-

The FHFA director’s recent comments about whether the government-sponsored enterprises should be designated as SIFIs tees up a potentially significant element of the mortgage finance debate.

May 23 American Banker

American Banker -

Charges against Stephen Calk indicate he lied to regulators about what he knew when he approved loans to Paul Manafort, as well as his interest in landing a job in the Trump administration.

May 23 -

Square is changing an earlier ban on cannabis payments and is conducting a pilot, raising the possibility that cannabis merchants may get greater access to banking and payment processing.

May 23 -

The California-based institution posted growth in loans but saw net income fall from a year earlier.

May 23 -

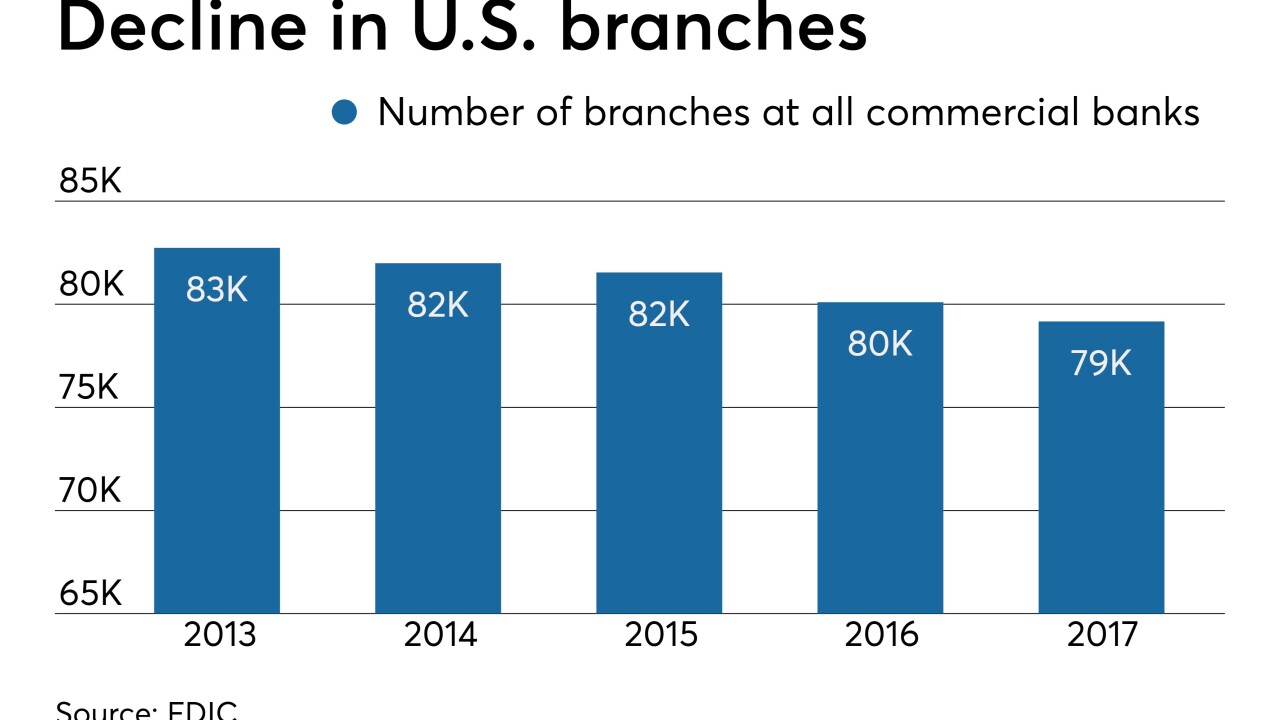

As foot traffic continues to decline, bankers are relying on gimmicks like dramatic lighting and placing buildings closer to highways in an effort to market their institutions.

May 23 -

During its monthly meeting, the National Credit Union Administration board also approved a proposal to increase CU access to non-member deposits, a move bankers are already railing against.

May 23 -

Online lenders now have close to 40% of the unsecured personal loan market, much of which is refinanced credit card debt. Banks' card portfolios are taking a hit.

May 23 -

Cloud-based treasury software provider Kyriba is partnering with JPMorgan Chase to launch a real-time payments API integration for its mutual corporate finance clients.

May 23 -

At first blush, Netflix may seem to have a fairly simple payment process: Collect a card number once, and keep charging it every month until the customer cancels. But even this process can be demanding.

May 23 -

The two lenders are bucking the trend for the overall industry, which saw year-over-year mortgage growth slide to a 17-year low in March, according to the Bank of Canada.

May 23