Most of us are extremely busy. Another program or project isn't exactly an exciting proposition, especially a project with an ambiguous name like Enterprise Risk Management (ERM), otherwise known to consultants as "billable hours" and to regulators as a "finding."

The reality, however, is that the seismic changes in the financial industry have cemented the necessity for enhanced risk management processes. The good news is that real ERM programs are extremely valuable and assist in driving enhanced knowledge and improved financial returns.

The problem is that many of us are disillusioned with finding that perfect solution (simple and cheap), or convince ourselves we "already" do ERM. Credit unions can fall prey to marketing programs anchored in fancy graphs and risk terminology. However, most of these programs consist of little more than a policy review or glorified compliance audit. Their focus is on ensuring the checklist of standard compliance procedures and documented policies are in place.

These programs are not designed for organization-wide risk management that helps to build financial and member value. Risk is a function of the various effects that events can have on our organization, creating obstacles to goal accomplishment, increased expense, unpleasant operational surprises and missed opportunities. Policy and compliance efforts are important, but serve a much different function than ERM.

It is simple - credit unions can write the perfect policy manual but it will have little bearing on the ultimate success of the business. Boards and managers are instead accountable for managing the assets of the credit union in such a manner to garner an acceptable level of return to best serve its membership in a prudent and safe manner (i.e., manage the business and the risks associated with running the business). Simple and cheap does not equal risk management or good management.

Why Comprehensive ERM Is Important

As necessary and effective as your current risk practices may be, they don't tell you when your strategies and processes are failing. Current risk practices are predicated on compliance, policy and procedural tasks. Other risk practices remain silo'd within single functional units, making it impossible to understand and strategize at a company-wide/holistic level.

A true ERM process does not replace existing risk-management efforts. Instead, ERM leverages existing risk management efforts and introduces a process that identifies measures and manages threats across the entire credit union, thereby delivering meaningful and decisionable information in real dollars and tangible terms.

An effective ERM program helps answer some of the most basic risk-related questions:

What are our largest strategic, process and performance risks?

How much total risk are we willing to take for a given level of return?

What are we doing about our risks, and is it enough-or even too much?

How effective are our risk and organization performance efforts? Are they sufficient or are they too much?

What, Exactly, is ERM?

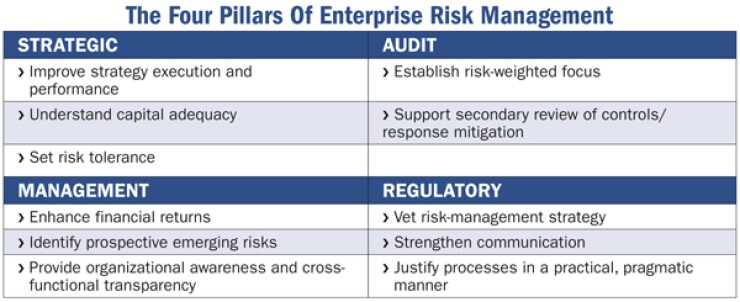

A real ERM program will provide you with four areas of opportunity: strategic, management, audit and regulatory (see box).

As its full name implies, Enterprise Risk Management is a process that drives decisioning to maximize performance/opportunities at a given level of risk. ERM encompasses all of the structures, methods and processes organizations use to identify, measure and manage risks related to achieving business and strategic objectives. It provides a formalized and repeatable process to validate that all organizational risk exposures have been accounted for, with the most pertinent being reported up through senior management.

In other words, ERM is about making better, more-informed decisions. It provides a conduit through which valuable information can be obtained and communicated earlier, allowing organizations to respond more quickly, and with more options. It provides the early warning systems that allow leaders to quickly mobilize staff and resources to respond appropriately to the uncertainties faced by every organization.

Your credit union is unique. Your strategy, your culture and your member value proposition must be distinctively nurtured in an effort to build a competitive advantage and ultimately survive in today's marketplace.

Real ERM is a competency that all credit unions must create. It's your choice as to what you will get out of it.

Tony Ferris is a Partner at The Rochdale Group. He can be reached at (913) 890-8001 or