-

The two companies first started collaborating last year, but now BBVA has white-labeled Prosper’s technology on its own website.

November 10 -

Though most bank customers expect to return to calling or meeting in person with their bankers when the pandemic is over, Citigroup is gauging how much business it can keep in the videoconferencing channel.

November 10 - AB - Technology

Most fintechs entertain the idea of getting a commercial banking license from time to time, but Current is content partnering with banks, says founder and CEO Stuart Sopp.

November 9 -

Some customer fraud and a lack of cooperation from partners Huntington Bank and Dwolla prevented Beam Financial from returning funds to savers, says Aaron Du, the fintech's CEO. He says he’s trying to make things right, but Huntington and Dwolla are taking the dispute to court.

November 4 -

The two banks are among those deploying advanced analytics to give customers advice before they may even know they need it.

November 3 -

The digital bank is on a larger mission to attract younger customers. It's inserting itself into the popular video game in the hope that game players will learn about its products and have fun at the same time.

October 30 -

The challenger bank now offers small businesses checking, lending and payments services on one platform and can link them through Plaid to external bank accounts.

October 29 -

The company is best known for its reciprocal deposit program, but it’s finding new ways to serve banks without competing for their customers.

October 29 -

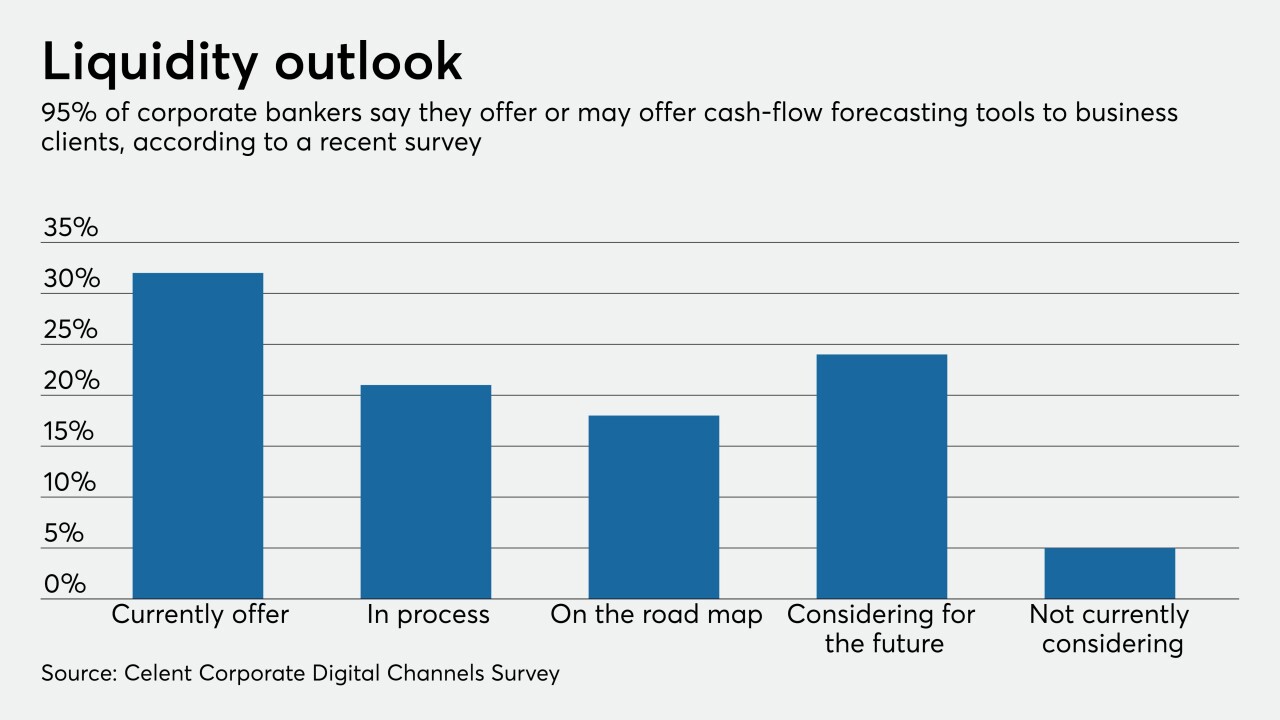

The global bank has rolled out cash-flow forecasting tools as financial institutions race to meet urgent demands from commercial customers trying to navigate uncertain times.

October 27 -

Speculation is part of the reason for the growing differential in market capitalization between legacy financial institutions and upstarts. But one venture capitalist says it's "a call to action" for traditional banks to match fintechs' all-digital, customer-friendly services.

October 26 -

Foreign banks for years have been using technology that folds several communication and information-sharing capabilities into one platform. Now Citigroup and others here are showing interest because of the growing importance of digital in the pandemic.

October 23 -

The media company Urban One has launched a new account that includes a prepaid debit card and encourages customers to buy from Black-owned business and lets them donate their cash back to charity.

October 22 -

The media company Urban One has launched a new account that includes a prepaid debit card and encourages customers to buy from Black-owned business and lets them donate their cash back to charity.

October 22 -

Over the past year, the Alabama bank has been developing new tools that analyze survey responses, phone interactions and social media posts to identify opportunities to improve digital offerings.

October 18 -

Bank of America is applying a familiar arsenal — including APIs and its popular virtual assistant, Erica — to online business banking, cross-border payments and cash management in an effort to modernize those services.

October 15 -

Mobile and online banking technologies that the Toronto bank previously rolled out, including a virtual assistant developed by Kasisto and money management tools made by Moven, have become much more popular since the arrival of COVID-19.

October 13 -

Chase First Banking is embedded in the bank's mobile app and has parental controls. It is an example of how banks are trying to attract Generation Z.

October 13 -

Crane Credit Union has taken an Instagram Stories-like approach, while Certified Federal Credit Union is crafting personalized email messages.

October 9 -

Television executive Ryan Glover, rap star Killer Mike and civil rights icon Andrew Young have launched a digital bank for Black and Hispanic consumers called Greenwood Financial.

October 8 -

SaveBetter.com from Deposit Solutions lets consumers shop for different savings products through one portal and provides national exposure for participating banks, which include Ponce Bank in New York and Central Bank of Kansas City.

October 7