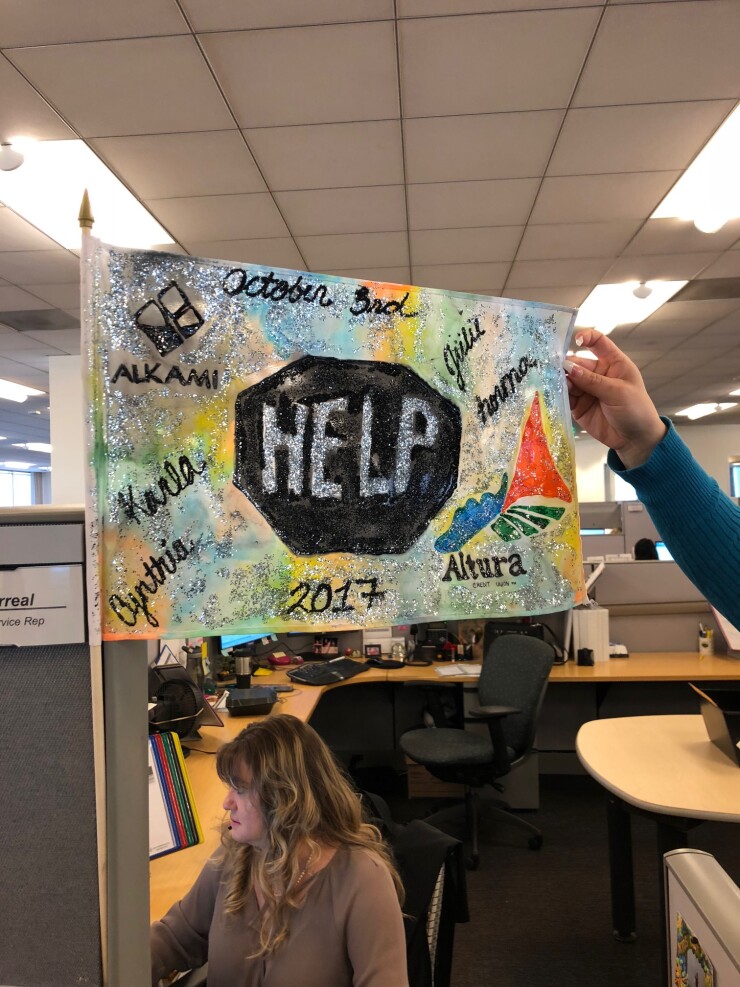

The request-for-proposal process started almost a full year before the CU’s go-live date, which was scheduled for October 2017. Yakinian told CUJ the “nitty gritty planning” started in April 2017. The credit union assigned an internal project manager and selected Alkami Technologies, a company based in Plano, Texas, that specializes in digital banking solutions.

“Our decision to use Alkami was about more than just this conversion,” Yakinian said. “This company is agile and wants to push the needle.”

The date of the conversion was not decided lightly, Yakinian explained. The conversion team worked from the assumption that it would be best not to shut down bill pay right before or after a holiday.

“We tried to find the least-impactful day for the membership,” he said. “There are a lot of little projects that spring out of something like this.”

Deciding how early to start notification of the upcoming shutdown, as well as exactly how and when to send such notices, was another big consideration.

“We did not want the message to get lost by doing it months in advance,” Yakinian recalled. “But once we started notifications we really hit them hard – almost annoyingly so.”

In August 2017, approximately 35 days prior to going live, the notification process began in earnest. Altura used everything from its social media channels to its telephone hold music to inform members bill pay was going to be shut down.

“We used anything we could to let people know it was coming,” Yakinian said. “We started with teasers on our website. About two weeks prior to shutdown we began with emails. We were messaging every third day, ‘This is a reminder, schedule your payments in advance.’ Of course, that is only as good as the email address we have on file.”

The longest shutdown happened to brand new users. For two weeks before go-live, starting Sept. 23, Altura did not allow new enrollees on bill pay. For existing bill pay users the shutdown was 2 days that they could not access the system. Oct. 3 was go-live day, meaning members could not access the system on Oct. 2. Yakinian said payments that were set up in advance were handled as scheduled.

New features, functions

After the conversion, Altura’s online banking and mobile banking systems have the same look, and both have added features and functions.

“We gave members more self-service tools and the ability to securely message us interactively from within the app instead of sending us an email. In this way, member services staff can assist members in real time,” Yakinian noted.

The more secure mobile app now allows members to make electronic transfers to other financial institutions and view statements. Another new feature supports users in setting specific savings goals. Members can upload a photo tied to the goal and the app will send regular reminders to keep them on track.

In addition, both the online and mobile platforms now offer financial news, financial tips and Altura news. “This is an effective way for us to communicate important information to our members,” said Yakinian. “Mobile users tend to use the desktop platform infrequently, and some online users bookmark the login page and never see the rest of our website. This feature lets our members see what Altura is doing in the community while also offering tips for financial success.”

