Want unlimited access to top ideas and insights?

It’s an especially happy holiday season this year at Cheyenne, Wyo.-based Blue Federal Credit Union, where applications for holiday loans are up by more than 40 percent over last year, thanks in part to streamlining the process through the CU’s mobile app.

Blue launched its holiday loan a few years ago as a way to help members during the stressful holiday season, explained Andrew Shaw, chief operations officer at the $961 million-asset credit union. The loan does not require a credit check, and members who have been with the credit union for at least 90 days can qualify for a 12-month loan of up to $1,200 (based on income) for 16.99 percent. While direct deposit at the credit union is not required, members with a direct deposit relationship receive three points off the rate.

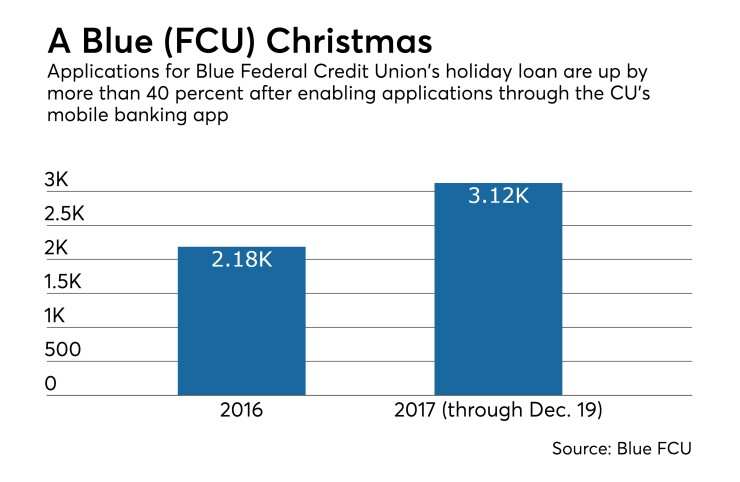

While response had been strong in previous years – the credit union processed 2,184 of them in 2016 – interest in the product surged this year, when Blue representatives worked with credit union consultancy DaLand to add a functionality to the CU’s online and mobile banking platforms that let members go from application to funding in a matter of minutes.

Shaw explained that members logging into those systems receive a notice about eligibility for a holiday loan. After indicating interest, the system automatically determines eligibility and then pre-approves the member. Since the system is integrated with DocuSign, users receive conditions and disclosures immediately, and once they click submit they can log back into the system and have access to the funds.

“From start to finish, with direct deposit if they met all conditions for approval, it could be done within five to 10 minutes,” said Shaw, adding that even those without direct deposit can complete the process within about a day.

As of Tuesday, Blue had processed more than 3,100 holiday loans this year, an increase of more than 40 percent over last year. And the vast majority – more than 1,750 of them, said Shaw – have come in via the mobile channel.

“We definitely do some in-branch still, because members come in and ask for it, and members will call us over the phone as well, but the vast majority have come in through that online and mobile channel,” he said. “It was a great surprise for us so we could see the benefits of that utilization.”

While Shaw credited much of the campaign’s success to how easy it was to apply, he suggested other lending channels might not be as successful because most other loans have more stipulations and greater underwriting requirements.

“It’s not just about wanting money – it’s wanting money for something,” he said. “the holidays tend to bring a crunch for a lot of people and I think tying the need to this – which is exactly why we built this product – and making it as easy as possible in an already-stressful time is where the magic comes into play.”

And there may be one more bit of magic in store.

The loan period runs from Oct. 15 through Jan. 15, and while demand has begun to slow down as Christmas approaches, “we see a bit more of a surge at the beginning of the year,” said Shaw. “When January comes, people go ‘I went way too over board and I need to get out of a crunch.’ The holiday loan is still there. I’ll be really eager to see with all the analytics what that jump looks like.”