-

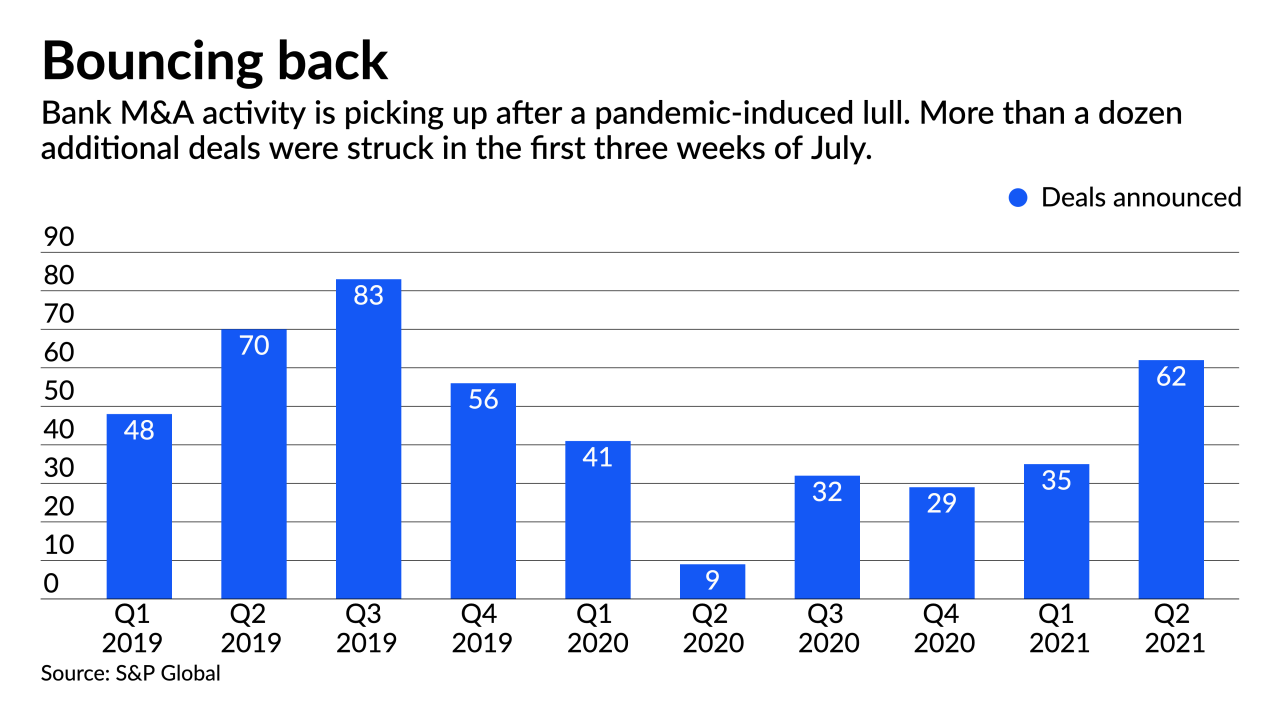

Scott Credit Union of Edwardsville said it is acquiring Tempo Bank in Trenton, Illinois. It is the fifth such transaction announced since Aug. 5 and the 10th of the year.

August 20 -

The measure bans banks that discriminate against gunmakers from entering into government contracts. Citigroup, which supporters of the law were targeting, has lost market share while Bank of America and JPMorgan Chase have gained ground.

August 18 -

M&T in New York, which is seeking regulatory approval to buy People’s United Financial, recently disclosed plans for around 1,000 layoffs. The backlash — focused on job cuts in the seller’s hometown of Bridgeport — has been stronger than in other recent deals.

August 15 -

Financial Services Superintendent Linda Lacewell said she will step down Aug. 24, the same day Gov. Andrew Cuomo plans to leave following a sexual harassment investigation. The state’s attorney general found that Lacewell helped with the governor’s public relations response to the allegations.

August 13 -

The London neobank, which has applied for a banking charter in California, is working to undercut banks on pricing for consumer payments to Mexico.

August 13 -

The e-commerce giant is adding a surcharge for Visa credit card payments in Singapore. It's a tactic reminiscent of the time its big-box rival outright banned the card brand in Thunder Bay, Ontario, in a bid to lower its costs.

August 11 -

Abbott Cooper, the head of Driver Management, says Codorus Valley Bancorp is not as profitable as its peers. Cooper, who has successfully forced the sale of at least two other banks, has indicated he's ready to launch a proxy fight.

August 10 -

The agreement between the state’s financial regulator and Meratas will subject the company to heightened regulation after years of criticism that income-share agreements have escaped scrutiny.

August 5 -

Stacy Kymes, the bank's chief operating officer and a 25-year company veteran, will succeed the retiring Steven Bradshaw.

August 4 -

The blockchain company's new lead on the Continent, Sendi Young, discusses its plans to foster real-time and cross-border transactions between banks and fintechs in ways that aren't possible on legacy networks.

