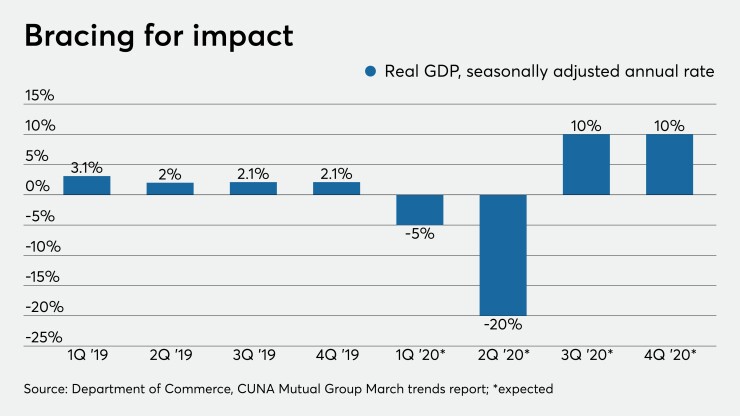

CUNA Mutual Group said it expects the economy to contract by 20% in the second quarter after falling by 5% in the first quarter as the coronavirus continues to spread.

Officials across the country have ordered non-essential businesses to shutter and prohibited large gatherings, resulting in massive job losses. More than 6.6 million Americans filed for

Employees who work in the service sector, such as travel, restaurants and retail, are being laid off or given reduced hours because of falling consumer demand. The manufacturing industry is also at risk because of supply side issues, CUNA Mutual said in its March Credit Union Trends Report.

The insurance and research firm predicted the U.S. is likely to slide into a recession as gross domestic product declines through the first six months of the year. It said it expects the unemployment rate to peak at 6.5% in the third quarter before falling to 5% in 2021 as the recovery from the pandemic takes hold.

Economists at the Credit Union National Association have suggested the nation may

Besides the coronavirus outbreak, there are several factors negatively affecting the economy right now, CUNA Mutual said. Uncertainty over this fall’s election, a dispute over oil prices between Russia and Saudi Arabia, the ongoing trade war and Boeing grounding its 737 Max aircrafts are all taking a toll.

However, Chief Economist Steve Rick, who authors the report, also anticipated that economic growth would surge by 10% in the third quarter, assuming that the coronavirus peaked by then.

All of this comes as credit union growth continued to slow in some areas even before the outbreak. Credit union loan balances increased almost 7% in January from a year earlier, the report said. But the industry’s average loan-to-savings ratio declined to 83.8%, down from 86% a year earlier, as institutions

In January, membership ticked up 0.14%, down from the 0.24% increase posted a year earlier, the report said.