-

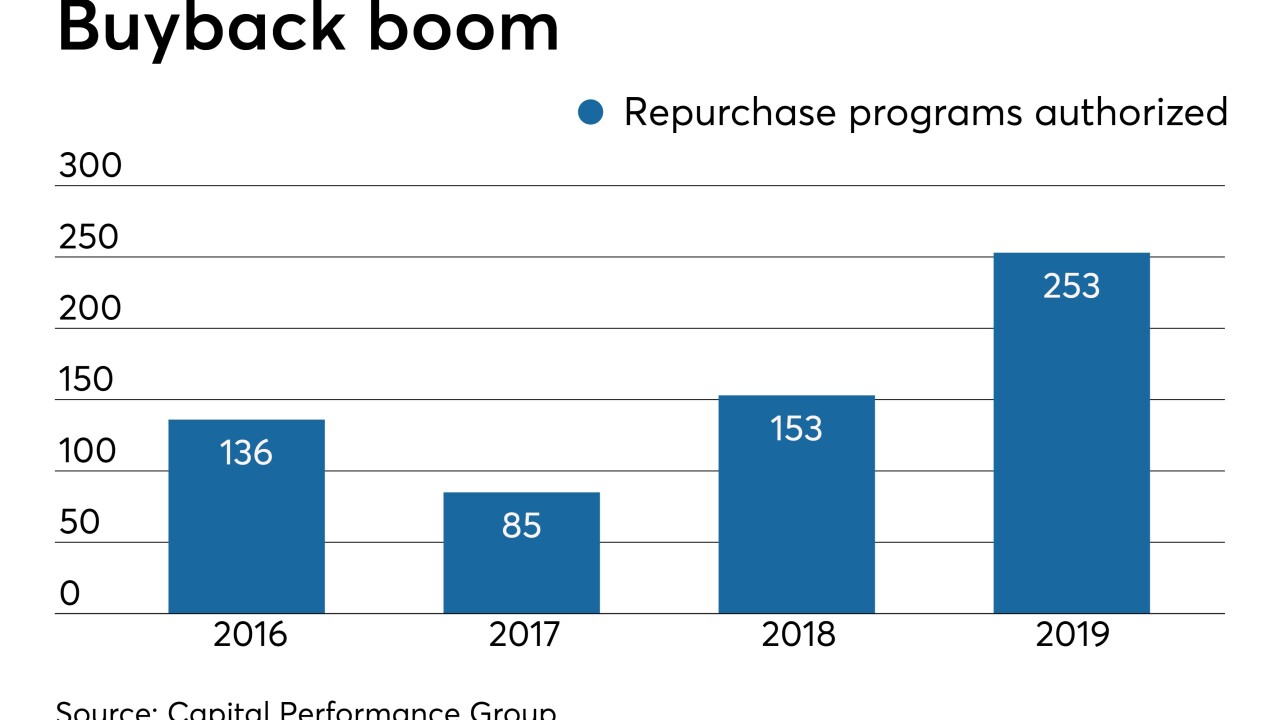

Anticipating a weaker economy and added pressure on stock prices, banks authorized more repurchases of outstanding shares last year.

February 5 -

Popular’s branch in a Brooklyn neighborhood faced an uncertain future until it was designated as a bank development district. Now it’s eligible to receive millions of dollars in municipal deposits.

February 5 -

The Maine-based credit union also grew membership last year to the point where it now serves nearly 40,000 consumers.

February 5 -

The bank’s former Asia investment banking co-chief is its third executive to be so punished; the agency says Telegram’s digital coin is a security.

February 5 -

Certain loan segments are showing signs of deterioration, but consumer lending and digital banking are bright spots. Meanwhile, bankers are eyeing opportunities to improve efficiency, add scale and take advantage of M&A disruption. Here's what to expect from smaller regionals in the year ahead.

February 3 -

The regulator said the investment bank and financial services company will help in the process of strengthening Fannie Mae and Freddie Mac’s capital standing for their eventual exit from conservatorship.

February 3 -

The California company will pay $1 billion for Opus, a once highflying bank that struggled with credit issues in recent years.

February 3 -

The expansion comes after a year in which net income at the Nashville-based credit union dropped by more than half amid a rise in delinquencies and charge offs.

January 31 -

Banks would be allowed to own stakes in venture capital funds; the combined BB&T-SunTrust isn’t realizing cost savings as fast as it projected.

January 31 -

Like its rival Mastercard, payments volume is on the rise at Visa, but the coronavirus complicates the near-term economic outlook and makes China an even tougher market.

January 30 -

Kenneth Lehman, a former banking attorney who acquires large stakes in small banks, will buy BankFlorida, which lost $555,000 through the first nine months of 2019.

January 30 -

The company has revised its near-term forecasts for reducing expenses, citing delayed branch closings and a decision to spend more time testing systems ahead of conversion and integration.

January 30 -

PayPal reported strong growth in revenues, earnings, payments volume and users, demonstrating as the company has finally transitioned away from the vestiges of its former eBay ownership.

January 30 -

The new regulation aims to standardize the process for determining if those owning less than a quarter of a bank must comply with holding company requirements.

January 30 -

In another rollback of the bank trading ban, the federal agencies unveiled a plan to allow financial institutions to invest in multiple companies through certain fund structures.

January 30 -

The bank raised its return-on-equity goals, based mostly on cost cuts and its core trading business; the Fed did raise the rate it pays on bank reserves.

January 30 -

The Los Angeles company set aside more money to cover a problem loan after an updated appraisal of the credit's collateral.

January 29 -

Loans made for Fiat Chrysler represented the largest chunk of Santander Consumer's lending in the fourth quarter, and Mahesh Aditya said their relationship is his top priority.

January 29 -

While touting iPhone 11 as a big hit with consumers because of its various features and high-quality camera, Apple CEO Tim Cook also pointed to Apple Card as a reason the company's newest smartphone sold so well during the holidays.

January 29 -

The six bills championed by Democrats aim to reduce consumer burdens and provide opportunities for borrowers to rehabilitate their credit, but the legislation garnered no Republican support.

January 29