With the majority of states under some form of stay-at-home order throughout April, new data from CO-OP Financial Services showed how credit union members' payments behaviors adapted during that period and could give insights into spending trends moving forward.

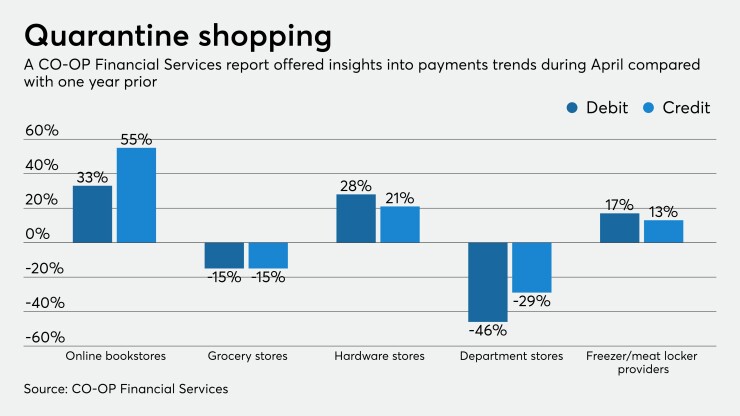

CO-OP found a 41% year-over-year decline in card-present spending for credit cardholders during April, while card-not-present transactions were up 30%. Among the biggest changes was at online booksellers (namely Amazon), which saw a 33% lift in debit spending and a 55% increase in credit card spending.

“This indicates a strong opportunity for credit unions to begin promoting their card to the top of the Amazon wallet in order to not only capitalize on this spending trend, but also hold on to transactions at this popular merchant for the future,” CO-OP said.

Some consultants have advised that if credit unions examine a member's card behaviors and no Amazon purchases show up within a 30-day period, there’s a good likelihood another institution has top-of-wallet status.

Not surprisingly, CO-OP also found a 15% decline in both credit and debit usage at grocery stores due to in-person shopping declining, though dollar amounts on these transactions were higher than one year prior.

Department stores also saw a significant drop, sliding 46% for debit and 29% for credit. CO-OP noted that many retailers are reducing inventory and shifting to in-store pickup in anticipation of lower traffic after statewide shutdown orders are eased, but there are also

As essential businesses, hardware stores also saw gains of more than 20% (specifically 28% for debit and 21% for credit) with consumers tackling DIY projects while stuck at home, CO-OP said.

Even with shutdown orders being eased across the country, CO-OP advised that payments volumes are likely to remain low, and “credit unions should look out for the potential shift to credit as more members experience financial hardships.” Payments fraud and delinquencies are also likely to increase, the company said, along with an increase in declined payments. CO-OP’s debit portfolio saw denials for online transactions jump 91% just during March.