-

The megabank and community bank recently announced they're offering accounts through the payment app. Both gave similar reasons: They need big tech to help them attract new customers.

November 23 -

Daylight's initial product lineup includes a prepaid debit card with the customer’s chosen name and educational content around issues unique to LGBT households.

November 20 -

The company's new relationship with Billshark highlights its quest for partners that can deliver financial management products to complement its banking services.

November 19 -

The startup, created in partnership with conversational AI platform LivePerson, will encourage users to send sums of money to strangers.

November 18 -

The two companies have worked together to provide a banking app that community banks can implement and deploy in 30 days.

November 18 -

A recent survey by the American Bankers Association found that mobile apps surpassed online banking as the go-to platform for consumers earlier this year, and its popularity has continued to rise since the onset of the pandemic.

November 18 -

The challenger bank will start by recommending how much users should allocate toward savings and spending, and will later transfer those amounts automatically.

November 17 -

Financial institutions like Ally Financial, Clinton Savings Bank and First National Bank of Omaha are recruiting personal finance experts, college students and local personalities to promote their products and services.

November 15 -

The fintech startup, which originally helped users cancel duplicate subscriptions, now wants to encourage healthier financial practices.

November 12 -

Scammers may have had more success at duping fintechs than banks in obtaining Paycheck Protection Program loans. But there are reasons for this apparent disparity.

November 11 -

The two companies first started collaborating last year, but now BBVA has white-labeled Prosper’s technology on its own website.

November 10 -

Though most bank customers expect to return to calling or meeting in person with their bankers when the pandemic is over, Citigroup is gauging how much business it can keep in the videoconferencing channel.

November 10 - AB - Technology

Most fintechs entertain the idea of getting a commercial banking license from time to time, but Current is content partnering with banks, says founder and CEO Stuart Sopp.

November 9 -

Some customer fraud and a lack of cooperation from partners Huntington Bank and Dwolla prevented Beam Financial from returning funds to savers, says Aaron Du, the fintech's CEO. He says he’s trying to make things right, but Huntington and Dwolla are taking the dispute to court.

November 4 -

The two banks are among those deploying advanced analytics to give customers advice before they may even know they need it.

November 3 -

The digital bank is on a larger mission to attract younger customers. It's inserting itself into the popular video game in the hope that game players will learn about its products and have fun at the same time.

October 30 -

The challenger bank now offers small businesses checking, lending and payments services on one platform and can link them through Plaid to external bank accounts.

October 29 -

The company is best known for its reciprocal deposit program, but it’s finding new ways to serve banks without competing for their customers.

October 29 -

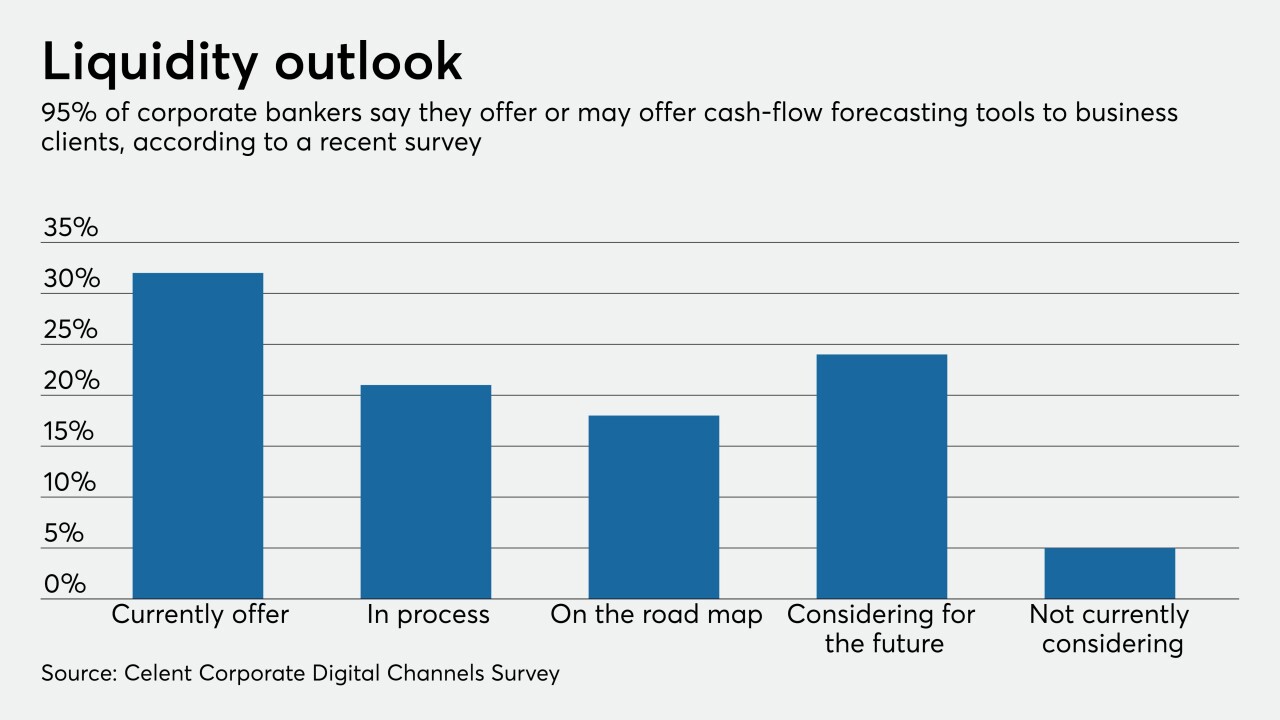

The global bank has rolled out cash-flow forecasting tools as financial institutions race to meet urgent demands from commercial customers trying to navigate uncertain times.

October 27 -

Speculation is part of the reason for the growing differential in market capitalization between legacy financial institutions and upstarts. But one venture capitalist says it's "a call to action" for traditional banks to match fintechs' all-digital, customer-friendly services.

October 26