-

How New York became Wells Fargo's new center of power; banks walk fine line in preparing for a coronavirus outbreak in U.S.; bankers on Bernie's electoral chances and whether a Sanders presidency would pose a threat; and more from this week's most-read stories.

February 28 -

With the world gripped in panic over the rapid spread of the coronavirus — and the stock market falling in response — payments companies have been left to speculate on what it all means to their operations in an increasingly global economy.

February 28 -

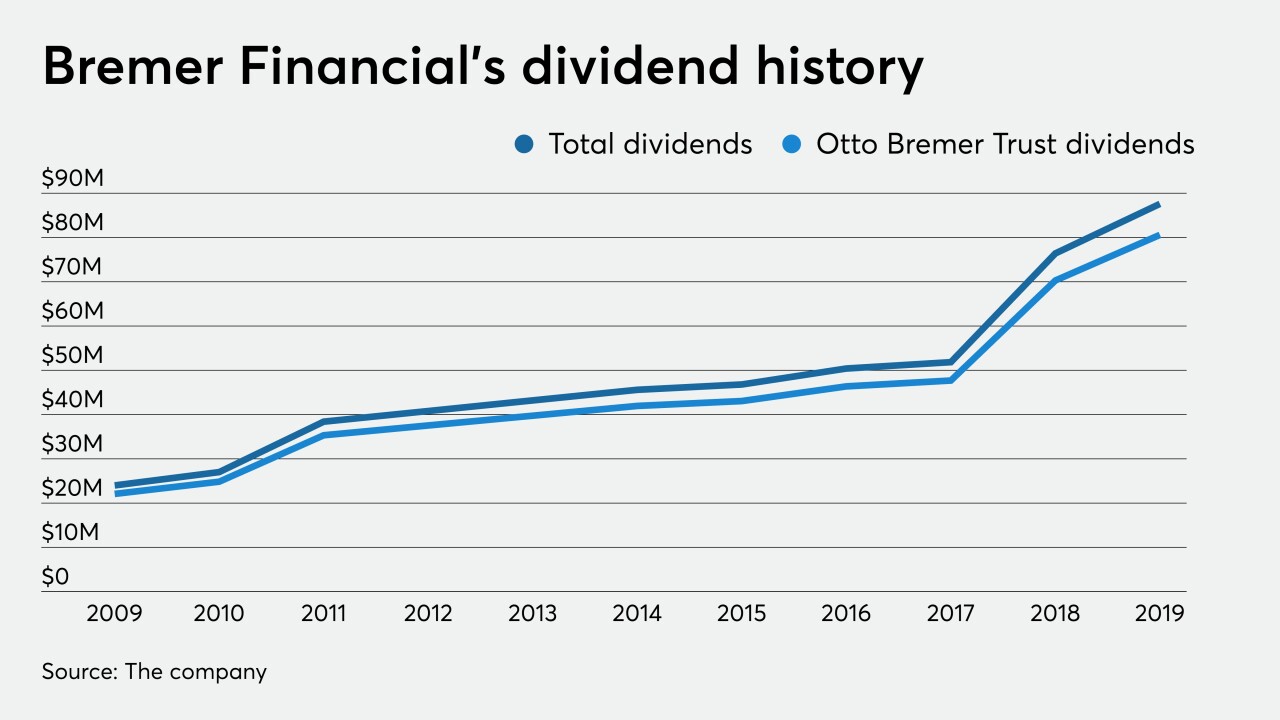

The Minnesota bank is locked in a bitter legal battle to preserve its independence. Its foe? The charitable organization set up by its founder.

February 28 -

San Francisco Bay Area Educators Credit Union became part of San Francisco Federal Credit Union earlier this month.

February 28 -

Given the possibility of a nationwide outbreak, the time is now for credit unions to take steps to protect themselves and their members.

February 28 Trident Shield

Trident Shield -

The Fed can take steps now to speed up existing networks.

February 28 Cato Institute

Cato Institute -

Credit unions could be feeling some of the heat from critics of their bank takeovers, or simply gearing up for another round of activity.

February 28 -

Immediate payments through an existing payments platform means firms can pay quickly, satisfying the expectations of gig workers who are increasingly important to the company’s functions.

February 28 Berkeley Payment Solutions

Berkeley Payment Solutions -

Afterpay has found an opening in the U.S. by targeting the millennials who don't have a credit card to use at the point of sale.

February 28 -

The release of Richard Cordray's retrospective of his tenure will come one day before the Supreme Court hears a pivotal case about the leadership structure of the agency.

February 27