Flaws in testing may be real source of Wells Fargo's tech failure

(Full story

Citi rolls out new personal loan, online savings account

(Full story

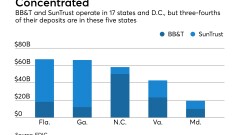

Talent, deposits up for grabs after BB&T-SunTrust deal

(Full story

Return of the barbell? How BB&T-SunTrust threatens banking's middle tier

(Full story

Fed, not FDIC, should regulate a merged BB&T-SunTrust

(Full story

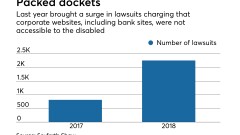

ADA lawsuits tied to websites mount: Should banks fix, or fight?

(Full story

Can JPMorgan Chase's JPM Coin knock off Ripple and Swift?

(Full story

Pot banking goes to Washington: 3 takeaways

(Full story

Closing many branches, but keeping most customers

(Full story

Square's banking bid avoids backlash that doomed Walmart's

(Full story