-

Smaller institutions should prepare themselves for some of what the competition has experienced, including increased provisions for losses and declining net interest margins.

April 20 -

Citizens, Regions and others say business investments initiated before the COVID-19 pandemic, including technology improvements and new consumer offerings, are on track.

April 19 -

The Senate Banking Committee chair will work with the heads of other panels in overseeing the $2 trillion stimulus package that Congress passed last month.

April 17 -

Wells Fargo tells business clients to consider other banks for emergency loans; JPMorgan Chase is temporarily reducing its exposure to the mortgage market; how TD Bank got a head start on pandemic preparations; and more from this week's most-read stories.

April 17 -

Consumers and businesses put more money in the bank as the pandemic worsened. How long the funds remain will depend on how quickly the economy recovers.

April 16 -

The National Credit Union Administration is giving lenders and borrowers extra time to complete appraisals to ensure mortgages are still being completed despite the pandemic.

April 16 -

Payments unicorn Stripe contends it has the financial power to apply its technology to coronavirus medical care, remote telework, business funding, and easier onboarding for companies that have been suddenly thrust into an internet existence.

April 16 -

Airwallex has raised $160 million in a Series D fundraising round to expand global payment offerings for small businesses and enterprises.

April 16 -

Wall Street trading arms benefited from first-quarter volatility, but it may not be enough to salvage future earnings; “unprecedented volume” of customers logging into their online bank accounts creates system overload at many banks.

April 16 -

The letter written by Rep. Maxine Waters, D-Calif., and Sen. Sherrod Brown, D-Ohio, was seen as a boost to Wall Street lobbying efforts seeking to quell the fallout of the coronavirus crisis on the mortgage market.

April 16 -

Quick forbearance actions averted an immediate hit to asset quality, but executives warned that a spike in unemployment and a looming recession will cause long-term problems.

April 15 -

The biggest lenders seem to have handled the corporate rush for cash heading into the economic shutdown caused by the coronavirus pandemic. But their ability to collect is as uncertain as the economic outlook for the next year.

April 15 -

Net income fell 46% in the first quarter as the company added nearly $5 billion to its loss reserves in anticipation of a wave of loan defaults.

April 15 -

The two U.S. banks set aside a combined $10 billion for future loan losses, which may not even be enough; a proxy firm says the Swiss bank did not adequately punish former executives for spying scandal.

April 15 -

With the coronavirus pandemic bringing economic activity to a virtual standstill, BofA, like Wells Fargo and JPMorgan Chase, is shoring up its reserves to brace for a likely recession.

April 15 -

The San Francisco bank said the amount of loans that could go into forbearance so far represents a small percentage of its total portfolio.

April 14 -

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

April 14 -

The Pennsylvania company said it faces $7.5 million in potential exposure from a commercial lending relationship.

April 14 -

Republicans balked at measures like an overdraft fee ban and interest rate cap in the recent stimulus bill, but Sen. Sherrod Brown, D-Ohio, isn’t done trying to add such proposals to future relief packages.

April 14 -

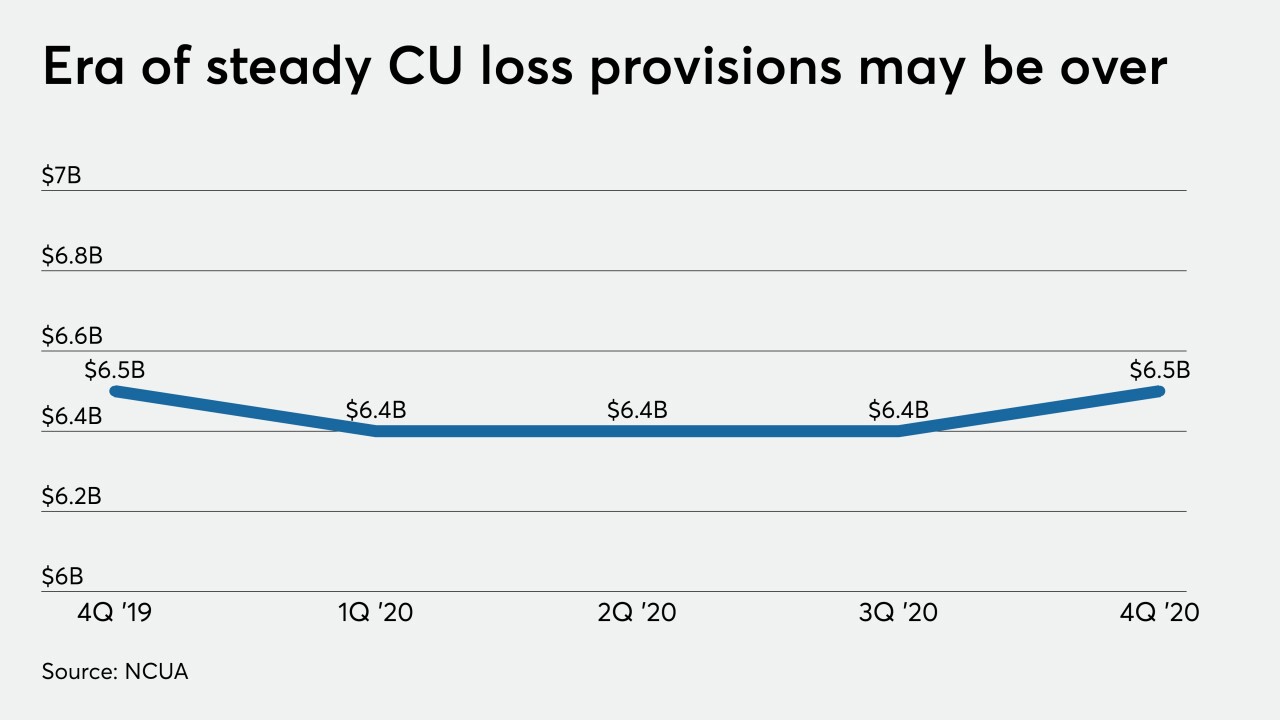

The National Credit Union Administration board unanimously approved changes to an interim rule regarding the regulator's Central Liquidity Facility.

April 14