Two New York credit unions have applied to switch to charters and to then merge into Sunmark Credit Union in Latham, N.Y.

Hudson River Financial Federal Credit Union in Mohegan Lake and Columbia-Greene Federal Credit Union in Hudson have both applied to the Banking Division of Department of Financial Services for New York to become state-chartered institutions. Both have also applied to become part of the $764 million-asset Sunmark, according to the weekly banking bulletin from the DFS.

A federally chartered credit union has to convert to a state charter before it can merge into another state-chartered credit union, according to the New York Credit Union Association.

Applications for the changes were received on Tuesday, according to the bulletin.

The $64 million-asset Hudson River serves almost 7,000 members with one location, according to data from the National Credit Union Administration. Columbia-Greene has $31 million in assets, roughly 4,700 members and two locations, according to NCUA data.

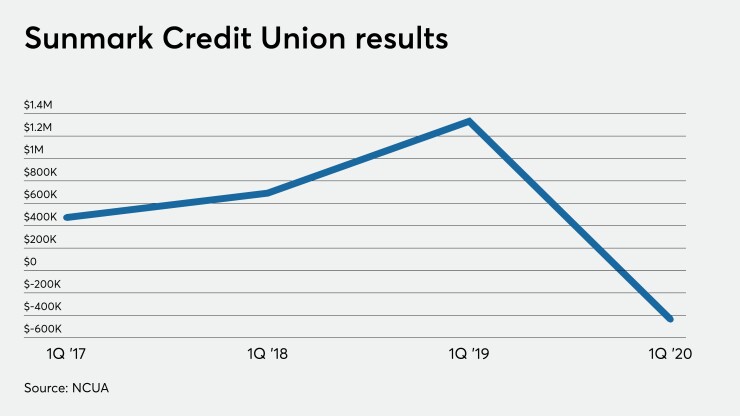

Sunmark

Sunmark did not immediately return a request for comment on the proposed charter changes and mergers. The credit union also absorbed