Federal bank regulators consider roughly a dozen new rules; firms tout tools to help financial institutions bank legal marijuana-related businesses; Mick Mulvaney defends CFPB enforcement powers; and more from this week's most-read stories.

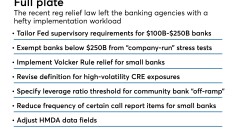

The hard part of reg relief is just getting started

(Full story

KeyCorp exec bolts for Toyota

(Full story

Banks team with fintechs to bring AI to commercial accounting

(Full story

Pot banking regtech is ready for its moment

(Full story

CFPB orders TCF to refund consumers for overdraft charges

cfpb-headquarters-ted-eytan.jpg

(Full story

In a twist, Mulvaney now defending CFPB enforcement powers

(Full story

Synovus returns to large-scale M&A with FCB acquisition

(Full story

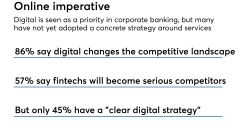

HSBC's strategy to improve digital services for commercial clients

(Full story

With loan growth tepid, banks are short on ways to juice profits

(Full story

EBay's Apple, Square pacts could strangle community banks

(Full story