-

Simmons First, which is based in Arkansas, plans to shutter 23 locations later this year, while Great Southern in Missouri has hired a firm to take a look at its network.

July 22 -

The Dallas bank set aside less in the second quarter for credit losses than analysts expected. Executives cited action in Texas and California to reverse reopenings and said they're still committed to the oil and gas business.

July 21 -

The Georgia company warned that outstanding loans could fall and deferrals will likely rise as its home state and Florida grapple with the pandemic.

July 21 -

Loans to retailers and hotels are at the highest risk of default, the Salt Lake City company said in its second-quarter earnings presentation.

July 21 -

The coronavirus pandemic has exposed weaknesses even at well-established fintechs. They could become more resilient by partnering with traditional financial institutions.

July 21 CCG Catalyst

CCG Catalyst -

The Financial Stability Oversight Council’s plan to study the market explains very little about which activities or firms, like Fannie Mae and Freddie Mac, will be designated as systemically important. Here's some clearer guidance.

July 21

-

The agency's request for information seeks comment on the idea of the FDIC partnering with a standards-setting organization to develop best practices for technology firms, among other things.

July 20 -

The OCC is proposing steps for determining which party is the "true lender," which affects how the agency oversees such arrangements.

July 20 -

The Pennsylvania bank incurred $2.3 million in expenses in second quarter after winding down unit BMT Investment Advisers.

July 20 -

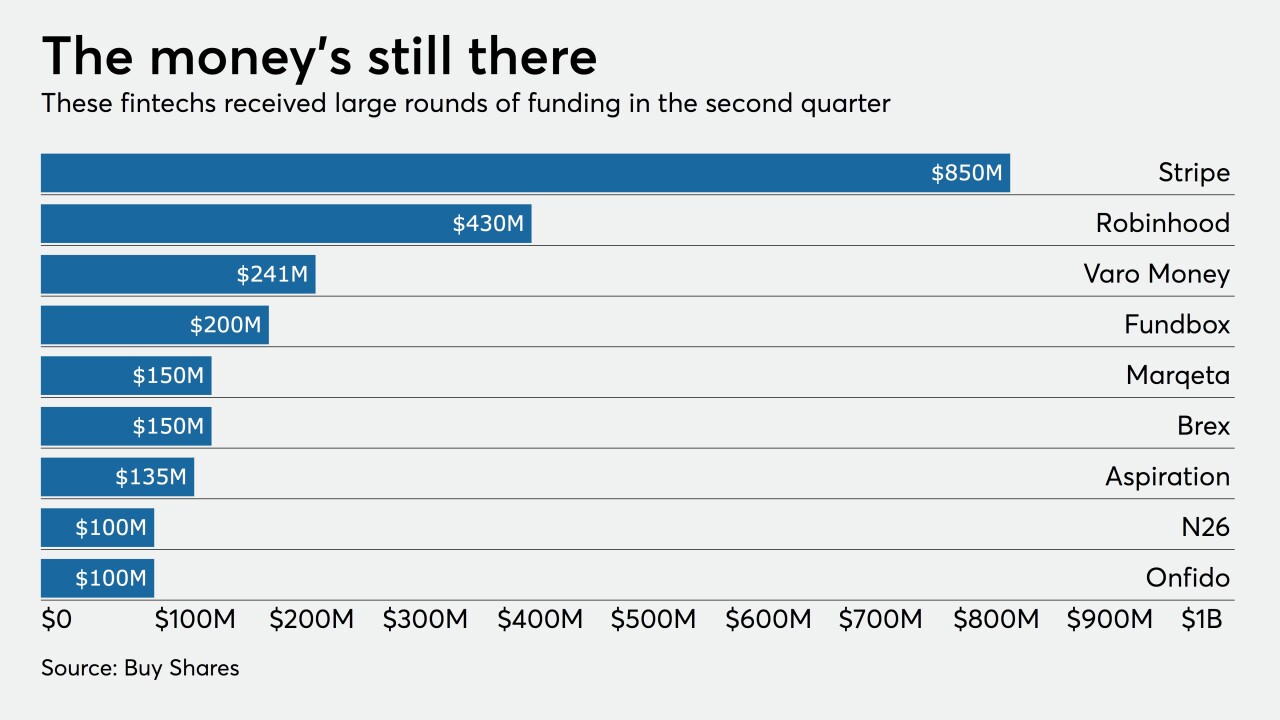

Business models and adaptability will determine the success — or failure — of financial technology companies as they deal with fallout from the coronavirus outbreak.

July 20