The prior mobile banking platform had minimum requirements that still were usable by older phones. After the conversion, members using some older phones could not download the new app. Yakinian said this was especially true of Android phones.

“We had not updated our mobile app in five years. We did not have thumbprint verification. There were vulnerabilities. We wanted to move to a dynamic platform, but we did not think about the impact on older phones. We had to have a conversation with those members and explain the change we made was an upgrade that was due to security.”

Several members left comments on the App Store. Yakinian said the transition team homed in on those app reviews.

“We did a really good job of being responsive to those. We tried to be human, not robotic, and try to help the members. Some people just needed to download the app. We had 16 total reviews before we converted. Three days later, we had more than 150 comments.”

The security aspect of old phones turned out to be an unexpected but important part of the conversion, Yakinian continued. He said any credit union going through a similar process will need a team dedicated to social media and/or the App Store – any platform on which members reach out in a social setting.

“It also is important to have a team dedicated to answer questions we did not know the answer to. Some questions needed research, so we would offer to call members back rather than trying to figure out the answer. The call center people had flags to wave when they needed special assistance. There were not a lot of big issues, but there were some small fires. Hold times were extended because it took longer to handle each call, so we offered to have a supervisor call them back. It is expected call volume will go up 200 percent to 300 percent during a conversion, so you want to manage that.”

Many of the calls Altura received were about change. Many asked: where can I find my available balance? Some members wanted reassurance that previously scheduled payments would go through. And yes, there were some that did not get any of the notifications of the bill pay shutdown.

“It is difficult when someone is talking about their financial institution and their ability to pay bills,” Yakinian said. “In some cases it was an inconvenience – the member wanted to pay on that day, rather than an actual late payment that would incur a late fee. However, no one pulled their account just because they could not get to bill pay that day.”

The upgrades are already paying off, Altura reported. Since the launch in the fourth quarter of 2017, user ratings for the mobile app have jumped from 2.5 stars to 4.7 stars.

Best practices for disruptions

Terri Panhans, vice president, contact center solutions for Harland Clarke, told CU Journal what Altura experienced with a spike in call volumes is typical for such a disruptive event. She said credit unions should consider having backup member service capability in place not only for digital banking changes, but also plastic card conversions, activating cards, marketing campaigns, outbound calls, and if there is merger/acquisition activity involving the CU.

“Another example is onboarding,” she said. “We recommend doing an outreach within 21 days of the member joining the credit union. Welcome them again, and make sure they are in sticky products such as online banking and bill pay. These are calls that take longer than an average call.”

Panhans said all the contact center solutions Harland Clarke has brought to market were created through conversations with clients.

“Our capabilities have evolved and will continue to evolve,” she said. “Some clients we support on an ongoing basis, while others we support on burst fashion, for a finite amount of time. Keep in mind, when the credit union does a major project such as reissuing credit cards, those regular calls do not go away.”

Panhans offered several best practices for credit unions in a similar boat. She said in most cases it may have been 10 years since a CU went through a platform conversion.

“We try to let credit unions know support is there. We have created a playbook. There will be a ramp-up period, the go-live period and then the aftermath.”

For ramp-up, Panhans said Harland Clarke gets involved approximately eight to 10 weeks out. She said the basic starting steps are: build a timeline, build a task force, make sure the team is ready.

“We see call volume tripling for some clients, which means we have to deal with line capacity with the telecom provider,” she said. “Some providers can increase capacity, at least on a temporary basis.”

Harland Clarke stresses to its clients the importance of communication, both with members and internally. Panhans said CUs need to make sure the contact center people are ready to answer questions and help members. On the external communication side, the company tells CUs to leverage as many channels as they can, even direct mail and statement inserts for those who still receive paper statements.

She added CUs need to be cognizant there will be a percentage of members that do not read any of the communications, no matter how hard the credit union tries.

“We tell credit unions not to put a specific date out there until they get close because things change,” she advised. “If you put a date out there and then it shifts there will be confusion and those people will call.”

Update IVR messaging

If the CU has an interactive voice response, or IVR, which routes calls before getting to an agent, Panhans recommends putting a special message upfront such as, “If you are calling about the new credit card, press 8.”

“That way those calls go directly to Harland Clarke rather than people automatically hitting whatever number they usually use to reach a person,” she explained.

Panhans reminded CUs that any major change – from new plastic to an online banking platform modification – puts a burden not only on members, but on the credit union’s internal staff. She said that burden is why it is important to have overflow contact capability in place.

“This is a differentiator of service being offered to members,” she said. “We say this is an opportunity not to just get through the conversion. If there is a step in the IVR there is acknowledgment, and if the members speak to a knowledgeable person that can walk them through, the credit union can really build loyalty.”

“In this digital age we live in people get used to self-service, but when there is a need for live interaction there is an opportunity,” she continued. “When there are long hold times or the person who answers does not know how to help, that can leave a bad taste in the member’s mouth. Credit unions have to be prepared to not just get through, but make a positive impact. On the other side, if you are not ready it can have a negative impact. These calls are not the normal handle times.”