-

The Consumer Financial Protection Bureau seeks to address challenged posed by the sunset of the London interbank offered rate at the end of 2021.

June 4 -

Fallout from the coronavirus pandemic is pressuring banks that have relied on expansion efforts and fee income to produce outsize investor returns.

June 4 -

The quarantine and Citi's shift from hardware to software tokens have led to a 300% spike in commercial clients' opening of accounts online as well as increased digital banking use.

June 4 -

The Defense Credit Union Council's annual event is the latest to be scuttled due to the coronavirus as state and national groups make conferences virtual.

June 4 -

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

June 4 FS Vector

FS Vector -

The longtime CEO of Local Government Credit Union previously served as chairman of the Credit Union National Association.

June 4 -

Digital banking has ramped up during the coronavirus lockdown but customers will seek somewhere to go as cities reopen. A branch could provide that safe haven.

June 4

-

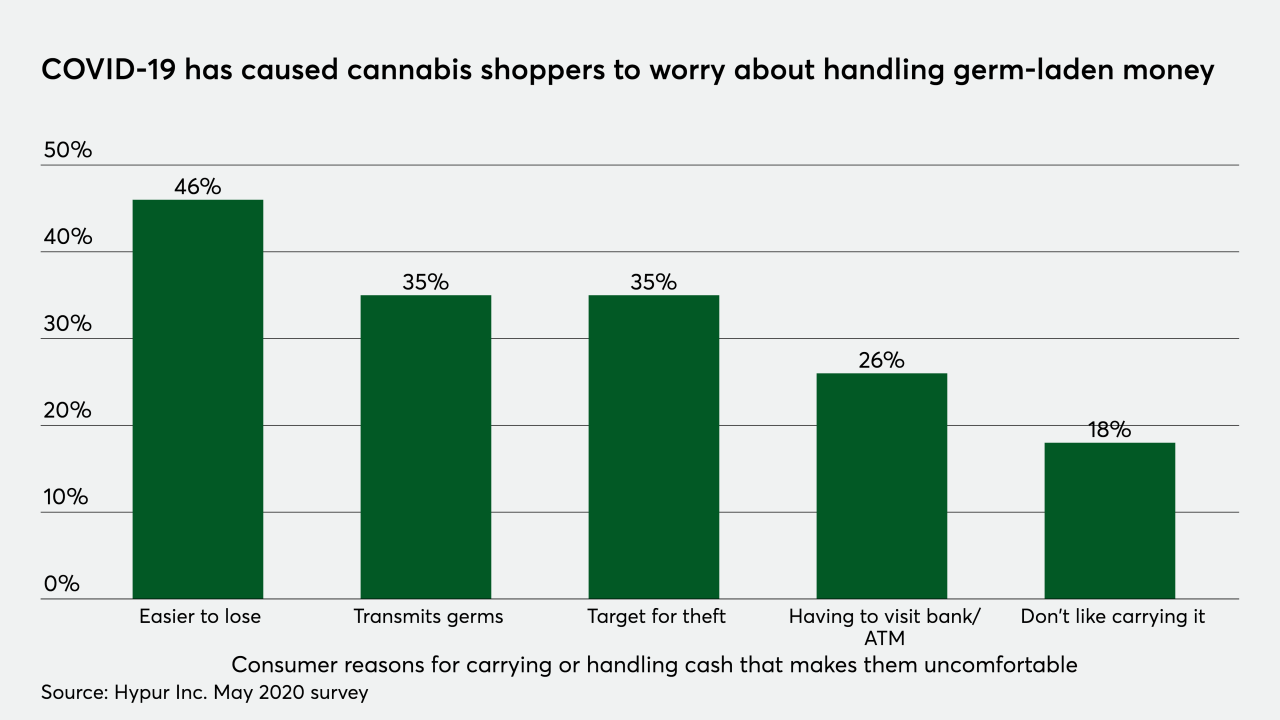

The coronavirus pandemic has changed the way many industries conduct business — and that's especially true of the legal cannabis industry, which was already struggling in the U.S. to find the best way to handle noncash payments.

June 4 -

The demonstrations following George Floyd's death in police custody are forcing the industry to grapple with how it can — or if it should —advocate for equality and better race relations.

June 4 -

Merchants will need to adopt practices to curtail the surge in chargeback activity and protect their businesses, even after the worst of the coronavirus outbreak is over, says Chargeback 911's Monica Eaton-Cardone.

June 4 Chargebacks911

Chargebacks911