-

Only two de novo banks have opened in 2024, while more than 100 launched annually prior to the 2008 financial crisis. Experts don't agree on how to solve the problem.

September 18 -

Regulators in two countries are strengthening rules requiring banks and merchants to accept paper, while a majority of Canadian payments are now tap to pay.

September 18 -

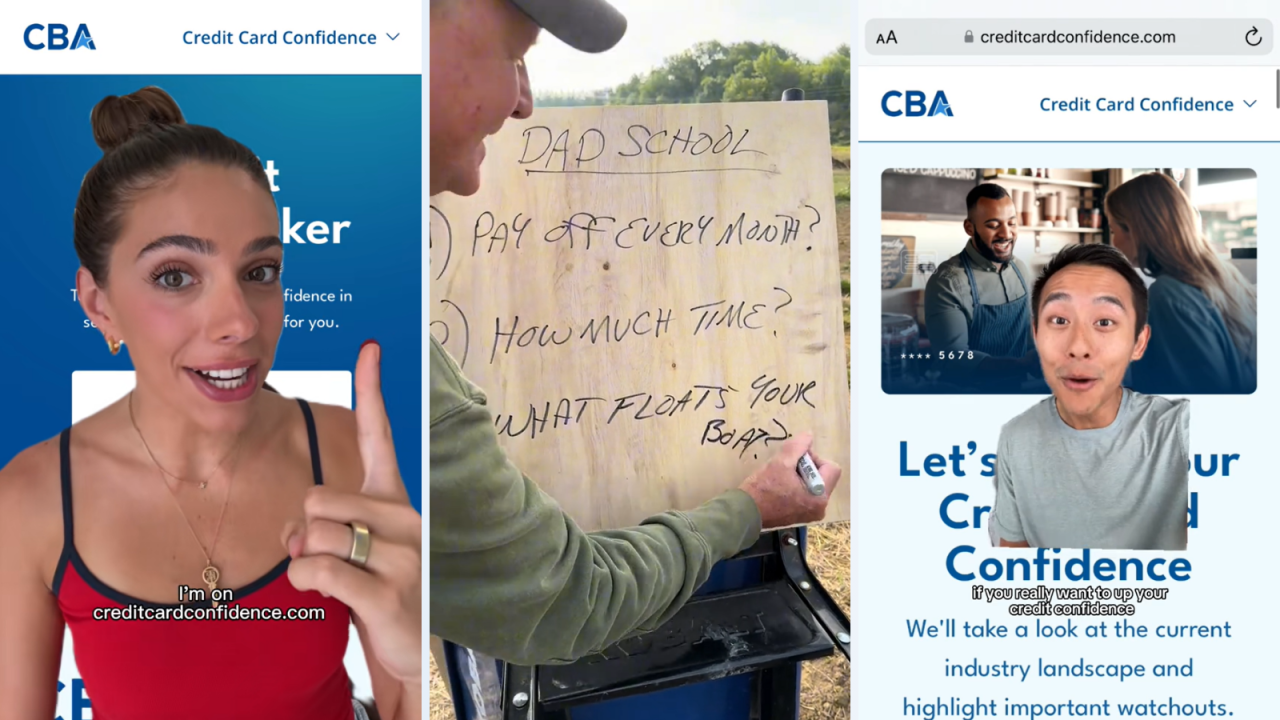

The Consumer Bankers Association launched its first campaign using social media influencers to promote credit card education, experimenting with a mix of personalities and refraining from specific card recommendations.

September 18 -

Overdraft fees continue to be in the spotlight, with the Consumer Financial Protection Bureau proposing a rule essentially to cap them. Certain credit unions are also now required to disclose additional information on this revenue stream.

September 18 Brookings Institution

Brookings Institution -

The move signals the end of the Federal Reserve's battle against runaway inflation in the wake of the COVID-19 pandemic. Fed officials expressed divergent views on further action this year.

September 18 -

Nothing less than a whole-of-government approach, in concert with the financial services industry, will be enough to address the spiraling cost of fraud to both businesses and consumers.

September 18

-

The BNPL industry is growing at a fast clip. Australia-based Zip's new CEO for U.S. operations is looking to carve out a place in what is becoming a crowded industry with expanded merchant partnerships and a Pay-in-8 product.

September 18 -

Reading the tea leaves this election for bank policy is more difficult than years past, experts say, but there are still hints about where former President Donald Trump and Vice President Kamala Harris stand.

September 18 -

Nellie Liang urges regulators to consider adjusting leverage rules to boost liquidity during stress periods, including leaving central bank reserves out of supplemental leverage ratio calculations.

September 17 -

As the commercial real estate industry sputters along, lenders, investors and analysts are putting less stock in loan-to-value ratios, a longtime bellwether of risk.

September 17