If you need directions or restaurant recommendations in a particular zip code, chances are that artificial intelligence (AI) “bots” like Siri and Alexa have an answer. But will similar bots be able to have real-time conversations with members about financial transactions and planning?

“We are starting to see a shift in the credit union community, and banking in general, in that there is a lot of interest in AI, particularly in chatbot,” said Joshua London, an executive with the New York City-based Personetics. “Credit unions want to be viewed as innovative financial institutions that are keeping up with the times and connecting with millennials.”

While there is interest in AI bot technologies, London said the challenge remains about how best to leverage bots in the credit union space.

“There is always the fear that this is a passing fad,” said London. “Credit unions are asking if they will see a real-world benefit from the time and effort they invest in it.”

And while Apple’s bot, Siri, is a household name, it is not as well-used as many people think, explained Jason Mars, assistant professor of Computer Science University of Michigan and co-founder of the research lab Clinc. The start-up recently launched a new “financial genie” application called Finie, a mobile voice-powered AI platform for banking.

“I just gave a talk to roughly 100 juniors and seniors at a university,” said Mars. “I asked how many had talked to Siri, Google Now or an [AI] assistant of any kind in the last 24 hours. Only four students raised their hands.”

While Mars concedes this is hardly a scientific survey, he believes that the reason there isn’t greater adoption rates to chatbots is due to one word: trust. The chatbots’ intelligence, he said, has to be scaled, and it has to solve people’s problems.

“Folks today have a higher expectation as to how they engage with technology,” said Mars. “AI has the potential to reduce the complexity of several tasks—if you can articulate it in human language.”

Adopt a Bot

Like Finie, which won best in show at the FinnovateFall 2016, there are many players in the AI space. Personetics, which works with credit unions, has an application framework that uses AI, predictive analytics and “machine learning” technologies to deliver a personalized member banking experience.

“Credit union asset size is an indicator [of adoption], but we are seeing interest across the board,” said Personetics Vice President of Marketing Eran Livneh. “In our work with banks and credit unions, we see that bots like Siri that can only answer questions will have limited adoption rates.”

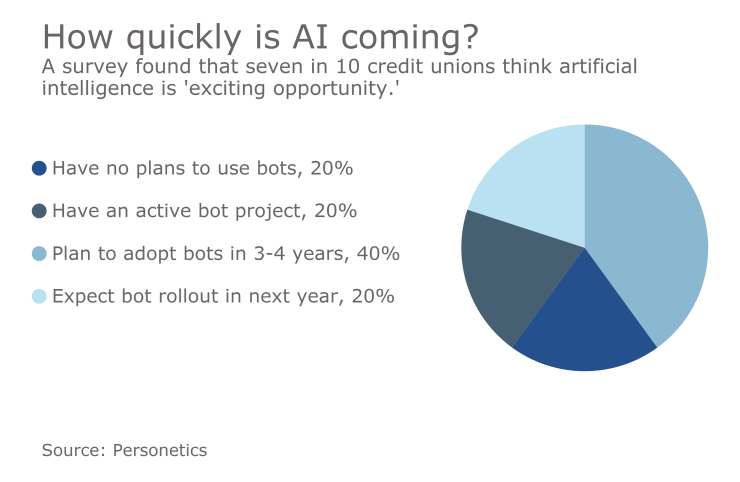

Last year, Personetics conducted a chatbot survey with 10 of its credit union clients. Seventy percent said AI is an “exciting opportunity.” When asked if the credit union planned to use bots, 20% responded that it has no plans, 20% said it has an active bot project, 40% responded it plans to adopt a bot in the next two to three years, while 20% expect to roll out a bot in the next year.

According to Livneh, future AI chatbots must be able to carry on intelligent conversations, anticipate member needs, understand personal context, access real-time transaction data, work seamlessly across multiple channels and learn quickly, while getting smarter over time.

“These are the type of things we believe will get people to adopt the solution at a greater pace,” said Livneh. “Proactively offering members information and insight that will help them better manage their finances is the key.”

Mars agreed with Livneh and said there will be an AI “iPhone moment.” And Mars hopes that Finie, which was awarded a $225,000 grant from the National Science Foundation last year, will be on the bleeding edge of the movement.

“By the end of 2017 and early 2018, there will be a number of large banks that will be rolling out some kind of AI,” said Mars. “Mass adoption is a tricky question. We still treat Siri and Google Now as toys. We haven’t had a transformative moment yet because the technology hasn’t delivered on the promise. We have to get over that hump to make AI an integral part of people’s lives.”