-

The California-based CU says its 2018 emphasis will be on member retention and expansion.

February 13 -

The California company has agreed to buy Grandpoint Capital, a business bank in Los Angeles, for $641 million.

February 12 -

Patriot National in Connecticut planned to build a regional small-business lending operation on its own — until it had a chance to buy a national platform.

February 7 -

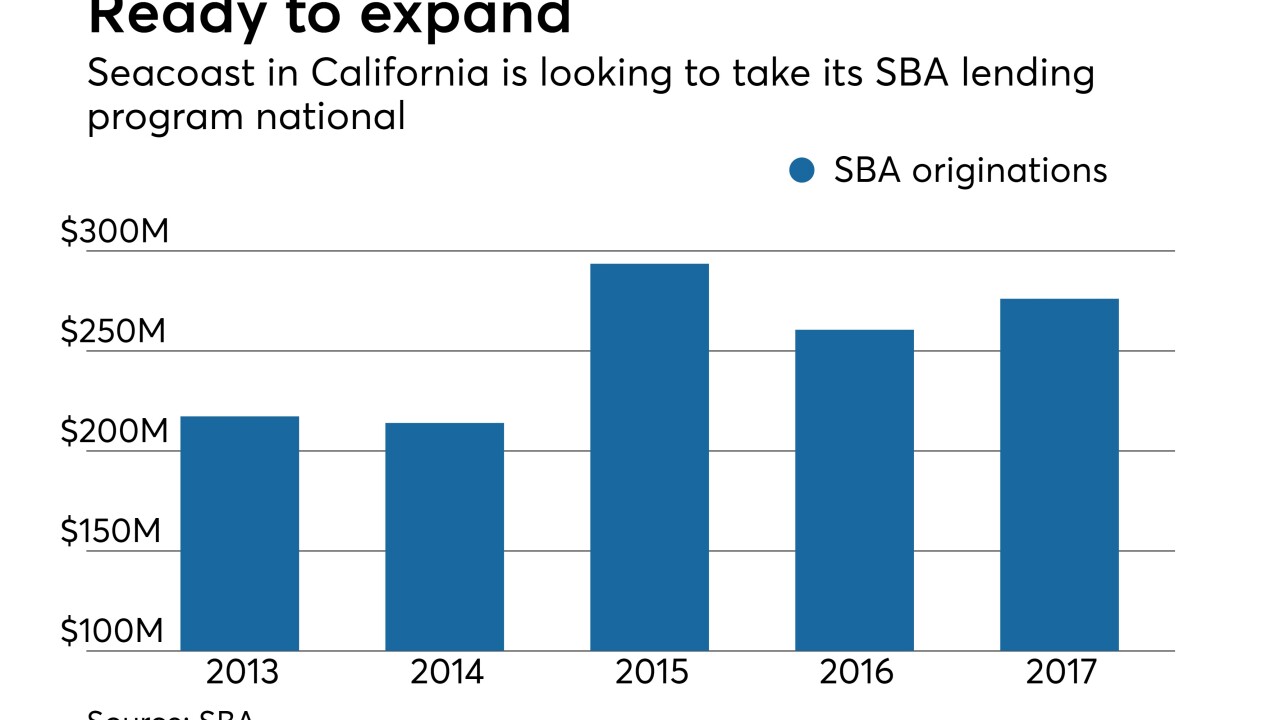

Seacoast Commerce is San Diego is already one of the biggest Small Business Administration lenders — half the loans on its books are tied to SBA programs. But will its underwriting hold up outside its traditional markets?

February 2 -

San Diego-based CU is the first new owner of the CUSO in 2018.

February 1 -

Nano Financial will offer new technology to Commerce Bank's commercial customers as it considers ways to license it to other financial institutions.

January 25 -

It's the 13th year in a row that the CUSO has been able to give money back to its CU shareholders, capping a record-setting year for indirect auto loan growth driven by the firm.

January 24 -

The client groups aim to take an active role in shaping the future of payments.

January 23 -

Attorney General Jeff Sessions did not keep the rest of Washington apprised of his plan to rescind an Obama-era memo on pot. Now Fincen and other federal banking agencies are dealing with the backlash from that decision.

January 18 -

Which large and midcap bank stocks have the most momentum? These 12 banks started the year off with the biggest bang, as measured by gains in stock price.

January 17