Democrats and Republicans are locked in a bitter election battle, but the credit union industry is trying to stay above the fray while still supporting candidates who back the industry’s priorities.

Political action committees donating to candidates base their decisions on the individual’s stance on issues important to the industry and try to steer clear of more divisive concerns that have little to do with financial services.

By doing this, they hope to avoid alienating their own members, who may find a candidate repugnant for other reasons, while also building relationships to ensure phone calls are returned from those in power.

“People have to understand [political donations are] not some ticket to get what you want,” said Geoff Bacino, a partner at the government relations and strategic-planning consulting firm Bacino & Associates and a former board member of the National Credit Union Administration. “It’s a ticket to get you in the door. It’s to let them know you’ve been supportive.”

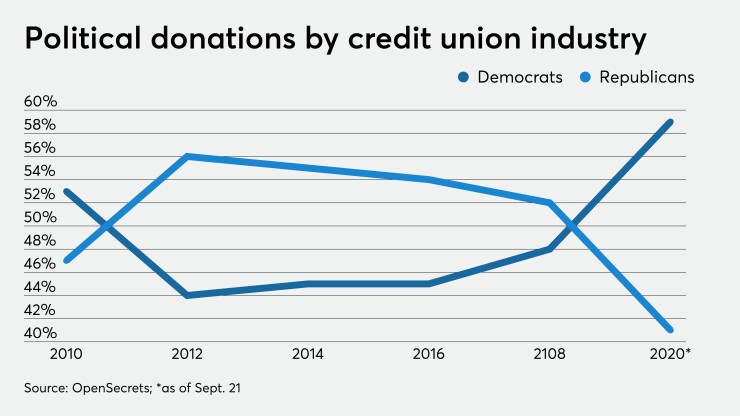

The credit union industry has given almost $4.4 million to federal candidates, parties and outside groups for the 2020 election cycle as of Sept. 21, according to data from OpenSecrets, a website that provides information on federal campaign contributions run by the Center for Responsive Politics. That amount includes funds supplied by both PACs and individuals in 2019 and 2020. Overall, about 59% of that money has been given to Democrats with 41% going to Republicans.

In contrast, during the 2018 cycle, 52% of donations went to Republicans and 48% was given to Democrats. Almost $4.3 million was donated for federal candidates, parties and outside groups during that election cycle.

It makes sense that the amount of money credit unions have donated to Democrats has ticked up for the 2020 election cycle, sources said. In 2018, the Democrats picked up 41 seats in the House, giving them a 235-199 majority over Republicans.

“You’ll tend to see a shift in the balance of giving as party control of a chamber changes or seems likely to change,” said David Primo, a professor of political science and business administration at the University of Rochester. “This explains much of the movement over time in the balance of giving.”

Additionally, groups that lobby members of Congress to get certain legislation passed generally support more incumbents since they have a better chance of winning. More than 90% of House incumbents won re-election and about 84% of Senators won their races in 2018, according to OpenSecrets.

Since there are currently more Democrats in Congress, there are simply more Democratic candidates for the PACs to support.

NAFCU/PAC, the political action committee for the National Association of Federally-Insured Credit Unions, has a general rule to only donate to incumbents, said Chad Adams, director of political affairs for the trade group. That’s because candidates who haven’t held office before don’t have a track record to review to ensure they will be supportive of credit union priorities. It also makes sure the group uses its funds effectively.

The trade group’s PAC has donated $200,000 this election cycle, according to data from the Federal Election Commission.

“Because of our size, to be impactful, it’s not something we can do,” Adams said of supporting those challenging incumbents. “We stay out of that space. Our focus is to support members who are friendly to credit unions.”

The majority of funds given for federal candiates, parties and outside groups for this election cycle — 69% — have come from PACs, according to the data from OpenSecrets. Looking at donations from PACs, rather than individuals, can be more telling about the motivations behind the contribution, Primo said.

For instance, NAFCU/PAC focuses on giving to members who sit on committees that more directly affect the industry, such as the House Financial Services Committee and Senate Banking Committee.

An individual who works for a credit union may give because they support the candidate’s stance on issues unrelated to financial services, such as education or police reform. Individual donors have to disclose their occupation and employer when giving.

“PACs are very strategic in their giving, so the focus is on who controls key committees with regulatory jurisdiction over the industry … not who is personally liked,” added Primo, a co-author of the book “Campaign Finance and American Democracy: What the Public Really Thinks and Why It Matters.”

The credit union PACs also generally stay out of the presidential contest and instead focus on races for seats in the House and Senate and that's been true this year. That's because they are more likely to have an impact on these campaigns and getting legislators elected can matter more to advancing the industry's agenda. However,

The Credit Union National Association’s PAC, the Credit Union Legislative Action Council, looks at several criteria before deciding to contribute to a candidate, including the person’s support for the industry and their chances of winning, said Trey Hawkins, vice president of political affairs at CUNA. CULAC is the largest credit union PAC and has contributed about $3 million to candidates and spent more than another $1 million on advertising for candidates this election cycle.

Even though the PAC supports candidates based on issues that relate to financial services, the person’s behavior or other views could also influence CUNA’s support, Hawkins said.

In 2018, the PAC donated $5,000 to Cindy Hyde-Smith’s Senate campaign and spent $200,000 in independent expenditures. But CUNA

“We know that who we are supporting are representatives of the credit union system and the movement,” Hawkins said. “We focus on candidates’ positions for credit union issues, but there are lines that we won’t cross. We don’t want to knowingly support someone who is racist or sexist.”

Still, the group is conscious that its members may disagree with candidates on policy issues not related to the industry.

“We joke sometimes that this isn’t a business for the faint of heart,” Hawkins said. “The challenge comes in communicating that to folks who may not realize our north star is on credit unions. In terms of decision making, if you keep that as your north star, you are looking out for candidates who will be the best advocate for credit unions.”

The industry often likes to tout the bipartisan nature of its donations. But this strategy is not unusual, experts said. Single-issue groups, such as those that support or oppose abortion, will only contribute to candidates who share their viewpoint, said Kent Redfield, an emeritus professor of political science at the University of Illinois at Springfield.

But groups that represent a specific industry will normally support candidates from both sides of the aisle to ensure they are never truly out of favor if control of the House or Senate changes.

“For single-issue groups, that’s the hill you die on. They have no legislative strategy,” Redfield said. “An interest group for credit unions is giving money but also lobbying for their priorities.”

Amplify Credit Union in Austin, Texas, encourages its employees to be involved in advocacy on policies that affect the industry, said President and CEO Kendall Garrison. Management gives workers up to four hours of paid time off to vote.

Garrison also started an advocacy committee at the $1.1 billion-asset credit union about a year ago and almost two dozen employees, or 10% of its staff, participate in the group. The committee meets on an ad hoc basis to discuss important issues and what state and federal legislatures can to do help.

Employees also have the option of setting up an automatic deduction through Amplify’s payroll to make contributions to the industry's PACs. About 19% of the credit union’s employees take advantage of the service, Garrison said.

Workers at Amplify have given about $21,000 to candidates and political parties during this cycle, ranging from just $1 up to $10,000, according to FEC data.

“There’s a saying, ‘If you don’t have a seat at the table, you are on the menu,’” Garrison said. “We are want our voice to be heard. We want the things that are important to our members to be at the forefront of advocacy at the state and federal level.”