-

Refinancing has been one of the bright spots in a difficult year for lending, and the industry has concerns that a fee to be imposed by Fannie Mae and Freddie Mac could slow down the business.

August 28 -

New analysis from S&P found that only two of the of the top 20 credit unions that participated in the Paycheck Protection Program loans had assets of less than $1 billion.

August 27 -

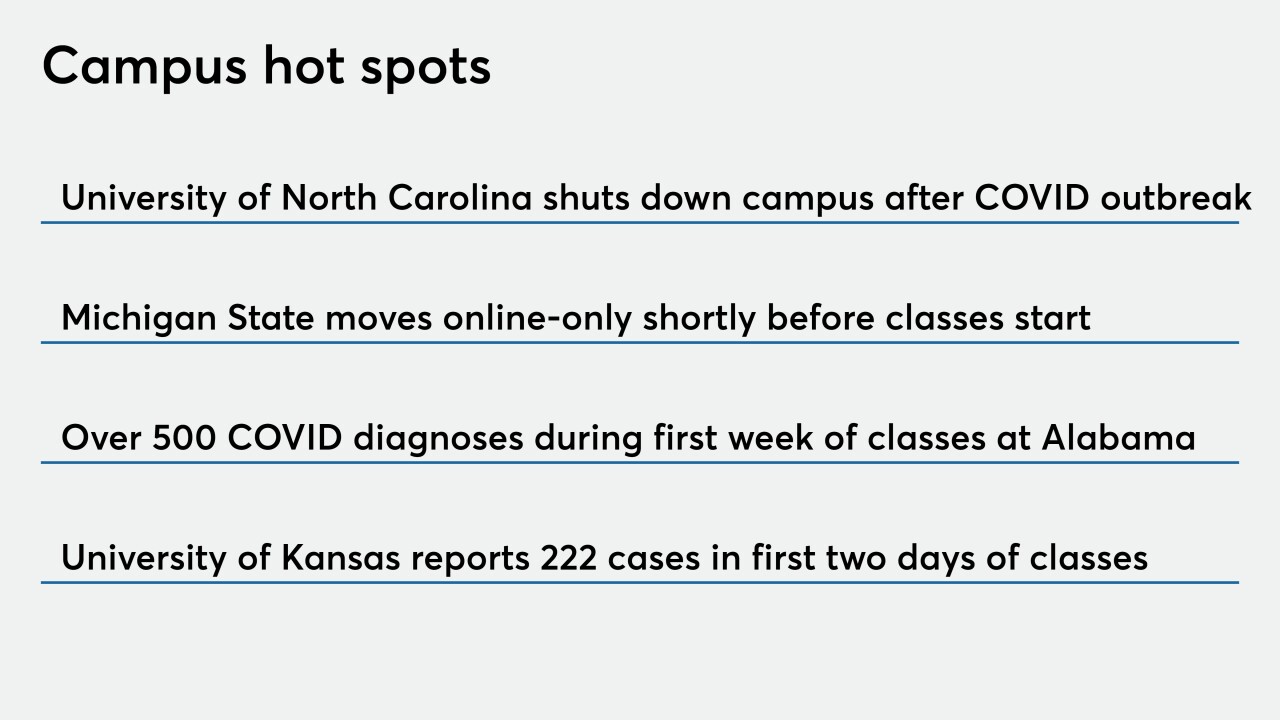

Institutions serving colleges and universities traditionally see membership surge in the fall, but are now planning for a decline as classes move online.

August 27 -

The former chairman of the National Credit Union Administration served at the agency during a crucial time for regulatory reform and credit union growth, though his tenure also had its share of scandals.

August 25 -

The product, which is also aimed at community banks, includes a "take-back" option that allows consumers to withdraw extra funds they've paid that go beyond their monthly scheduled mortgage payment.

August 25 -

If Congress wants to provide better access to banking services for low-income and rural Americans, it would be wise to consider financial services partners that operate under a not-for-profit model.

August 25

-

Whether the number of deals for 2020 can come close to last year's record-setting level will come down to one question: Can community banks generate strong enough profits in the second half to justify their independence?

August 25 -

The GOP is unlikely to discuss much policy that affects financial services this week during its national convention, though there could be remarks addressing controversial changes to the U.S. Postal Service.

August 24 -

The Nashville-based institution is still awaiting regulatory approval on a proposal to operate as a subsidiary of Fortera Credit Union.

August 24 -

Late fees on loan payments and late-arriving documents tied to forbearance and loan forgiveness are just some examples of how delays caused by cutbacks at the U.S. Postal Service could affect lenders and their customers.

August 24