It may seem counterintuitive — opening new branches while existing ones have had restricted access during the coronavirus pandemic.

But the industry has signaled intentions to open or expand hundreds of branches and facilities. Some of these plans were likely in the works for months before COVID-19 forced many institutions to close branch lobbies entirely or move to appointment-only services. Because of that, it makes sense that management teams forged ahead with their plans.

However, experts said at least some credit unions are likely to continue

“I think there are probably two forces at play,” said Jim Burson, managing director of the channels practice at the consulting firm Cornerstone Advisors. “Several credit unions are still trying to expand in the markets they serve, especially those that have more of a geographic charter rather than a [select employer group] charter. … And still a significant chunk of the market place values a branch when making decisions.”

Despite the increased adoption of digital banking, branches still matter to consumers as they select which institution they want to bank with, research has shown. In 2019, 38% of respondents listed convenient branches as one of the top reasons for choosing a new financial institution, according to the 2020 U.S. Banking Shopper Survey from Novantas.

Because of that, some credit unions continue adding to their networks, even as some of their bank counterparts have announced plans to close locations. As of Sept. 30, 745 credit unions had plans to add branches or expand facilities, according to data from the National Credit Union Administration. Overall, there were about 20,700 credit union branches, almost level with figures from the end of 2019 but up about 2% since December 2016, according to NCUA data.

For many institutions, the branch still serves as an important marketing tool, said Jeffrey Baker, president and creative director of Image 4, a branding consulting firm. If designed properly, physical locations can serve as a sales platform and help promote the institution’s image.

“A lot of smaller institutions, especially the boards, overlook the sales platform and marketing value,” Baker said.

That means many institutions rely upon physical locations when they are attempting to deepen their presence in an area or enter new markets. Burson noted that even some banks that are closing branches in some areas are still opening new locations in other markets.

For instance, PNC Financial Services Group in Pittsburgh

“If no one cared about branches, we would all be with Capital One 360 or Ally or one of the neobanks like Chime,” Burson said. “But the reality is people still value the ability to have a face-to-face interaction.”

Since 2016, Blue Federal Credit Union in Cheyenne, Wyo., has added eight branches through mergers and organic growth, including opening its sixth location in Cheyenne in December. It now has 18 branches.

Management at the $1.4 billion-asset institution still sees value in physical locations and a survey found that 41% of respondents still preferred having access to a branch, even if they do most of their banking online or through their mobile device. Before opening a new location, management considers factors, such as the potential for population growth and the income of the area.

New locations are more high touch and inviting with touches like comfortable chairs and a fireplace and utilize technology, such as virtual teller machines. A concierge greets members at the door.

“The intention of the location is much more high touch to build on your financial relationship,” said Bobby Matthis, vice president of digital innovation. “It’s not to get you in and then get you out the door.”

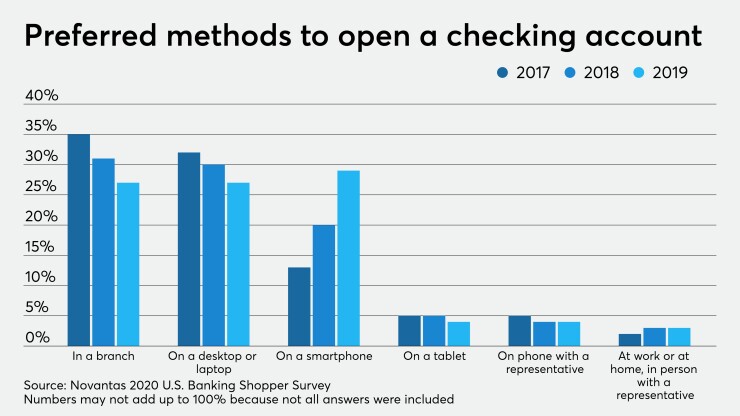

However, the importance of physical locations has also diminished. In 2017, 35% of consumers preferred opening a new checking account in a branch, eight percentage points higher than in 2019, according to the Novantas survey. Overall, 60% of respondents preferred a digital method for opening a checking account, such as a computer, smartphone or tablet, in 2019, up from 50% in 2017, according to the survey.

Additionally, in 2017, the convenience of branches was cited as a top reason for picking an institution by 46% of respondents, eight percentage points higher than in 2019, according to the survey. In contrast, the importance of online and mobile banking increased from 26% to 33% over that same time period.

As consumer preferences have changed, branches have also been slowly transforming, and the coronavirus pandemic may have sped up the process.

For one, credit unions have been opening fewer branches in the workplaces of select employer groups and instead have been looking for locations near where members live. This could become even more important if employees continue to work remotely, even once the pandemic has subsided. Some institutions, including Associated Credit Union in Georgia, have already said they plan

Additionally, branches have gotten smaller. Traditionally, locations could range up to 6,000 square feet. But today the average is around 2,500 and can be run by as few as four people, said Paul Seibert of Paul Seibert Consulting, a firm that works on designing branches.

“There needs to be an acceleration to smaller branches,” Seibert said. “But we probably don’t need fewer branches. If you want to grow in our markets, you need to add more smaller locations.”

Management teams and boards must also review their footprints once the pandemic ends, and the economy begins to recover, Seibert said. That will ensure locations of the institution's branches still make sense and aren’t inside a retail center that faltered during the shutdown, for instance.

Ascend Federal Credit Union in Tullahoma, Tenn., is one of the institutions that continues to expand its branch network. It opened a location in Gallatin, Tenn., in December and will continue adding more as part of its growth strategy.

However, the $3.1 billion-asset institution’s locations have followed industry-wide trends by shrinking in size and utilizing more technology. Today the average footprint of an Ascend branch is more than 50% smaller than before, and the credit union introduced ITMs several years ago.

Despite the pandemic being a catalyst for some changes in member behaviors, management believes that physical locations will remain important for some needs, such as getting financial advice and even replacing a lost debit card.

“Innovation is certainly changing the consumer service experience, but people still have a preference to bank with a provider that has a physical presence that is convenient to them,” said Matt Jernigan, executive vice president at Ascend. “The ITMs have reduced the footprint that has to be dedicated to cash servicing, but the branches remain very relevant for consultative services. Additionally, we provide instant issue of debit and credit cards at all our locations. Being able to provide members with a card they can immediately begin using is an important differentiator.”

Correction: An earlier version of this story incorrectly stated that there were plans for 745 branches to be added or facilities expanded. Instead, 745 credit unions have plans to make changes to their branches or facilities.