-

Thinly traded First Trust Bank was a popular stock with investors early Friday after rumors circulated that the Charlotte community bank could soon be acquired.

April 27 -

Swope Montgomery, the longtime CEO of BNC Bancorp in High Point, N.C., details his growth strategies, cautions on deals and the risks and rewards of private equity.

August 31

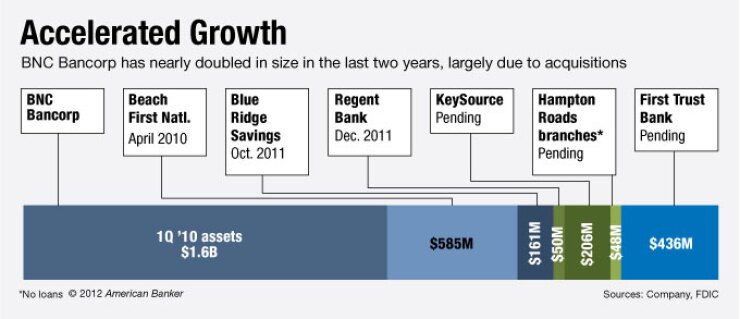

W. Swope Montgomery Jr., the chief executive of BNC Bancorp (BNCN), is continuing to make good on his word to be an active acquirer in the Carolinas.

The High Point, N.C., company said on Monday that it would purchase First Trust Bank (NCFT) of Charlotte, N.C., for $35 million in cash and stock. It is the $3.2 billion-asset BNC’s fifth deal in North and South Carolina since September.

BNC, that parent of Bank of North Carolina, also said Monday that it plans to raise $72.5 million by selling preferred stock that would be convertible to common stock at $7 per share. Aquiline Capital Partners, a New York private equity firm and the bank’s largest shareholder, is leading 19 buyers of the shares. The capital raise is scheduled to close on Friday.

"The two transactions announced today epitomize BNC's growth strategy of building with top-quality bankers both organically and through acquisition," Montgomery said in a press release. "With this capital and the addition of First Trust, we will be able to further leverage our infrastructure to better support our growing customer and shareholder base."

BNC's shares finished Monday at $7.40, down 5.25%. First Trust's shares were unchanged, at $5.90.

Montgomery said last year that BNC was interested in

BNC announced in September (and later completed) plans to buy Regent Bank in Greenville, S.C., and it acquired a failed bank in North Carolina in October. It also is in the process of

The $436 million-asset First Trust has three branches that serve small businesses in the Charlotte metro area.

Seventy percent of BNC's payment would be made in stock, and 30% would be in cash.

First Trust shareholders would receive 0.98 shares of BNC common stock for each of their First Trust shares or $7.25 per share in cash.

The deal is expected to close in the fourth quarter. Upon its completion, BNC would have more than $650 million of loans and $589 million of deposits in the Charlotte metro area. James T. Bolt Jr., the chief executive of First Trust, would join BNC's board and become an executive vice president at the bank.