Right now credit unions are walking a tight rope when it comes to employee benefits because of the coronavirus.

A number of institutions have announced bonuses, especially for frontline staffers, to thank them for their hard work during the crisis. Congress has also recently passed legislation that requires some employers to provide additional leave and sick time to workers to deal with the onslaught of the pandemic.

However, there are concerns that the financial hit from the coronavirus may eventually force credit unions to follow the path of many other industries and either lay off or furlough employees.

“Credit unions are really bending over backwards to keep folks safe,” said John Bredehoft, a member of the employment law and consumer finance practice groups and who works with credit unions at the law firm Kaufman & Canoles. “The first thing credit unions want to do is understand their obligations.”

Providing extra benefits

The pandemic has significantly reshaped much of American society in a short period of time. Nonessential businesses have been closed, schools have been shuttered and those filing for unemployment benefits have shattered previous records.

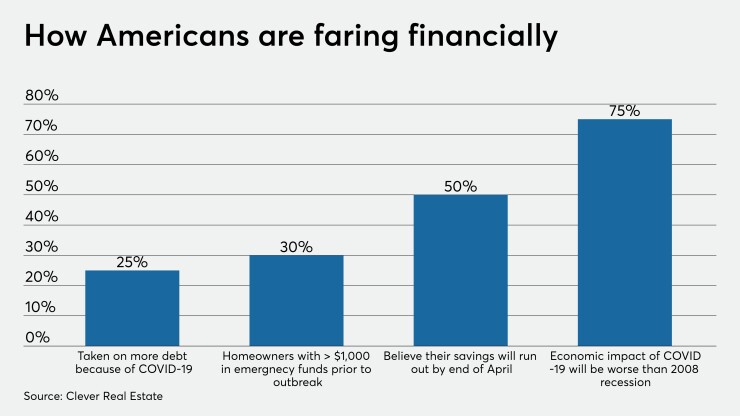

All of this has taken a toll on Americans.

As much as one quarter of Americans have taken out loans because of the pandemic,

A number of credit unions have done their part to show their appreciation for staff members during this stressful time and to help offset any financial hardship they may be facing. Hiway Federal Credit Union in St. Paul, Minn., has

Besides bonuses or free childcare, there are a number of other benefits that credit unions could offer employees right now, said John Harris, CEO of CU Benefits Alliance, a credit union service organization. For instance, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, allows employers to help repay their workers’ student debt without that money being considered taxable income, making this a more attractive option to credit unions. Institutions could also offer workers personal loans with no interest.

Credit unions that provide employee assistance programs could do more to ensure staff members know about those services, Harris said. These programs provide free and confidential mental health services for employees but are often poorly promoted.

“There are more people working from home,” Harris added. “Things like abuse or financial burdens could be getting worse. It’s sad and this just gives people a way to reach out to get some help.”

Required extra time off

The industry is also dealing with perhaps an unprecedented expansion of paid leave benefits. Under the Families First Coronavirus Response Act passed by Congress last month, businesses with fewer than 500 workers in general have to provide up to 12 weeks of leave — two weeks are unpaid or could be covered with days off from an employee's regular PTO while the rest is paid — to care for children who are out of school because of the pandemic.

That law also requires certain businesses to provide up to 80 hours of paid sick time for a broader range of issues related to COVID-19. For example, someone who has been ordered to quarantine by a doctor or government could apply for this benefit.

Employers who provide this expanded leave receive a credit against their share of the Social Security payroll tax.

These new benefits should apply to the majority of credit unions. About 89% of the roughly 5,200 credit unions in the U.S. have less than $500 million of assets, according to fourth-quarter data from the National Credit Union Administration.

But this expansion has also caused some confusion for credit unions, experts said. Some are small enough that they haven’t dealt with the Family and Medical Leave Act before and assume this legislation also won’t apply to them.

There were also changes made between when the law was written and when lawmakers finally passed it, and further discrepancies have arisen between the statute passed by Congress and regulations written by the Labor Department.

Toronto-Dominion Bank plans to give most employees the option to return to the office this month and is aiming for workers to officially transition to their new working models by June.

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

Employees will still have some flexibility to work from home, but are strongly encouraged to collaborate with colleagues in person, according to people familiar with the matter.

“I’ve had to change my advice to clients 20 times,” Bredehoft said.

There are concerns that this new required leave could be a burden for smaller businesses, said Gregory Hearing, a shareholder in the law firm GrayRobinson focused on labor and employment law. The Department of Labor has written rules that allow a business to exempt itself from the expanded leave if providing the time off would endanger its operations, even at a minimal level. That's a high threshold to meet and most credit unions probably couldn't, Bredehoft said.

“I’ve had several calls now with, ‘How do I avoid letting employees take this leave?’” Hearing said of the 12 weeks of time off to care for a child. “They are saying that employees didn’t need this last week but now that this is in effect employees are asking to take the leave.”

S.C. Telco and Hiway said they did not expect to face any hardship from providing additional leave to employees.

“In fact, the health and safety of our employees is first and foremost, and we have made every effort to ensure our employees are aware of the benefits available to them under the Act, and that they do not experience loss of wages,” S.C. Telco CEO Brian McKay said.

Darker times ahead?

Right now credit unions may be lavishing employees with extra benefits but there may come a time when the economic fallout begins to hit their bottom line. With so many Americans out of work and businesses closing, borrowers are likely to eventually default on repaying loans.

Because of that, credit unions may at some point turn to laying off or furloughing employees or asking workers to take pay cuts, experts said. Harris has already heard of one credit union that was going to start furloughing some staff members.

Hearing warned that credit unions should be careful about potentially eliminating jobs or cutting pay for workers who had previously asked for paid leave. He noted that such a move could be seen as retaliatory.

Additionally, if an institution does take this step, it should make sure those who are affected are well informed about the generous unemployment benefits that are being paid right now, experts said.

“Credit unions are notorious for not laying people off,” Harris said, adding that this is new even for tenured CEOs who have been in their positions for decades.

Hiway FCU CEO Dave Boden said his institution is doing everything it can to reduce expenses to ensure it doesn’t have to make cuts to its workforce and it was too early to tell if steps like that would need to be taken. Costs for items such as deposits and travel were already naturally falling and the institution will probably put off other initiatives to save money.

“But I would be remiss to say [layoffs] couldn’t or wouldn’t be in the discussion at some point down the road if economic circumstances demanded it,” Boden added. “We have never done that before but the financial picture of any institution would dictate that. At some point, you have to look at employee costs, then [different] strategies, like salary freezes, reduction in pay, furloughing some workers. Any of those could be a strategy but hopefully we won’t have to. That’s why we are being so proactive now.”