-

Itaú Unibanco Holding in São Paulo, Brazil, has denied that it is in negotiations to buy Citizens Financial Group, the U.S. arm of the Royal Bank of Scotland (RBS).

August 8 -

The strikingly low price Citizens Financial Group Inc. has agreed to accept for its New York supermarket branches reflects a lack of demand for deposits — and for those particular branches.

February 28

Mr. Hester, carve up this bank.

That is the advice investment bankers have for Royal Bank of Scotland (RBS) Chief Executive Stephen Hester on what to do with Citizens Financial Group in Providence, R.I.

Takeover speculation, which has dogged Citizens since its parent was nationalized in 2008, has heated up again. RBS' regulatory woes might force it to sell its $130 billion-asset U.S. bank, according to various news stories in recent weeks.

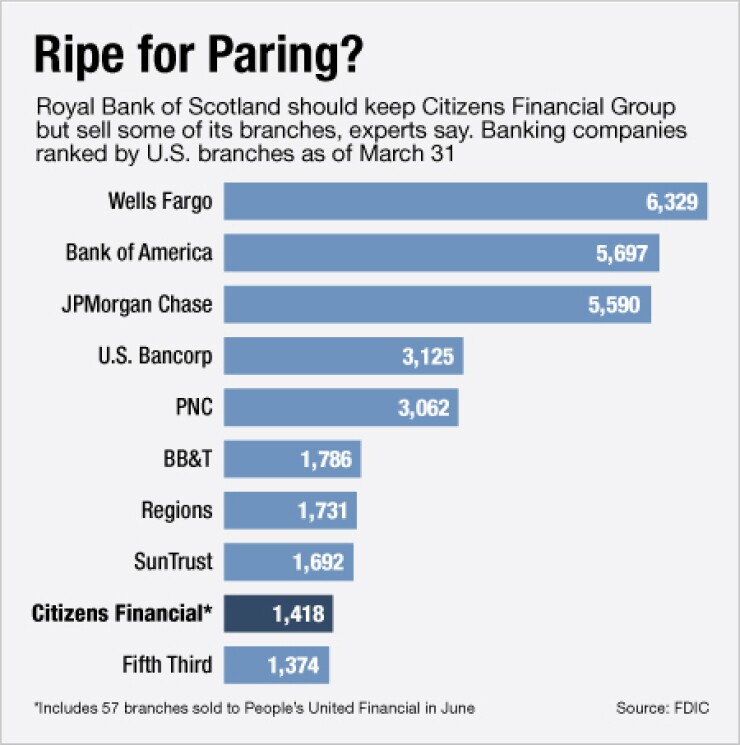

Hester is said to be reluctant — and perhaps unable — to sell the 1,400-plus-branch Citizens at the moment, so dealmakers eager to energize the U.S. bank mergers market are urging an alternative: unload lackluster parts of Citizens, which operates in 12 states in the Midwest and Northeast.

Leaving two markets where it is a relatively minor player — Chicago and Detroit — could generate much-needed cash for RBS, say several investment bankers who have advised RBS on U.S. strategy or recently put out feelers on its M&A intentions. It would make the rest of Citizens more valuable and easier to manage, they say.

Citizens does not comment on market speculation, a spokesman says. "We are focused on continuing to grow our business by delivering great customer service and top-quality products for our consumer, small-business and corporate customers," spokesman Jim Hughes says.

An RBS spokesman did not respond to an email seeking comment.

The recommendation for Citizens to sell its Detroit and Chicago branches resembles HSBC Holdings'

The pressure on Hester to at least consider similar exits from markets where Citizens is treading water is evident, bankers say.

RBS, which is 83% owned by the British government, posted a $3.09 billion loss last quarter, in part because of money set aside to cover regulatory violations and a recent computer system breakdown.

Meanwhile, Citizens had a first-quarter profit of $192 million. Its ratio of nonperforming assets was 1.24% in the first quarter, and its return on assets was 0.28%. It earned $1.2 billion last year.

European regulators

Those regulatory woes reignited speculation that Citizens was in play this month, with multiple news reports that Toronto-Dominion Bank and Itau Unibanco had expressed interest in acquiring it.

Hester has since publicly stated — and multiple bankers have confirmed — that Citizens is not formally on the block. An outright sale of the 21st-largest U.S. bank holding company by assets may be impossible at the moment given Citizens big size and a lack of able buyers, bankers say.

However, the conditions are ripe for divestitures of bite-size pieces of the operation — like Chicago and Detroit, they say.

Citizens has a lot of branches in those two towns but not much to show for them.

A bank ideally wants to have top-three deposit share in any key market. In Chicago, Citizens is No. 13 in deposit share and has 106 branches, or five more offices than in its home territory in and around Providence, where it is No. 1, according to SNL Financial data. In Detroit it has 96 branches and No. 7 share.

Both towns are dense with able buyers: U.S. Bancorp (USB) and Bank of Montreal (BMO) are active in Chicago, while

Citizens could reasonably expect to fetch a 6% to 7% premium for its $9.7 billion of deposits in Chicago and Detroit, depending on what kind of assets were included, bankers say.

At that premium a sale could generate proceeds of $580 million to $680 million.

RBS has already proved it is willing to streamline itself in the states

The question is whether the company is willing to cut deeper. Pulling back to its dominant markets of Ohio, Pennsylvania and New England could make Citizens a stronger stand-alone company, but the proceeds from selling 200 branches in Detroit and Chicago would amount to a rounding error for a company as big as RBS, one investment banker said.

Citizens added more than 600 branches in the Midwest and upstate New York when it bought Charter One in 2004. It has sold small batches of branches in New York and Indiana in recent years.

Yet Citizens and its European parent have been deeply reluctant to engage in any major spin-offs in the U.S. that would rattle customers and employees and raise questions about RBS' long-term commitment to the U.S., bankers say.