-

Organizers of Bank of St. George still need to raise $18 million before opening.

December 30 -

The Wisconsin-based institution's $4 million return is double what it paid out just five years ago.

December 30 - LIBOR

Regulators' oversight of the industry's switch to a new interest rate benchmark is expected to intensify as a key deadline approaches.

December 29 -

Low rates and spotty loan demand mean banks are having to “dig deeper” to improve efficiency and maintain profit margins.

December 26 -

Paul Murphy took full responsibility for a recent spike in charge-offs at the Houston company. His challenge in 2020 is keeping credit issues in check.

December 24 -

A roundup of some of this year's patronage dividends and how credit unions are passing their success back on to members.

December 24 -

The shift away from LIBOR won't take place until at least 2021, but there are steps credit unions can take to prepare now.

December 23 PenFed

PenFed -

PE firms have made investments in only seven banks in 2019, compared with 21 last year. Here's what's driving the slowdown.

December 22 -

The two agencies have delayed the deadline for the public to respond to a request for information on the rating system used to score banks' overall health.

December 20 -

The San Francisco-based Ripple, which launched in 2012, will use the funding to add personnel to its global organization and enrich its services that power payments using blockchain technology with its XRP platform.

December 20 -

The state has proposed a law to cap the interest rate on certain consumer loans, but nonbanks aim to skirt it by seeking a rent-a-charter.

December 20 California Department of Business Oversight

California Department of Business Oversight -

Lower interest rates are allowing banks to use the cheaper capital to repay higher-cost debt and prepare for future expansion.

December 19 -

Many large lenders pointed regulatory restrictions on their balance sheets and reduced risk appetite to explain why they stood on the sidelines during the September spike in overnight funding rates, according to a Federal Reserve survey of senior credit officers.

December 19 -

Big picture the industry is doing well, but at the median, lending and membership are flagging even as deposits and assets rise.

December 18 -

It's long past time for the National Credit Union Administration to implement a risk-based capital standard, and the recently approved delay could hurt more than it helps.

December 17

-

New York is the latest state to change its statutes regarding public deposits and credit unions as more institutions seek out strategies to boost liquidity.

December 17 -

The Department of Business Oversight said TitleMax charged consumers fees to push loan amounts above the threshold at which the state's rate cap applies.

December 16 -

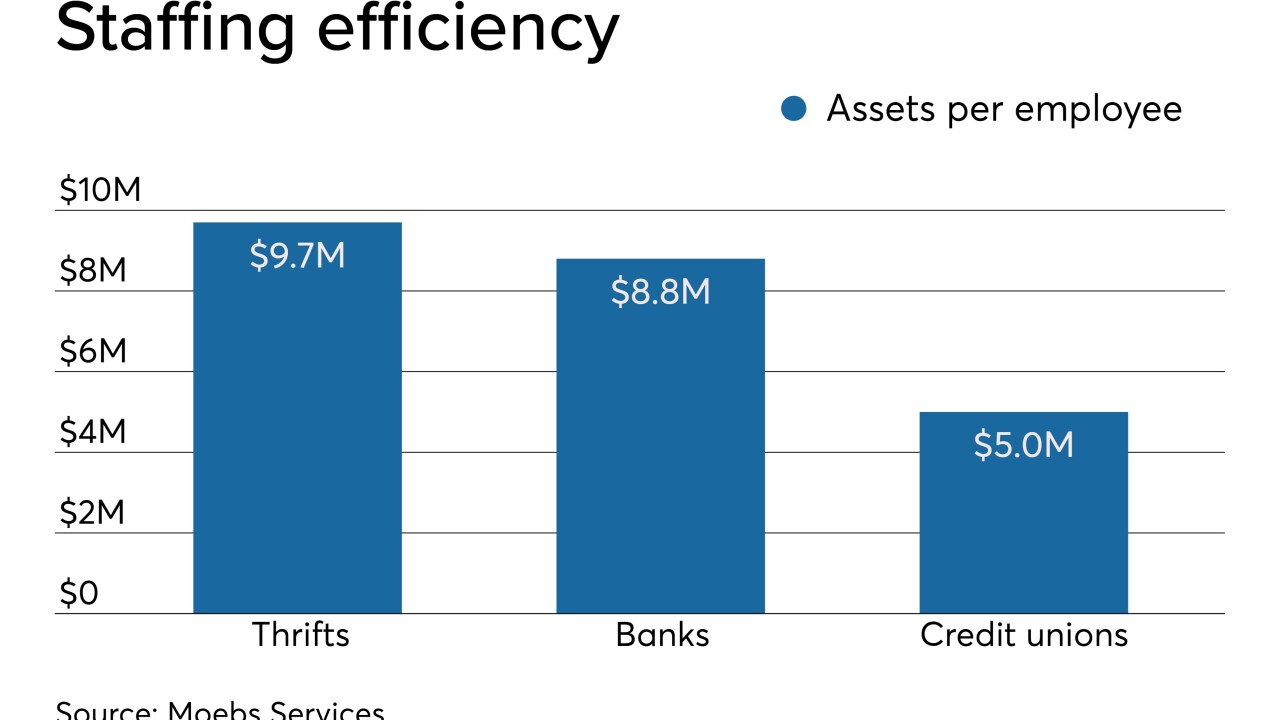

Savings institutions are aggressively cutting staff and shortening hours to be more competitive. As a result they have become more efficient than commercial banks.

December 16 -

It's long past time for the National Credit Union Administration to implement a risk-based capital standard, and the recently approved delay could hurt more than it helps.

December 16

-

John Williams said Friday that the Federal Reserve's three interest rate cuts this year have bolstered the housing market and consumer spending.

December 13