-

The industry and its allies have their work cut out for them navigating the political standstill.

November 7 -

Paul Aguggia, a lawyer before leading Clifton Bancorp, has become a partner at Holland & Knight in New York.

November 6 -

From former journalists to police officers and more, they all have two things in common: they're running for office and they've all worked inside the CU system.

November 6 -

Credit union advocates are keeping a close watch on several races in this week's midterm elections.

November 5 -

Recent comments from the chairman of the National Credit Union Administration signal the agency may soon take a lighter touch with small institution

November 1 Inclusiv

Inclusiv -

The lawsuit comes as the $188 milion-asset institution faces backlash from a high-profile national news story that portrayed its business practices negatively.

October 31 -

Van Wanggaard is running for re-election as a Wisconsin state senator by focusing on bringing more jobs to his state and fighting for victims’ rights.

October 30 -

Midterm elections are just eight days away and credit unions are making efforts to help get out the vote. Meanwhile, one Virginia-based CU is back in court over alleged ADA violations.

October 29 -

Sarah Vega had accepted an offer to lead the four-state credit union league but has chosen instead to stay on as chief of staff to NCUA Chairman Mark McWatters.

October 26 -

Consumer Financial Protection Agency Acting Director Mick Mulvaney is winding down some of the efforts his predecessor worked hardest on: enforcement of payday and fair lending rules and the Military Lending Act. Reporter Kate Berry shares the latest.

October 25 -

Mona Shand, a former teacher, journalist and communications professional, aims to bring industry priorities to Lansing if she's elected to the state's legislature next month.

October 19 -

Governors in Arkansas, Georgia, Oklahoma, Texas and Wisconsin used International Credit Union day as an opportunity to recognize the industry.

October 19 -

Credit unions won't have to comply with the controversial rule until at least 2020, but a forthcoming proposal on alternative capital could raise the ire of banking groups.

October 18 -

Currently running for a fourth term in Congress, former credit union employee Denny Heck is a vocal proponent of changes to NCUA's risk-based capital rule and other industry priorities.

October 11 -

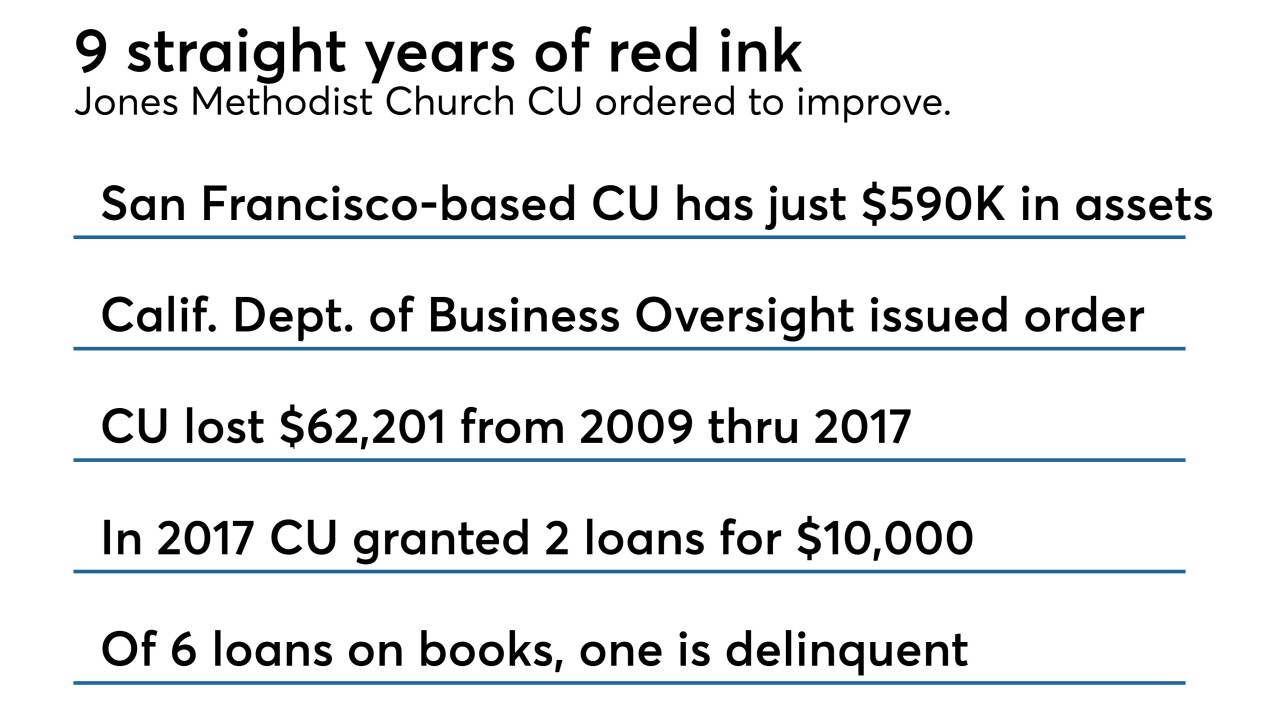

Jones Methodist Church Credit Union has been ordered to address "unsafe or unsound practices" following nine years of losses and other problems.

October 10 -

Larry Hoff, retired CEO of Fibre Federal Credit Union, is running for a seat in Washington's state legislature – his first foray into politics.

October 4 -

National Credit Union Administration Chairman Mark McWatters called on lawmakers to further expand field-of-membership options for CUs and to permit the regulator to oversee third-party vendors, including fintech partners.

October 2 -

As NCUA Chairman Mark McWatters heads to Capitol Hill, credit unions are facing new threats at the ATM and CU trade groups are writing big checks in advance of midterm elections.

October 1 -

The National Credit Union Administration is eyeing a 1.1 percent funding increase for 2019 for a total of $334.8 million

September 26 -

The bureau's findings and request for information came after acting Director Mick Mulvaney had cited data security as a flaw at the agency.

September 26