-

The company has formed a special committee to find a successor for James Ford, who will retire as president and CEO next year.

March 9 -

Chris Hendry has served on the credit union's board but has spent his career in health care and philanthropy. He said many of his skills are easily transferable, including a focus on marketing and community engagement.

March 9 -

The unnamed investors will pay about $50 million for Northern California National Bank through a tender offer.

March 8 -

The deal, subject to approval from regulators and members, will add to Valley Strong's existing branch network and comes after several years of losses at Solano First.

March 4 -

The company would gain its first branches around Annapolis after it buys Severn Bancorp in a deal valued at $146 million.

March 3 -

DMG Bancshares, formed by banking veteran Don Griffith, wants to buy more West Coast banks. For California First, the sale ends a four-year period in which it substantially shrank its loan book after it was ordered to shed leveraged loans.

March 3 -

The bank's purchase of Sodak Home Loans in Sioux Falls, S.D., adds to a string of bank deals for mortgage lenders this year.

March 1 -

The company has agreed to pay $43 million for a bank with assets of $354 million.

March 1 -

Members of two smaller institutions will soon vote on whether to join South Carolina-based REV, boosting its assets by 15% and giving it a foothold in North Carolina.

February 26 -

The bank, formed in 2019 when investors bought and recapitalized Sound Bank, will use the funds to hire lenders and improve its overall infrastructure.

February 26 -

Efforts to simplify business operations under incoming CEO Jane Fraser will cost a lot of money but will ultimately create a safer, more profitable company, Chief Financial Officer Mark Mason said.

February 25 -

Capital One Financial has begun to lift borrowing limits for certain customers as it seeks to restart growth in its sprawling credit card business.

February 24 -

Some in the industry are beefing up online educational offerings and enlisting social media ambassadors on college campuses to help recruit younger consumers.

February 22 -

The Office of the Comptroller of the Currency issued a prompt corrective action directive to First National Bank and Trust in January, requiring it to hire a forensic auditor and provide the OCC with access to documents and records.

February 22 -

The deal for the $63 billion-asset People's United would create a company with more than $200 billion of assets and a branch network stretching from Maine to Virginia. Buffalo, N.Y.-based M&T has not made an acquisition since buying Hudson City Bancorp in late 2015.

February 22 -

The company has agreed to pay $32 million for a bank with six branches and $256 million of assets.

February 18 -

The Houston-based lender is working with financial advisers to solicit interest from potential buyers, according to people familiar with the matter.

February 18 -

Acquiring AmeriHome would provide the fee revenue the Phoenix company seeks to compensate for low interest rates and tepid commercial loan demand. The deal also would allow it to reinvest billions of dollars of excess liquidity.

February 17 -

The Arizona company will pay $1 billion for the parent of AmeriHome Mortgage, which manages a $99 billion mortgage servicing portfolio.

February 16 -

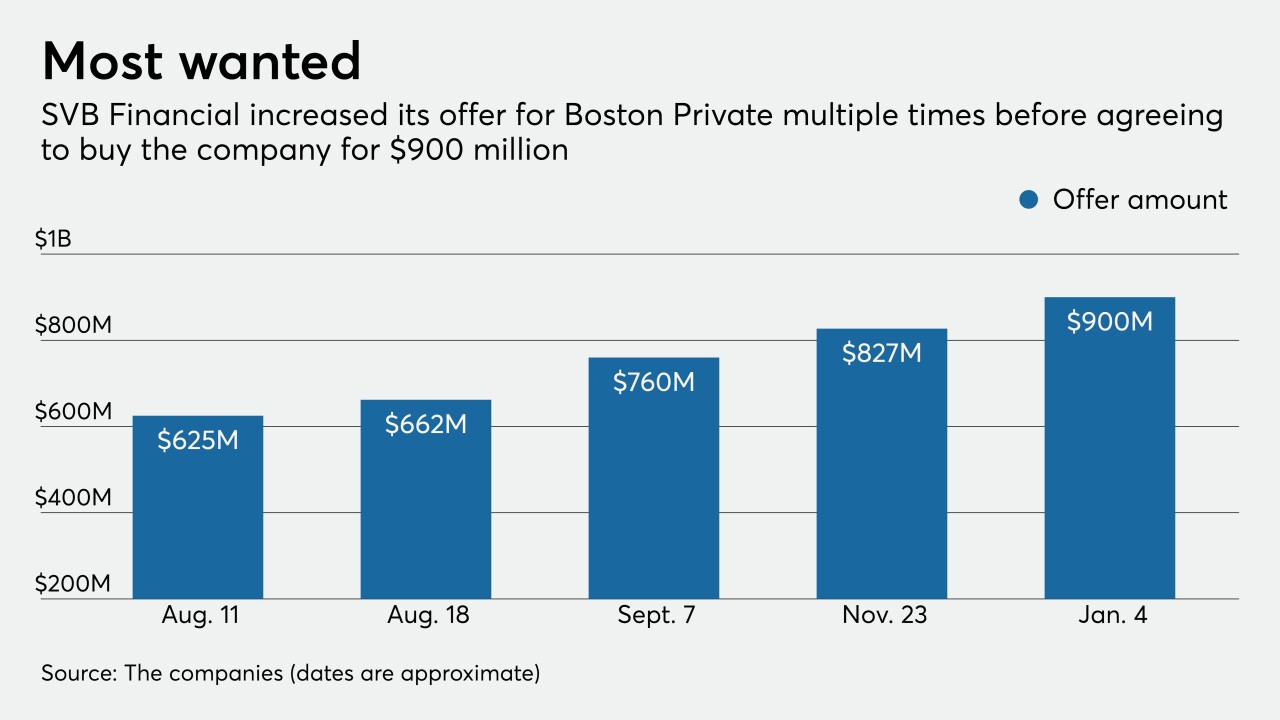

The leadership at Boston Private Financial Holdings wanted to establish a wealth management partnership with SVB Financial Group — but ended up striking a deal to sell the company to SVB instead.

February 16