It’s finally here.

Nineteen months after Democrats began announcing their plans to take on President Trump, the 2020 campaign season will formally kick off this week. Former Vice President Joe Biden and Sen. Kamala Harris will accept their party’s nominations this week, with President Trump and Vice President Mike Pence to follow next week at the Republican convention.

Despite the nation being mired in a recession, neither convention is likely to focus on matters related to banking. Biden, Harris and others will instead focus on the pandemic and President Trump’s character and actions while in office.

The industry doesn’t take sides in presidential elections, but credit union trade groups regularly donate to political candidates on both sides of the aisle. Neither the Credit Union National Association nor the National Association of Federally-Insured Credit Unions contributed to Harris’s 2016 Senate campaign or Biden’s 2002 and 2008 Senate campaigns. However, in 2005 the Credit Union Legislative Action Council did donate to Unite Our States, Biden’s leadership PAC.

Though the industry’s focus tends to be on Congress rather than the presidency, CUNA praised Harris’s merits as a VP candidate.

“During her tenure in the Senate, Senator Harris has proven that she understands the important role credit unions play in improving consumers' financial well-being and advancing communities by supporting legislation that enables credit unions to better serve small businesses and underserved consumers,” CUNA President and CEO Jim Nussle said in a press release. “The amount of attention [last week’s] announcement is receiving underscores the energy voters feel going into this November's election, and illustrates how crucial it is for every eligible credit union member to make their voice heard this fall.”

Lawmakers were expected to stay in their home districts until after Labor Day, but House Speaker Nancy Pelosi on Sunday announced plans to recall members of that chamber for a vote on the current crisis regarding the U.S. Postal Service and what many view as President Trump’s attempts to sabotage it in order to hamper mail-in voting.

There are dozens of credit unions across the country chartered to serve postal workers, but it’s unclear to what extent they are impacted. Many have diversified their membership away from solely serving postal employees, but Postmaster General Louis DeJoy has cut overtime pay and asked carriers to limit deliveries to specific hours, which could affect employees’ take-home pay. That could make it more difficult for some members of those credit unions to keep current on their loans at a time when many institutions are already seeing reduced earnings because of the recession related to the coronavirus.

A slowdown in mail delivery could also impact the speed with which members are able to receive new credit and debit cards, statements, direct-mail loan promotions and more, which would affect the industry well beyond just institutions serving postal staffers.

Despite the promise of a House vote, it’s not clear whether the Republican-led Senate will take up the issue.

Voters in Alaska, Florida and Wyoming will cast their ballots in primary races this week. Trey Hawkins, VP of political affairs at CUNA, noted the contest for Florida’s 19th congressional district is particularly fierce, with nine candidates vying for the Republican nomination. While the Credit Union Legislative Action Committee has already donated $5,000 to support Florida House Majority Leader Dane Eagle’s candidacy, CUNA has also partnered with the League of Southeastern Credit Unions to spend more than $320,000 on direct mail and digital advertisements targeting Republican households with credit union members in that district.

Lastly, despite the National Credit Union Administration board not meeting again until next month — the panel normally takes an August recess — Chairman Rodney Hood said last week the agency hopes to introduce an updated capital proposal before the end of the year, including rulemaking on subordinated debt. The board had intended to address some of those issues earlier this summer but the proposal was

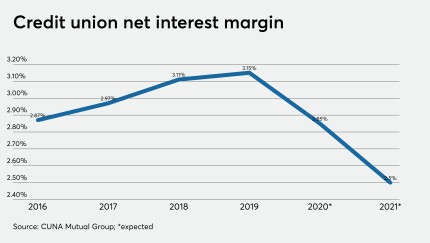

The industry will have to grapple with pressure on net interest margins, interchange income and credit quality, said CUNA Mutual's Steve Rick during a virtual conference.

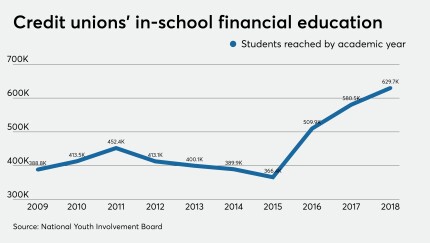

From student-run branches to courses on credit, budgeting and more, one of the industry's longest-running partnerships is being upended as districts across the country move to virtual learning.

The new “adverse market fee” for refinanced mortgages resembles steps the companies took to combat the 2008 mortgage crisis. But critics charge it isn’t necessary and will hurt borrowers’ ability to tap into low rates.

The federal banking agencies clarified that minor violations of Bank Secrecy Act rules will typically not result in a cease-and-desist order.