Want unlimited access to top ideas and insights?

Municipal Credit Union, which was embroiled in an embezzlement scandal last year, has been conserved by regulators.

The New York State Department of Financial Services took over the New York City-based credit union on Friday and appointed the National Credit Union Administration as conservator. Members will be able to continue to access regular services at the institution.

In May 2018, Kam Wong, the former CEO of the $3 billion-asset Municipal, was charged with

The U.S. Attorney’s Office alleged that from at least 2013 to January 2018, Wong engaged in a “long-running multi-faceted scheme” to steal money from the credit union. For example, he allegedly submitted fake invoices for dental work that was never performed and then pocketed the reimbursement money.

He received money under other questionable circumstances, including receiving millions in cash payments instead of a long-term disability insurance policy.

Municipal

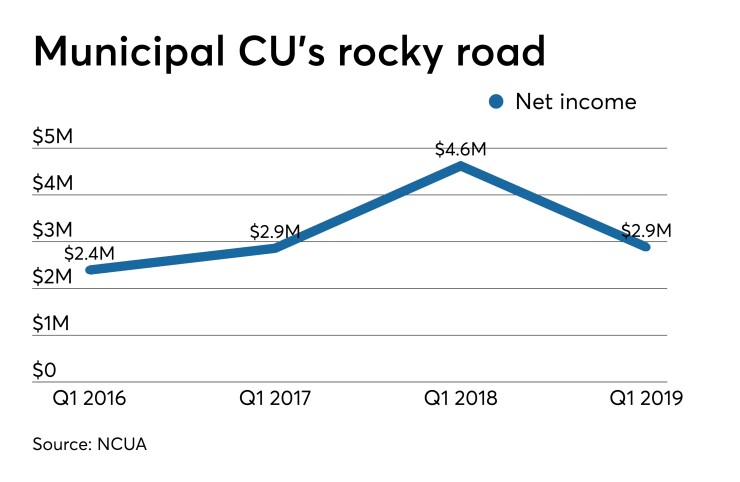

The credit union earned $2.9 million in the first quarter, down more than 37% from a year earlier, according to call report data. It was well capitalized with a net worth ratio of 7.59%, according to its first-quarter call report.