-

The trend to mobile is accelerating due to government stimulus checks, closed bank branches and the move to e-commerce, sayd Mitek's Michael Diamond.

April 20Mitek Systems -

Minorities are often hit harder financially during a crisis, but if regulators move forward on revamping the Community Reinvestment Act, they’ll only make matters worse.

April 20 D-N.Y.

D-N.Y. -

This is the first time since 2014 that the regulator won't penalize credit unions that file within 30 days of the deadline.

April 20 -

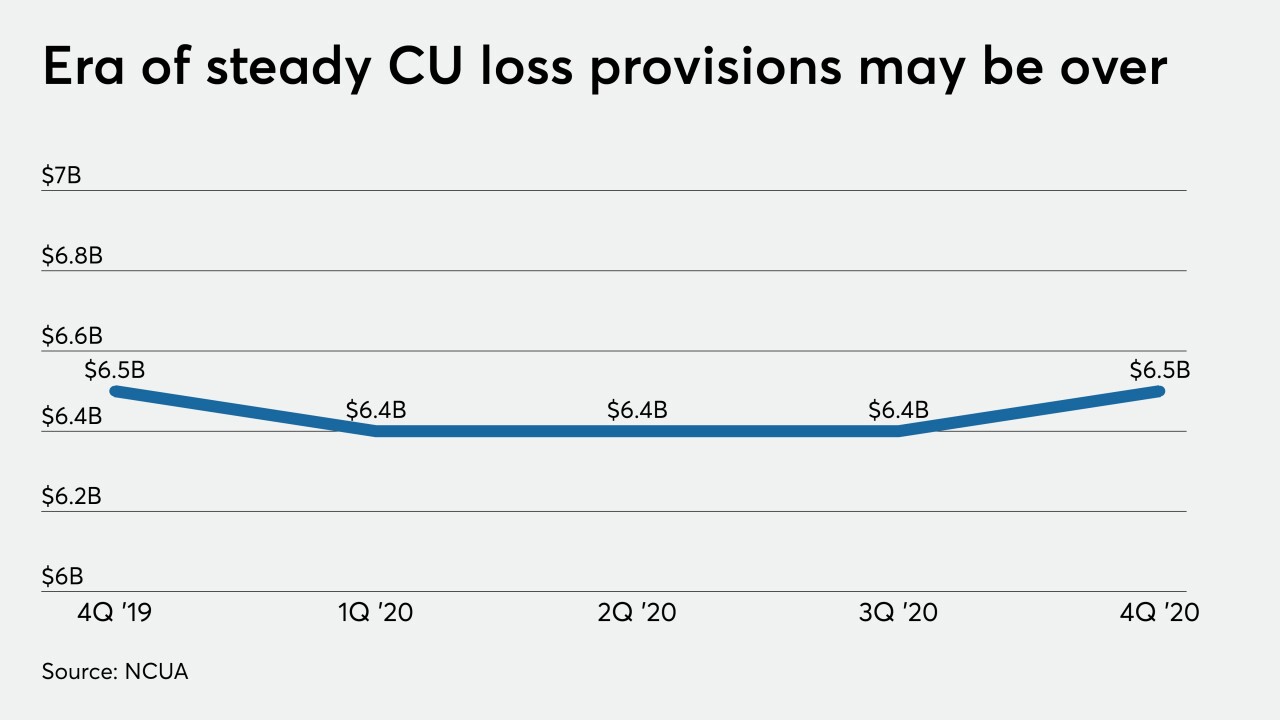

Smaller institutions should prepare themselves for some of what the competition has experienced, including increased provisions for losses and declining net interest margins.

April 20 -

When we go back to normal, it's our opportunity to start making long-overdue infrastructure upgrades, says Nvoicepay's Derek Halpern.

April 20 Nvoicepay

Nvoicepay -

Fast-moving payments innovation was already threatening comfortable connections between consumers and businesses before the pandemic turned the trend into an outright crisis.

April 20 -

Citizens, Regions and others say business investments initiated before the COVID-19 pandemic, including technology improvements and new consumer offerings, are on track.

April 19 -

The Senate Banking Committee chair will work with the heads of other panels in overseeing the $2 trillion stimulus package that Congress passed last month.

April 17 -

Wells Fargo tells business clients to consider other banks for emergency loans; JPMorgan Chase is temporarily reducing its exposure to the mortgage market; how TD Bank got a head start on pandemic preparations; and more from this week's most-read stories.

April 17 -

Stress and exhaustion are catching up to lenders and call center employees helping customers grapple with the coronavirus pandemic.

April 17