A number of community banks punch above their weight when it comes to the Small Business Administration's 7(a) lending program.

7(a) is the agency's flagship program and continues to appeal to borrowers and lenders. These loans can be as large as $5 million, with borrowers using the funds for a variety of expenses such as working capital or purchases of machinery, equipment or real estate. Lenders enjoy a guarantee of up to 85% of each loan.

Lenders made more than 57,000 of these loans, worth more than $27 billion combined, in fiscal year 2023, which ended Sept. 30, according to data from the agency. That's up from fiscal year 2022, when there were roughly 47,000 loans totaling $26 billion.

For 2023, the average loan size was just under $480,000, down from roughly $540,000 for the year earlier, according to SBA data.

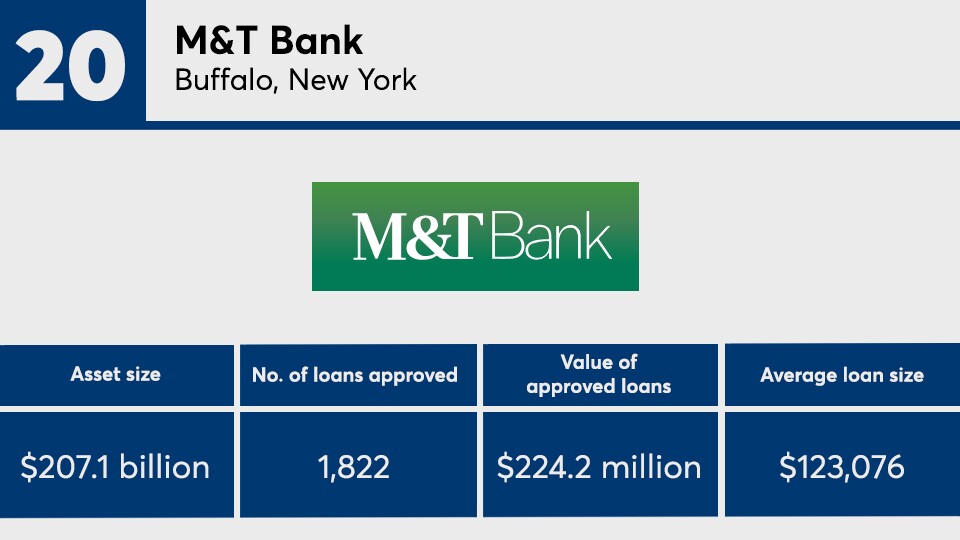

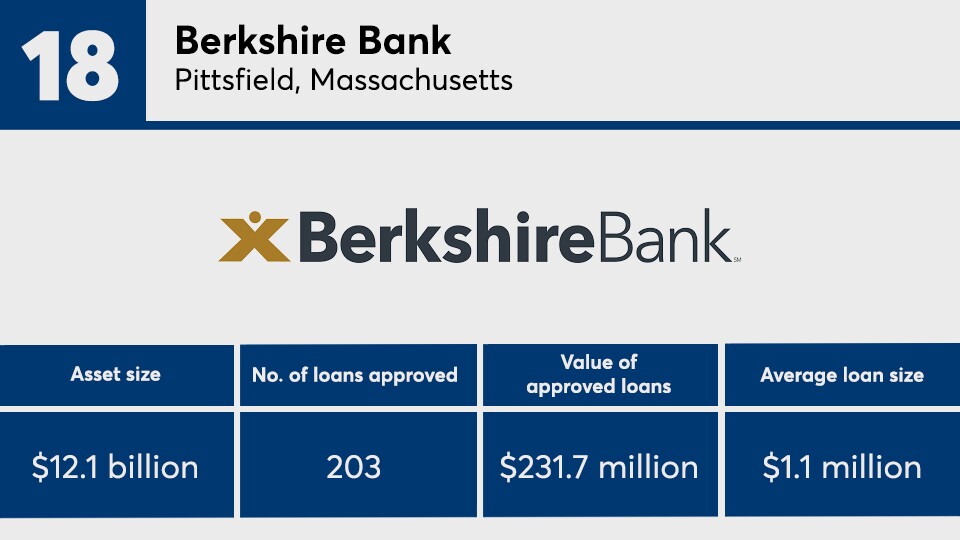

