There may be a wider audience for credit unions’ financial wellness offerings in the year ahead.

More than three quarters of American adults (78%) planned to make New Year’s resolutions related to finance, according to recent research from the National Endowment for Financial Education, and even more (79%) are stressed about their finances. Saving money topped survey respondents’ concerns at 54%, while 46% indicated an interest in learning to better manage debt.

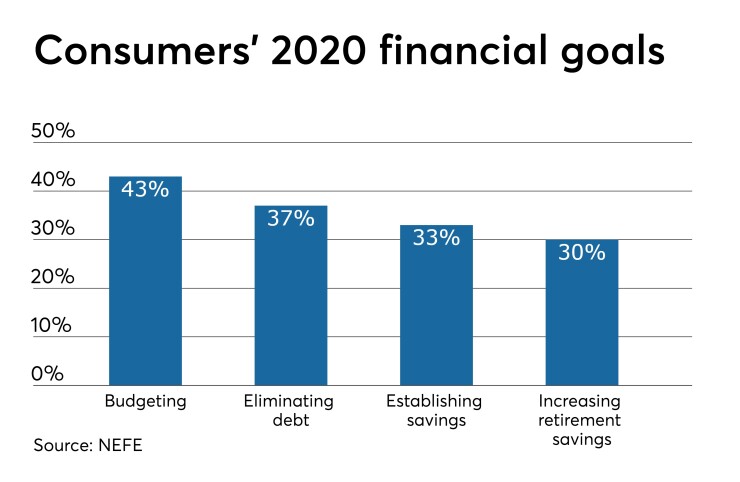

According to the study, consumers’ top financial goals for the year are:

- Setting and following a budget (43%)

- Getting out of debt (37%)

- Establishing savings (33%)

- Increasing retirement savings (30%)

“Given uncertainties over the past year, Americans are demonstrating both the desire to control their finances and understand the importance of improving their financial well-being in 2020,” Billy Hensley, Ph.D., president and CEO of NEFE, said in a press release. “Even in a strong economy, more than half of Americans say they are living paycheck to paycheck due to credit card debt, managing housing expenses and dealing with employment struggles."

NEFE further reported that 72% of American adults experienced unexpected major expenses or financial setbacks within the last year, ranging from transportation issues (25%) to household repairs (23%), medical bills (21%) and an inability to keep up with debt (20%). Nearly one-third of respondents (29%) said that if faced with a major unplanned expense they would turn to a credit card. Thirty-two percent said they would use cash while 31% would rely on emergency savings.

Other results from NEFE’s survey include:

- More than a quarter (28%) of Americans say their financial lives are worse than they expected.

- Women are more likely than men to follow through on New Year’s resolutions related to finances (46% compared to 39%).

- About one-fifth (21%) of Americans expect to pay higher federal income taxes when filing for 2019.