-

The credit union regulator has not yet announced an agenda, but the meeting could potentially include mattes related to field of membership and risk-based net worth.

July 1 -

Business continuity plans should be used constantly, not just when the crisis is at its peak, says the New York Fed’s head of financial services.

June 24 The Federal Reserve Bank of New York

The Federal Reserve Bank of New York -

A budget item establishing a new agency to protect consumers from predatory lenders has been put on hold as state officials deal with the coronavirus response and other priorities. But it could be revived in legislative talks later this summer.

June 11 -

The acting head of the agency says it cannot continue relying on web-based exams put in place during the coronavirus and will start sending staff into banks.

June 11

-

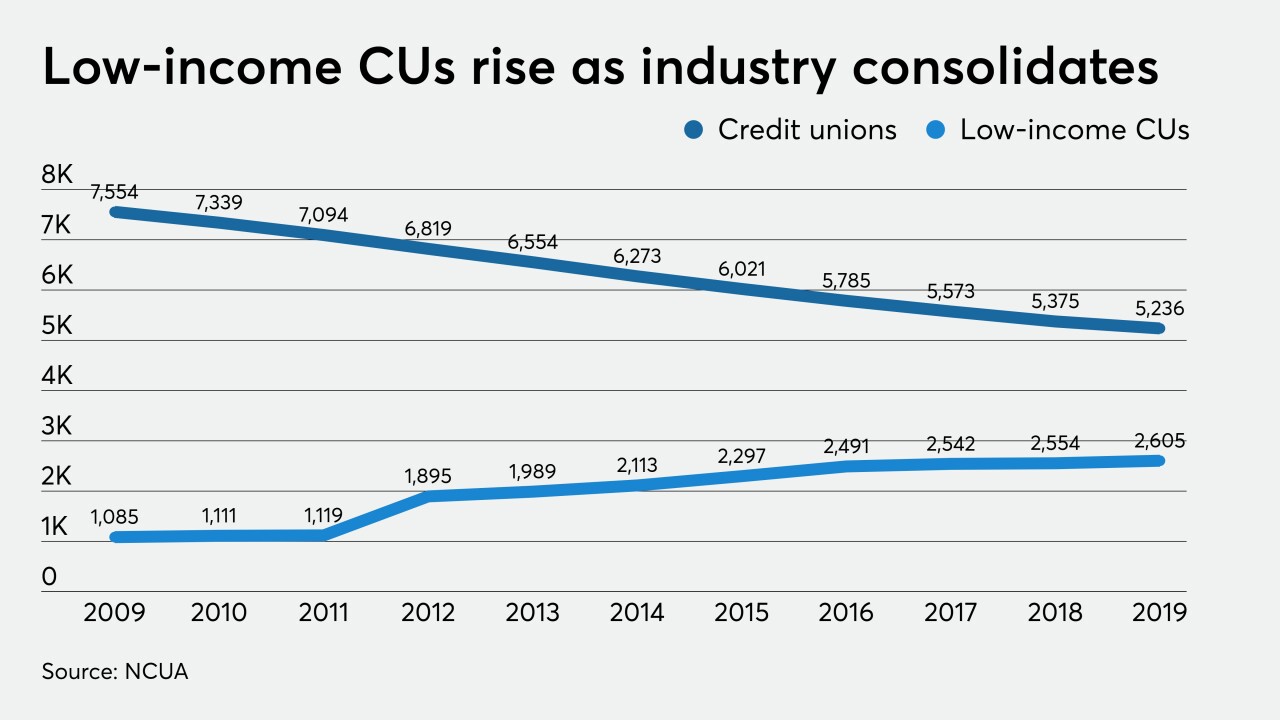

The Independent Community Bankers of America has asked NCUA's inspector general to review the agency's decision to change how low-income credit unions receive that designation.

May 29 -

The credit union regulator is adding line items to required quarterly reporting in order to better account for loan forbearance, CUs lending through the Paycheck Protection Program and more.

May 28 -

Banks would be wise to dust off their Great Recession playbook and shed nonperforming loans while growing through M&A.

May 28DebtX -

Comptroller of the Currency Joseph Otting’s regulation reforming the Community Reinvestment Act lacks performance metrics criticized in an earlier proposal. But neither the FDIC nor the Fed is supporting the final plan.

May 20 -

Recent tweaks to Reg D have blurred the line between checking and savings accounts, opening up the possibility for new innovation in those products.

May 20 -

The final regulation will significantly revise a December proposal, responding to concerns from stakeholders. Meanwhile, in a surprising move, the regulator who had championed the reforms is expected to resign this week.

May 19 -

The Independent Community Bankers of America accused the National Credit Union Administration of using the coronavirus to usher in additional changes without the normal amount of scrutiny.

May 7 -

Banks tend to pull back in times of crisis by tightening credit and focusing on collections efforts. But consumers, and not returns, must be the focus during the coronavirus pandemic.

May 5 Financial Health Network

Financial Health Network -

Southwest HealthCare Credit Union agreed to merge into Canyon State because of increased competition and regulatory demands.

April 20 -

This is the first time since 2014 that the regulator won't penalize credit unions that file within 30 days of the deadline.

April 20 -

Five Democrats on the Senate Banking Committee sent a letter to Director Kathy Kraninger calling the agency's response to COVID-19 “tepid and ineffectual at best.”

April 7 -

The only current CEO who steered a major U.S. bank through the financial crisis, Dimon said JPMorgan’s earnings will be “down meaningfully” this year as a result of the coronavirus pandemic.

April 6 -

The Ohio Democrat argued that the public wouldn't be able to meaningfully provide feedback on rules given the stressful circumstances related to the outbreak.

March 20 -

Refinancing activity is surging, existing borrowers are inquiring about loan modifications, loan closings are being delayed by more complex credit checks — and banks are short on people to handle it all.

March 19 -

Many new artificial intelligence and machine learning methods used for underwriting are not fully equipped to predict defaults.

March 19 Regions Bank

Regions Bank -

The National Credit Union Administration also ordered its own employees to work from home until at least the end of March.

March 16