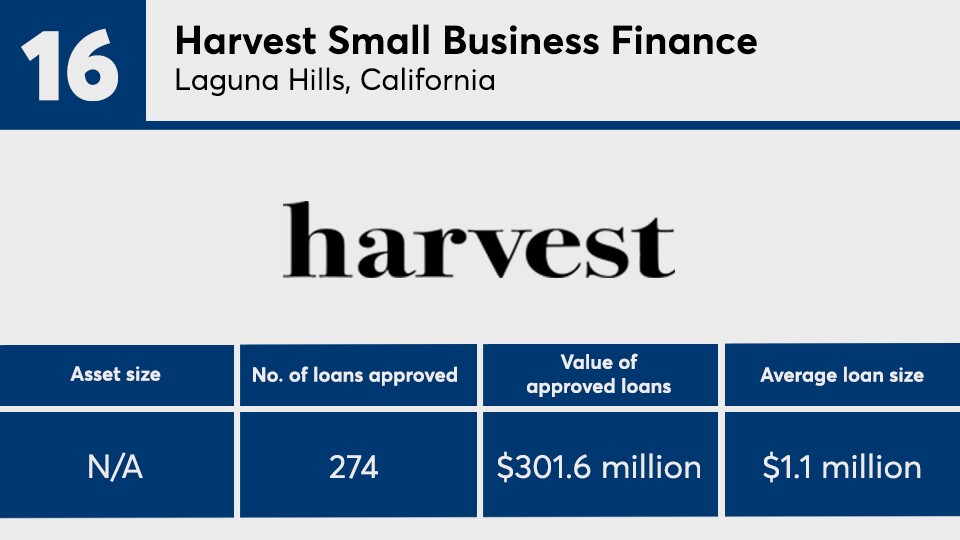

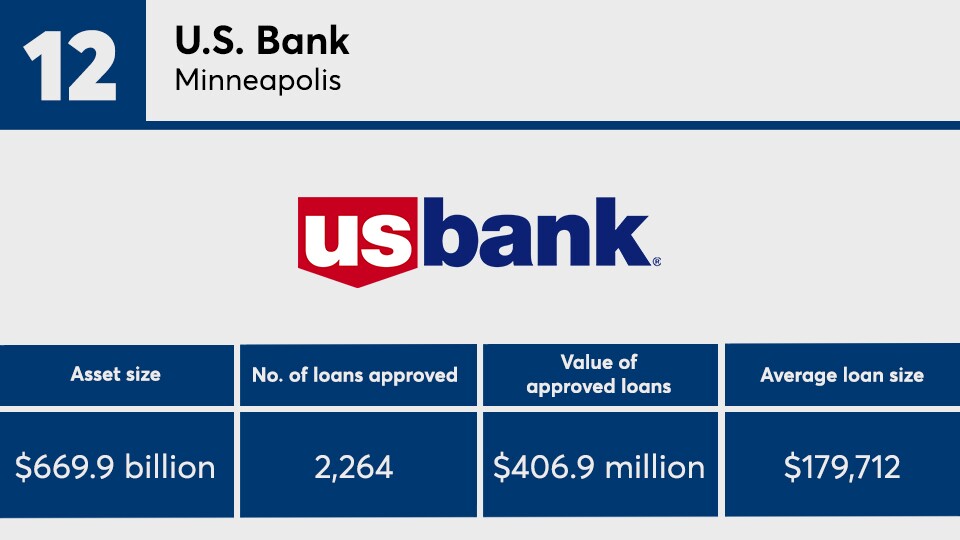

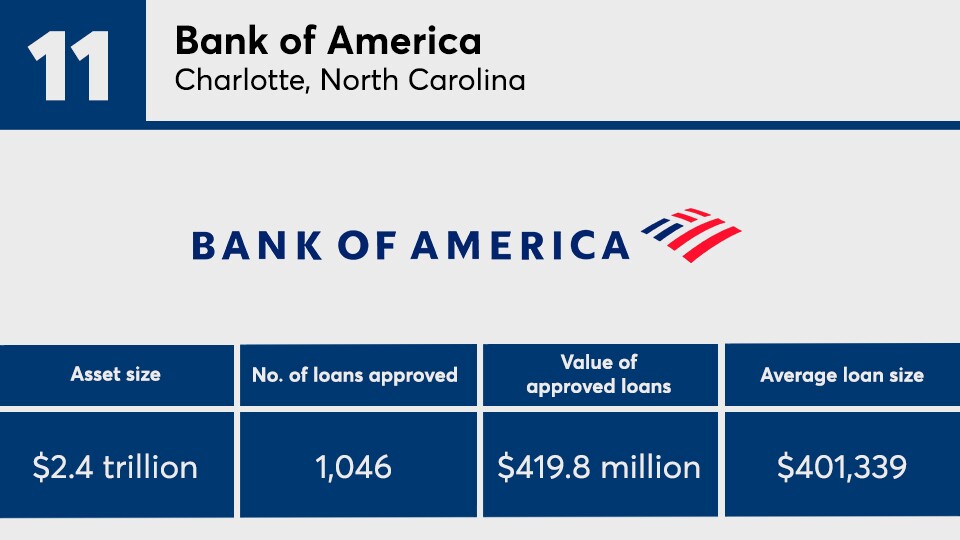

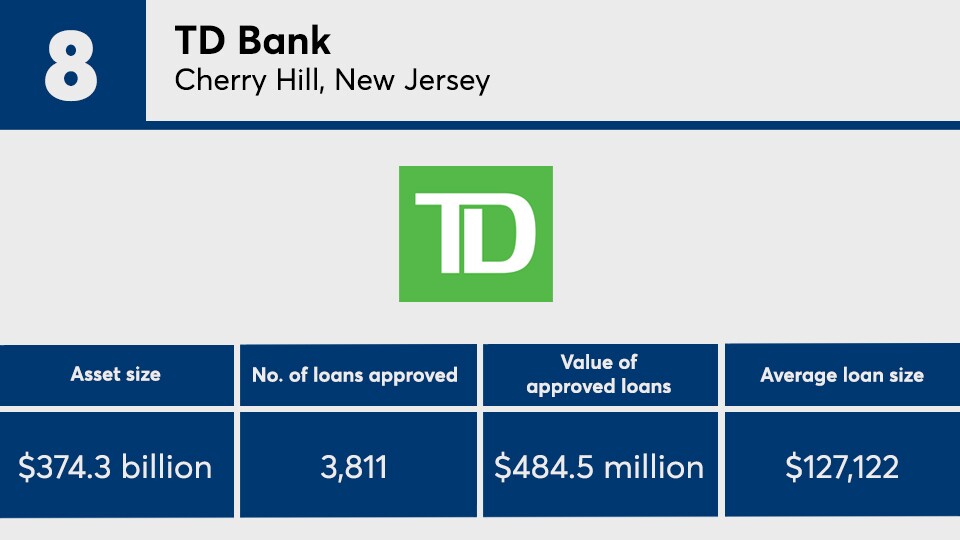

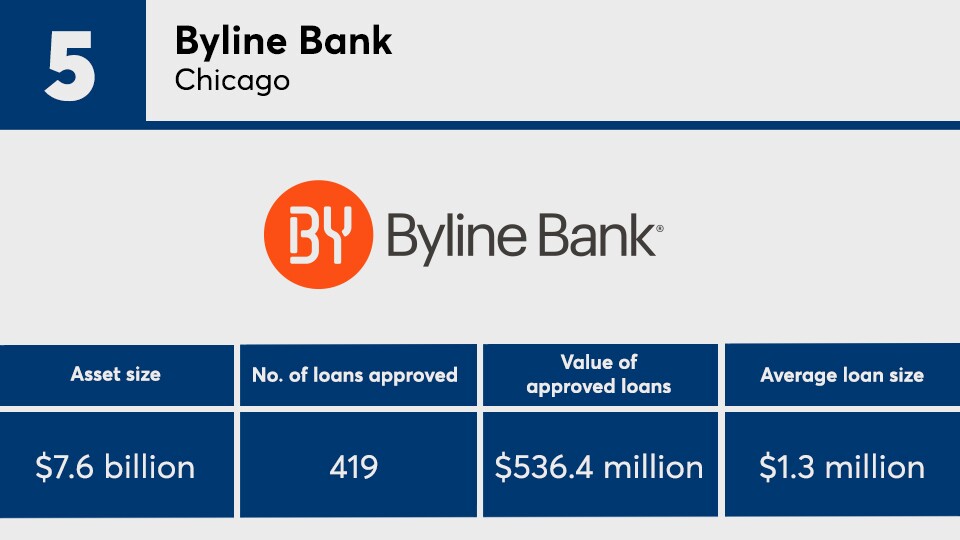

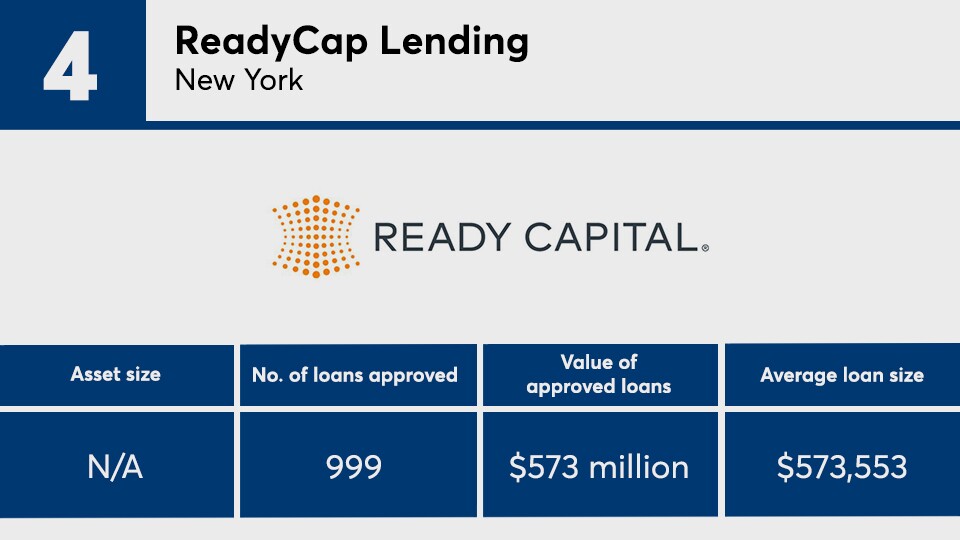

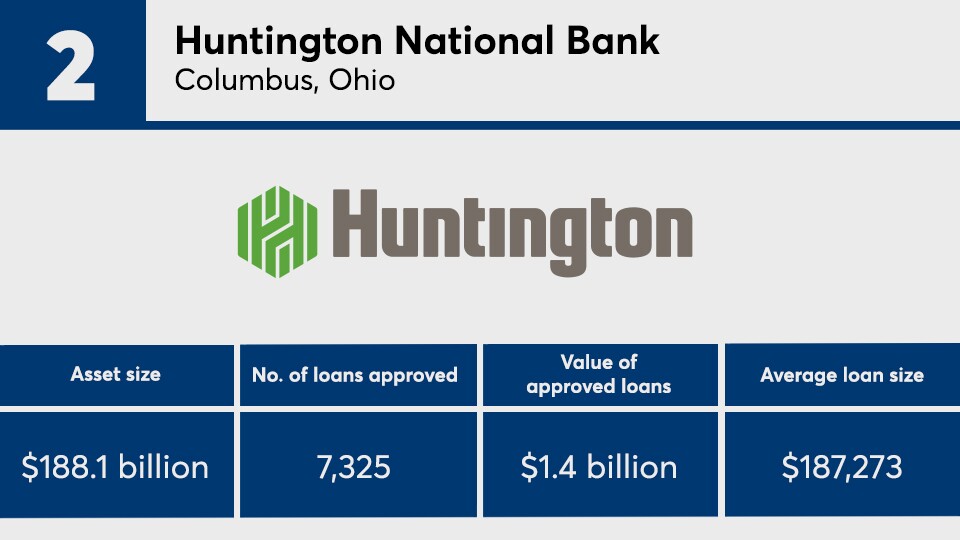

Several of the nation's largest banks were in the top 20 SBA lenders. But several community banks and nonbanks proved to be competitive in this line of business, too.

Read on for more details about the top 20 SBA lenders for fiscal year 2023, which were ranked by the value of approved loans. And for additional coverage of the SBA, please

Note: The following are the top 20 7(a) lenders based on loan approval totals made public by the SBA. The asset sizes come from the Federal Deposit Insurance Corp. and the Federal Reserve. The lending totals for Newtek Small Business Finance and Newtek Bank were combined.