-

James Farrell, who ran New Haven County Credit Union from 1992 to 2015, transferred funds from the CU's general ledger into the account of a local business.

September 3 -

Bruce Adams, who previously served as general counsel to Connecticut Lt. Gov. Nancy Wyman, will join the Credit Union League of Connecticut next month.

July 19 -

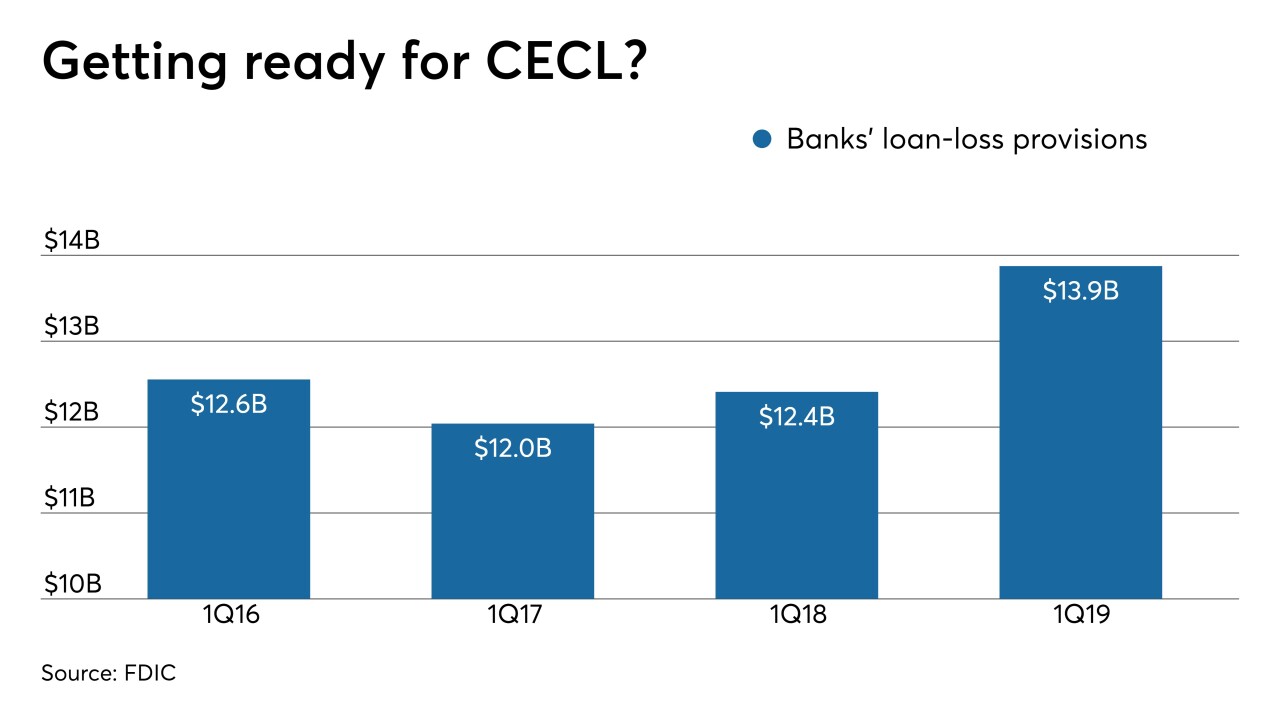

After FASB's decision to give most credit unions and banks extra time to prepare, lobbying groups are pushing for more.

July 18 -

After FASB's decision to give most banks extra time to prepare, lobbying groups are pushing for more.

July 17 -

The Connecticut company, which will top that asset milestone when it buys United Financial, says it could acquire more banks in coming months.

July 16 -

The Connecticut company will add heft in its home state and Massachusetts when it buys the former mutual.

July 15 -

Jill Nowacki has announced plans to enter the credit union consulting space. An interim leader has not yet been named.

May 8 -

Several credit union leagues and credit union service organizations have formed a new group, called AffirmXCU, that will offer risk management technology.

April 18 -

The Connecticut bank, which has been unable to complete a pending deal for an SBA platform, has managed to build the business anyway.

March 13 -

The $59 million-asset credit union has named a new CEO and chief operating officer.

March 6 -

Rheo Brouillard, the head of SI Financial, finally had a solid offer in hand after more than two years of searching for a buyer. But the resignation 10 days later of the man who made him that offer — Berkshire Hills’ Michael Daly — sent Brouillard scrambling.

February 12 -

John Ciulla, one year in as CEO of Webster Financial, discusses how he is preparing for the next downturn, picking his spots in tech spending, and remaining cautious about M&A.

January 27 -

At a FASB meeting Monday on proposed changes to the accounting standard, its critics will be given a platform.

January 25 -

Executives at Key pushed back against doubts over a deal for Laurel Road Bank’s digital lending platform so late in the credit cycle, arguing that its customers are prime borrowers with high incomes.

January 17 -

The online platform, created by Laurel Road Bank in 2013, allows users to refinance student loans and originate mortgages.

January 17 -

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

After more than 60 years as Wepawaug-Flagg Federal Credit Union, the $116 million-asset institution has rebranded as Crosspoint FCU.

January 9 -

Bob Mahoney, CEO of Belmont Savings, called Jack Barnes after People's United agreed to buy a Connecticut bank. The banks announced their own merger agreement five months later.

January 3 -

The $180 million acquisition is the first for Berkshire since the sudden departure of CEO Michael Daly.

December 12 -

The Bridgeport, Conn., company is developing a specialty in banking technology businesses. Like so many other small regionals with ambitious growth plans, it faces a tricky balancing act: how to take creative risks without getting in over its head.

November 28