The latest Credit Union Trends Report from CUNA Mutual Group shows that year-over-year credit union membership growth in October was the slowest in six years.

The report, released this week, covers data through October, and the firm noted that credit union memberships grew by 47,000 in October, or 0.04%, much slower than the 252,000 new members, or 0.21%, added in October 2019.

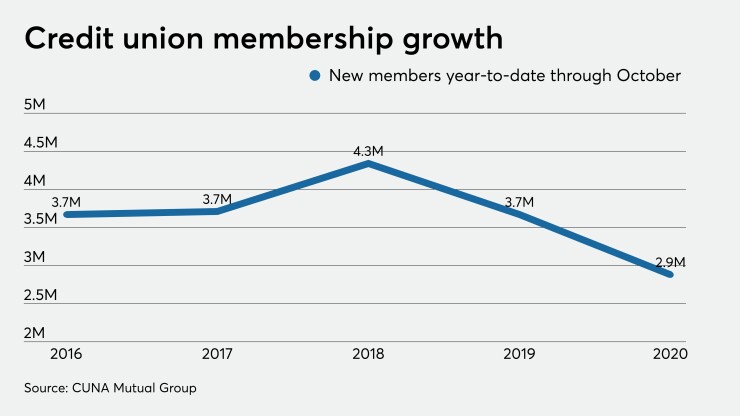

Total credit union memberships reached 125.7 million in October, 2.8% more than October 2019. Year-to-date, credit unions added 2.9 million new members, which is slower than the 3.7 million members added during the same period in 2019.

The group does, however, expect membership growth to accelerate to 3% in 2021 as loan growth gains momentum.

CUNA Mutual also said industry consolidation is expected to continue at its long-run pace in 2021. As of October 2019, CUNA estimates 5,336 credit unions were still in operation, down 167 from October 2019. Year-to-date the number of credit unions fell by 124, an increase over the pace seen during the first 10 months of 2019, when 100 credit unions closed their doors.

“We expect a surge in credit union mergers in the 2022-2024 period, like what we experienced the years following the Great Recession,” the report said.

Since 1980, the number of credit unions has declined by roughly 3.5% each year, and a similar pace would result in another 187 credit unions leaving the financial system in 2021. Only 2,617 credit unions will remain in operation in 20 years — half as many as there are today — if that pace hold, the group said.

More broadly, CUNA Mutual

Loan balances at credit unions were unchanged in October, below the 0.6% increase reported in October 2019.

“Expect purchase mortgage lending to increase 12% in 2020 due to rising incomes, rising consumer confidence and modest job growth. However, expect refinance mortgage lending to drop 50% as 30-year mortgage interest rates rise from around 2.75% today to over 3.5% by the end of 2021,” the report said.

Other highlights from the report:

- Total credit union assets increased 1.6% in October, faster than the 0.7% gain reported in October of 2019. Assets rose 17.4% during the past year due to an 19.5% increase in deposits, a 19.3% decrease in borrowings and an 8% increase in capital.

- Credit union capital-to-asset ratios fell to 10.4% in October, down from 11.3% over the last year. Credit union loan delinquency rates fell to 0.54% in October, down from 0.68% one year earlier due to loan forbearance programs.

- CUNA Mutual's latest economic forecast predicts the economy will expand at a 4% annualized pace in the fourth quarter and 2.5% during 2021. Economic output remains 3% below its previous peak attained in the fourth quarter of 2019 and 5% below potential output, the group said.