What Democrats' House takeover means for banks

(Full story

Synchrony has a lot to lose in fight with Walmart

(Full story

Should industry fear Waters-led banking panel?

(Full story

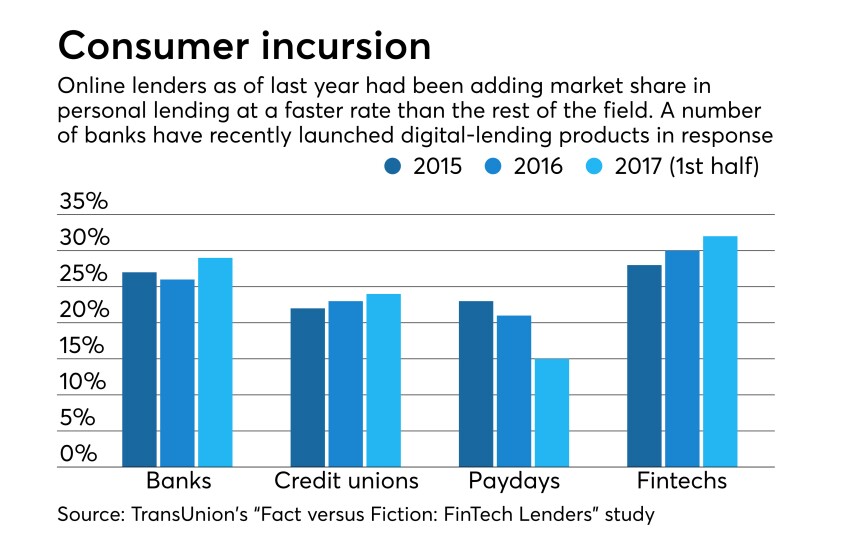

Sizing up the real fintech threat to banks

(Full story

Small banks join forces to address fintech challenges

(Full story

Even in the cloud, banking is tied to legacy tech

(Full story

With Jeff Sessions out, will pot payments thrive?

(Full story

What's keeping chief risk officers up at night

(Full story

There's no excuse for ignoring the unbanked, big banks' own data shows

(Full story

Window may be closing for small banks to compete for small business

(Full story