-

The Pittsburgh company’s sale of its stake in the asset manager yielded billions of dollars that could cushion the pandemic’s economic blow and eventually help fund a big acquisition.

May 15 -

The agreement comes a day after Axos Financial warned that H&R Block was ending their six-year-old partnership.

May 15 -

The merger between the two Corpus Christi, Texas-based institutions is expected to close this summer.

May 14 -

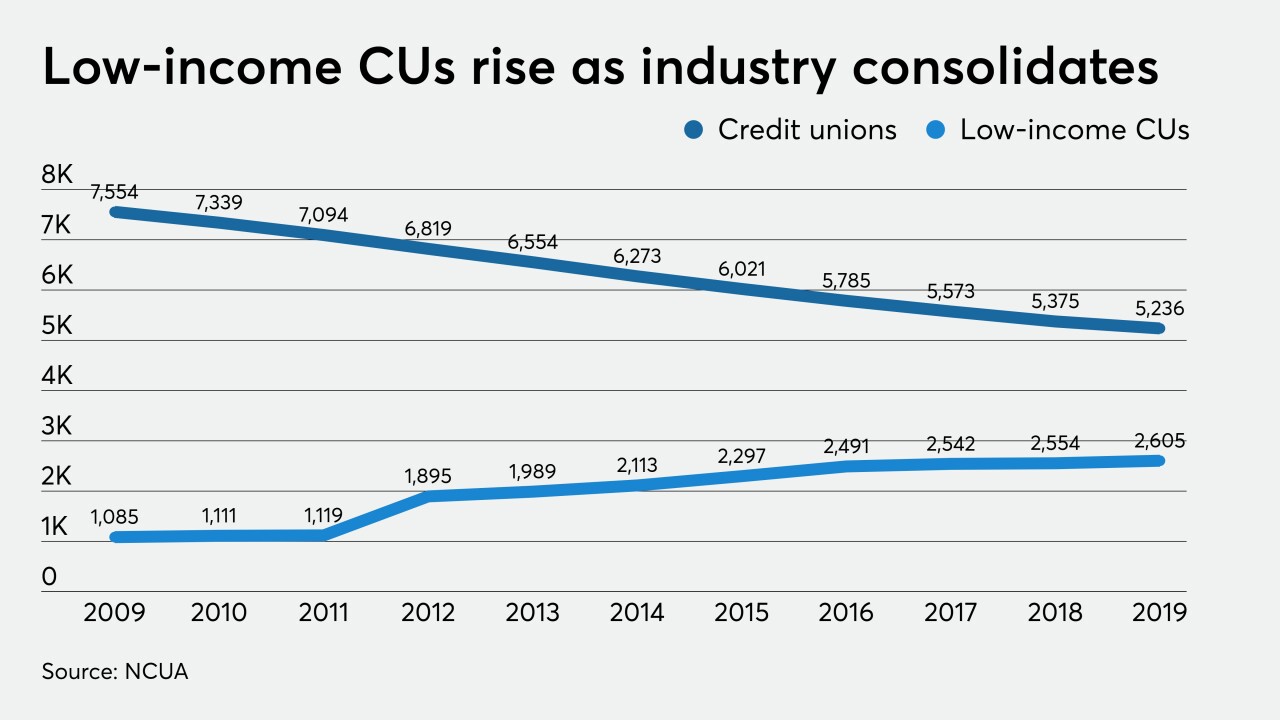

The Independent Community Bankers of America would not rule out legal action if Congress doesn't address the National Credit Union Administration's recent decision expanding the low-income designation.

May 13 -

The Georgia-based credit union hopes to gain more flexibility to widen its field of membership by switching from a federal charter.

May 12 -

C&NW Proviso, which has no website or online services, will gain a slate of new products and additional locations from the deal.

May 12 -

The Pittsburgh company has owned a 22% position in the money manager since 1995.

May 11 -

The Summerville, S.C.-based institution will also close two branches as part of a broader strategic effort to better service members.

May 11 -

Institutions need to think about revenue streams and portfolio diversification as the coronavirus affects much of the U.S. economy.

May 8 Alliant Credit Union

Alliant Credit Union -

Members of West York Area School District Employees Federal Credit Union approved the merger into First Capital, and the deal is expected to close this summer.

May 8 -

Local 229 IBEW Federal Credit Union, which had less than $2 million in assets, has merged into White Rose Credit Union.

May 7 -

The Independent Community Bankers of America accused the National Credit Union Administration of using the coronavirus to usher in additional changes without the normal amount of scrutiny.

May 7 -

Seneca-Cayuga Bancorp's capital levels have fallen steadily since peaking in 2013.

May 6 -

TruStone Financial and Firefly Credit Union have announced plans to merge, pending regulatory approval and charter changes.

May 5 -

The Illinois company will sell Bates Cos. to an undisclosed buyer less than two years after buying the wealth management firm.

May 4 -

The Wisconsin regional said the funds will support loan growth and its dividend policy as well as create an added capital buffer.

May 4 -

The $468 million-asset institution said expansion isn't required now but the move is a proactive attempt to ensure its long-term viability.

May 4 -

Locally sourced campaigns are providing more capital as traditional loans fall short of covering operating expenses.

May 1 -

The integration of Habersham Federal Credit Union into HALLCO Community Credit Union is expected to take several months.

May 1 -

Members of Maryland-based GEICO Federal Credit Union are set to vote on whether to merge into Illinois-based Baxter Credit Union.

April 29