-

Community bankers keep harping on the illusory issue of "too big to fail." If they're serious about strengthening the economy, they should make more of an effort to unite the industry, not divide it.

March 10

-

The credit education provider plans to use its deep knowledge of credit scoring to advise account holders on how to improve their scores and cash management simultaneously.

March 10 -

The Georgia company will expand into central and southern Florida by buying the parent of Seaside National Bank & Trust.

March 10 -

Artificial intelligence has given merchants and banks handling payment data a fighting chance against fraud because it essentially pits machine against machine in compiling data and establishing prevention algorithms.

March 10 -

There may only be so much institutions can do if the outbreak affects borrowers' ability to repay credit.

March 10 -

As we launch into a new decade, today’s new workforce wants, expects and demands easy-to-use apps in the vein of what they’re used to in their day-to-day lives, says Fyle's Yash Madhusudan.

March 10 Fyle

Fyle -

The Consumer Financial Protection Bureau says the Cincinnati bank engaged in aggressive sales practices and open bank and credit card accounts without consumers' authorization in order to meet sales targets.

March 9 -

First American Bank agreed to cover costs incurred by the Iowa Division in Banking, while the regulator made it clear that the accord would not set a precedent for future credit union-bank deals.

March 9 -

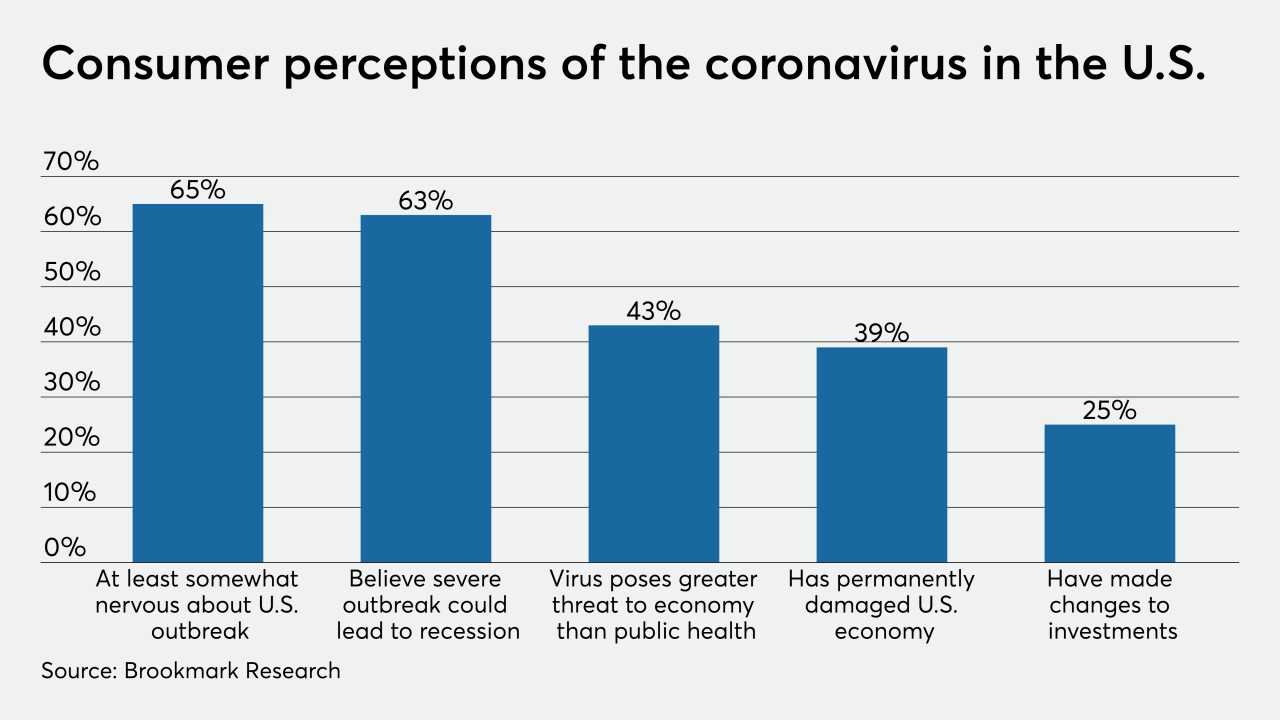

Concerns about the economic fallout of coronavirus have mostly focused on supply chain disruptions. But fears are growing that weakening consumer demand could spark a recession.

March 9 -

State and federal officials committed to providing “appropriate regulatory assistance” to banks whose customers may be hurt by the coronavirus outbreak and said prudent measures would not be subject to criticism by examiners.

March 9