-

The Arkansas company will gain branches around Nashville as part of the acquisition.

May 5 -

The company agreed to pay $104 million for a one-branch bank with $391 million of assets.

May 5 -

Lenders including Howard Bancorp and First Carolina Bank are shunning acquisitions as a route into new markets, to avoid overpaying for targets and inheriting potential loan problems.

May 5 -

The company, once known as Southern National Bancorp of Virginia, plans to launch the as-yet-unnamed platform by the end of this year.

May 4 -

The purchases of Truck Insurance Specialists and Hometown Insurance are expected to help the company expand its dealings in transportation and agriculture.

May 4 -

The company will start to offer insurance planning and risk management services as part of its purchase of Strategic Wealth Group in Valdosta, Ga.

May 4 -

The company’s retail banking and auto-lending businesses in the U.S. generated a larger share of overall profits in the first quarter, and Executive Chairman Ana Botín and other executives unveiled expansion plans for both units.

April 28 -

The Arkansas bank is turning to asset-based lending and loans to venture capital and other investment groups to help fill a void created by a shortage of new, big-ticket commercial real estate deals.

April 28 -

Mike Daniels has been president and CEO of Nicolet's bank since 2015.

April 28 -

The Dallas company will pay nearly $54 million for a 49% stake in a lender that operates in 10 states.

April 28 -

The $56 million acquisition will extend Southern California Bancorp's footprint north of Los Angeles.

April 28 -

The Missouri company announced the deal just five months after buying Seacoast Commerce in San Diego.

April 26 -

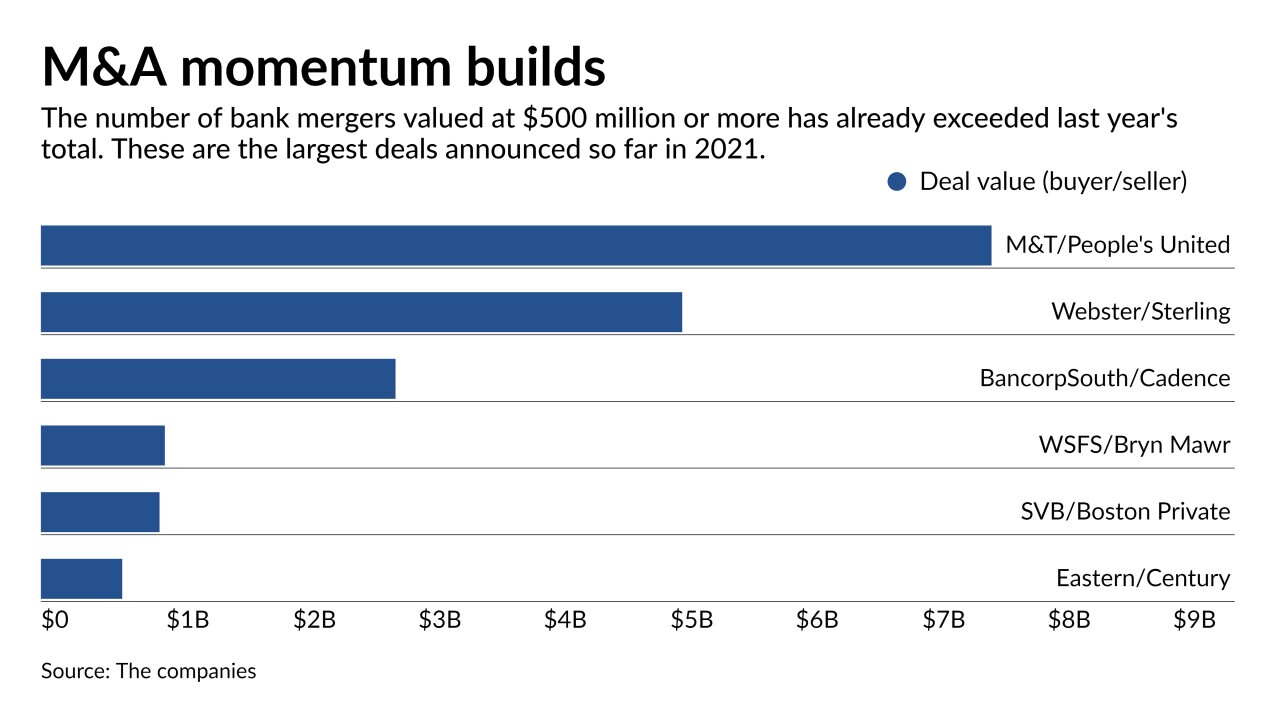

The merger would create a company with nearly 400 branches, 87 loan production offices and $87 billion of assets.

