-

The central bank expanded the reach of the program as pressure mounts on the government to support localities struggling economically because of the coronavirus pandemic.

April 27 -

As banks accept new applications for the paycheck program, they are dogged by complaints that they prioritized wealthy borrowers. But lenders likely fast-tracked clients they knew best under difficult circumstances, observers say.

April 27 -

Use of banks' mobile apps and websites has risen about a third since the coronavirus crisis began, according to J.D. Power.

April 27 -

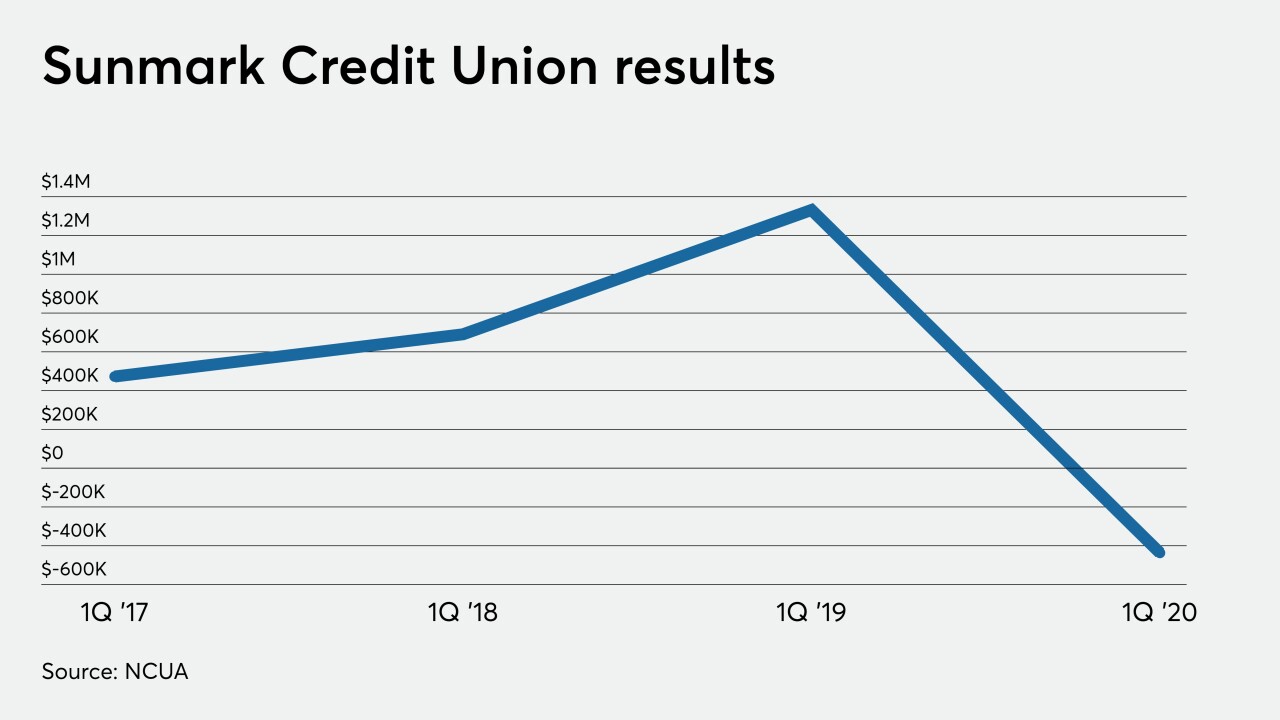

The New York-based credit union is set to absorb Hudson River Financial FCU and Columbia-Greene FCU following charter conversions at those institutions. Sunmark has picked up at least two other small CUs within the last 18 months.

April 27 -

The latest version of the business lending initiative has $60 billion set aside for smaller lenders, including credit unions, but there are concerns the money will be allocated just as quickly this time as it was during the first round.

April 27 -

Not everything is in decline. T&E approval processes need to be ready for spikes in invoices for streaming content, tele-meetings and remote technology rather than air travel and hotels, said AppZen's Uri Kogan.

April 27 AppZen

AppZen -

When Plastiq pivoted its bill-payment services to target cash-strapped SMBs instead of consumers, the startup had no way of knowing how coronavirus would affect its growth.

April 27 -

Michael Baker will become president and CEO of SAFE Federal Credit Union in May while the institution's current leader, Darrell Merkel, plans to retire this summer.

April 27 -

The modern-day payment system was, over the last two decades, tailor-made for the shelter-in-place conditions many live and work under today.

April 27 Commerce Bank

Commerce Bank -

A credit union-specific liquidity backstop is far less popular than other options such as the Federal Reserve's discount window. The National Credit Union Administration wants to change that.

April 27