Want unlimited access to top ideas and insights?

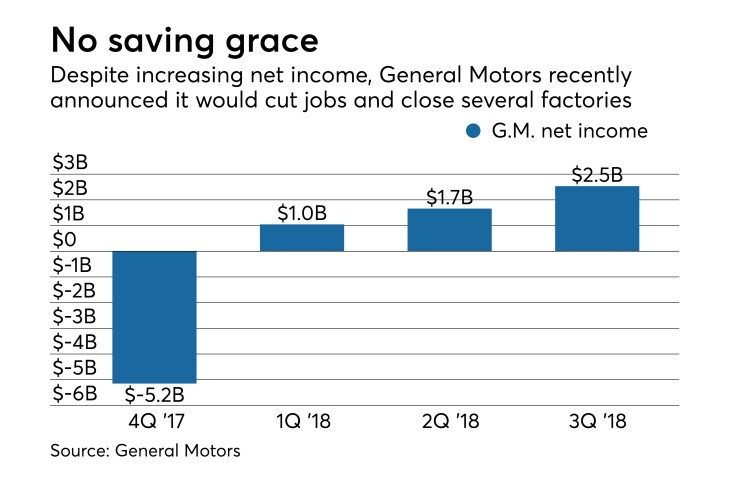

The massive layoffs at General Motors next year could also have an impact on credit unions.

Last week the iconic car manufacturer said it would cut about 14,000 jobs, and close three assembly and two propulsion plants in the U.S. and Canada by the end of 2019. But the impact could go well beyond the factories themselves, and other businesses in the surrounding communities may also be forced to scale back. All of this is likely to put a strain on everything from household pocketbooks to budgets for local schools that rely on property taxes for funding.

Associated School Employees Credit Union in Youngstown, Ohio, is already bracing for any impact it may feel from the closure of GM’s Lordstown Assembly plant in nearby Warren, Ohio, while also thinking about ways to help members affected by the shutdown.

“This closure is one that has kind of been anticipated in the community,” said President and CEO Michael Kurish. “People have witnessed the sale of the [Chevrolet Cruze] declining. … But nothing prepares you for the actual closure.”

Associated School Employees was initially founded to serve the local school district but eventually expanded its field of membership to include the communities at large, explained Kurish. A number of years ago it acquired another institution that served the Lordstown plant, which is scheduled to shut down in March. The credit union even has an ATM inside of the facility.

The Lordstown factory opened in the 1960s and helped boost employment even as other industries in northeast Ohio, such as steel production, faltered. Today the plant produces the Chevrolet Cruze, a compact car G.M. launched in 2008. But with oil prices remaining low, consumers continue to demand larger vehicles such as SUVs and trucks, and the Cruze’s sales have languished.

The plant previously employed thousands of workers, but GM had previously canceled two of the factory’s three shifts and that number dwindled to about 1,400. Beyond that, there are other businesses that support the GM plant, such as warehouses and transportation companies, that are likely to feel some pain, Kurish added.

“This has a monetary impact on the individuals affected but it also brings out an emotional impact to the community as well,” Kurish said. “That needs to be dealt with as well when talking to our members.”

The $133 million-asset Associated School Employees is already talking about what it can do to help. Kurish estimates 300 of its 13,700 members work at the Lordstown plant or at businesses that could be impacted by the move. So far, the credit union has mulled pulling together information about resources available for those facing financial hardship and making that easily accessible to members. It may also look at ways to modify terms of loans made to anyone impacted by the plant’s closure.

With the plant set to shut its doors in March, unemployment benefits to the workers would likely run out in September, around the start of the school year, Kurish said. The credit union may do a back-to-school supply drive or provide small loans to members to help them buy the materials their children need, Kurish said.

Kurish said he is also reaching out to other credit unions to brainstorm ideas and coordinate efforts.

FOM diversity a must

It makes sense that Kurish and other credit union executives would want to help their members, said Mike Schenk, deputy chief advocacy officer for policy analysis and chief economist at the Credit Union National Association. Credit unions frequently jump in to help during times of stress. For instance, credit unions have provided

“It is in the credit union DNA to help members who find themselves in unexpected financial hardship,” Schenk said.

Besides broader implications for their communities, institutions that have a limited field of membership or lack other diversification could feel the sting if an important employer in their area announces massive layoffs, Schenk said. For instance, there were once 27 credit unions that served Sears employees but as the retail giant fell on hard times over the years, that number dropped. The last one serving Sears employees, Sears Spokane Employees Federal Credit Union,

Similarly, a variety of credit unions once served primarily General Motors employees, but most of those have expanded their charters or merged into institutions with broader fields of membership. For instance, the credit union that served GM employees that eventually merged with Associated School Employees had expanded its field of membership.

Genisys Credit Union in Auburn Hills, Mich. near Detroit, for example, began life as T&C Federal Credit Union, serving employees of GM’s Truck and Coach plant. But as the result of mergers and charter expansions, the credit union now serves a broader membership base. The “Gen” in the CU’s name is even a reference to General Motors. Despite that connection and the dilution of its GM membership, Genisys is not expected to be significantly impacted by the closure of GM’s plant in Hamtramck, Mich., near Detroit.

A Genisys representative did not immediately return a request for comment from the Credit Union Journal.

Similarly, Astera Credit Union in Lansing, Mich. serves GM employees, but with the company’s Lansing factory staying open, that credit union will not likely be impacted significantly by the layoffs.

“The situation does underline the importance of diverse fields of membership,” said CUNA’s Schenk. “[The National Credit Union Administration] has done a good job recently attempting to make it easier to diversify field of membership and reduce risks to institutions and the insurance fund.”

Kurish is trying to remain optimistic about the situation and hopes that another business might move to the area. There has been talk of a warehouse coming in and taking over the GM facility.

But Kurish is still concerned about the affects the layoffs could eventually have on his credit union. Right now Associated School Employees has good liquidity but members may eventually be able to save less, hurting deposits. Additionally, over time it could have more trouble recruiting employees and members as people leave the area for economic opportunities elsewhere.

Troubled loans could also tick up eventually, though Kurish wasn’t sure what kinds of credits may take the biggest hit. The CU provides a range of services, including mortgages, auto loans and credit cards.

“The number of major employers and opportunities for our children is not as great as it has been in other areas of the country,” Kurish said. “When individuals find jobs elsewhere we find a brain drain in our communities. … I have children and I am concerned about their future. I would like them to have the opportunity to remain in the community.”