April 26 -

The proposed acquisition is the second deal in as two days to involve an Atlanta-based seller.

April 23 -

The Illinois companies agreed to merge in a transaction that is expected to close later this year.

April 23 -

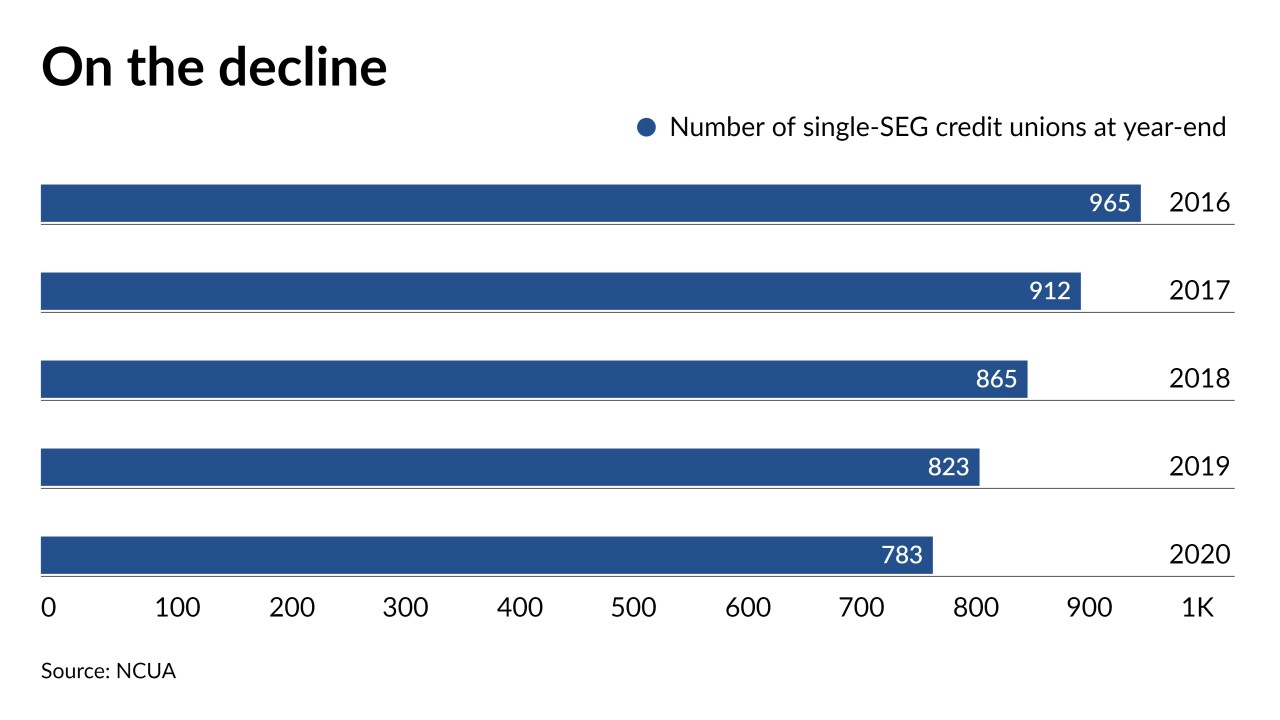

Regulators recently eased field-of-membership rules to promote growth of federal credit unions. A handful of institutions are taking advantage of the changes to recruit more members, but some may find the process too cumbersome.

April 22 -

The Georgia company agreed to pay $84 million for a bank with nine branches and $715 million of assets.

April 22 -

The deal would be Independent's sixth since 2015 and would continue a wave of consolidation among Boston-area banks.

April 22 -

Clarity on credit quality has bankers ready to strike deals after a lengthy pause. A steady rise in stock prices has also given potential buyers the financial wherewithal to pursue acquisitions.

April 21 -

Cal Poly Federal Credit Union's recent merger into SchoolsFirst highlights the difficult choice many small institutions face: diversify your field of membership or risk going out of business.

April 21