August 4 -

Apple and Affirm's PayBright are planning to launch a buy now/pay later program for Apple device purchases in Canada, stepping up the iPhone maker’s ambitions to offer more financial services.

August 4 -

“You need scale to keep up with necessary technology spend and regulatory costs,” CEO James Hillebrand said in explaining why the bank agreed to buy Commonwealth Bank & Trust just three months after it bought Kentucky Bancshares.

August 3 -

Stored-value cards are growing in popularity with underbanked gig workers who need an easier way to get paid as well as with younger consumers in Canada who have traditional bank accounts but prefer the cards for e-commerce transactions.

August 3 -

First Hawaiian and Bank of Hawaii are warning that a global spike in coronavirus cases could stunt the state's momentum and threaten credit quality.

August 2 -

The $29 billion deal would enable Square to better compete with PayPal and Apple, and provide an opportunity to cross-sell other services to the Australian lender's global audience.

August 2 -

Mutual banks tend to combine only with fellow mutuals. Spencer Savings' deal to acquire a stock-traded rival shows how the pressure to expand is forcing some buyers to get creative.

July 30 -

Two upstate New York credit unions are combining to create an $8 billion-asset institution, continuing a trend of bigger deals driven by a need to match the scale and technological capability of rival banks.

July 29 -

The high cost of living in the state's bigger markets is limiting growth and turning off buyers. CVB Financial and TriCo Bancshares found sellers in the more affordable cities of Visalia and Bakersfield.

July 28 -

The Rhode Island bank is doubling down on the nation’s largest market after agreeing in May to buy dozens of branches from HSBC. Meanwhile, Investors Bancorp’s decision to sell itself underlines the challenges facing smaller regionals.

July 28 -

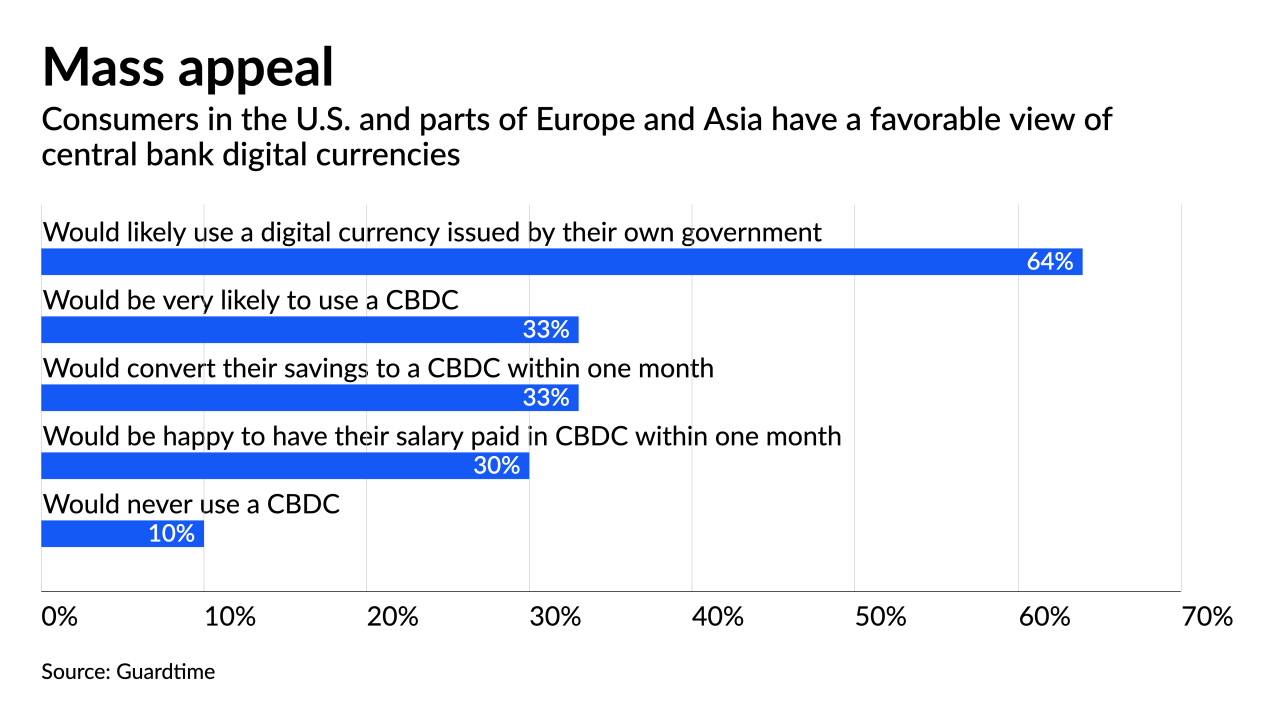

Western central banks trying to develop sovereign cryptocurrency models face pushback from lawmakers and other obstacles, while the digital yuan has a much clearer path.

July 27