-

The Worcester, Mass.-based credit union was selected to participate in the Federal Home Loan Bank of Boston's Equity Builder program, and can receive up to $110,000 this year to help homeowners with down payments, closing costs and more.

March 20 -

The company's deal for Coastway Bancorp in Rhode Island makes sense since both institutions are former credit unions.

March 14 -

The mutual has agreed to buy Cape Ann Insurance, which specializes in personal insurance products.

March 9 -

This year marks the third consecutive year the league has awarded $125,000 to member credit unions.

March 8 -

The merger in Massachusetts is the latest in the consolidation of the credit union movement, as another tiny credit union is acquired by a much larger counterpart.

March 6 -

The $356 million-asset Bridgewater Credit Union plans to merge into $596 million Merrimack Valley Credit Union in the summer of 2018, pending regulatory approval.

March 2 -

Louise Mills Federal Credit Union will now operate its lone branch as "Louise Mills, a division of Webster First FCU."

March 1 -

Kathleen Henry and Steven Antonakes have been named to the bank's management committee.

February 28 -

The Boston mutual, which lost its innovation team when it spun off Numerated last year, has hired a State Street executive to oversee a plan to encourage all employees to be more creative.

February 23 -

With the state only months away from allowing the sale of pot for recreational use, its top cannabis regulator is urging policymakers to consider creating a public bank to provide services to growers and dispensaries that might otherwise have nowhere else to bank.

February 22 -

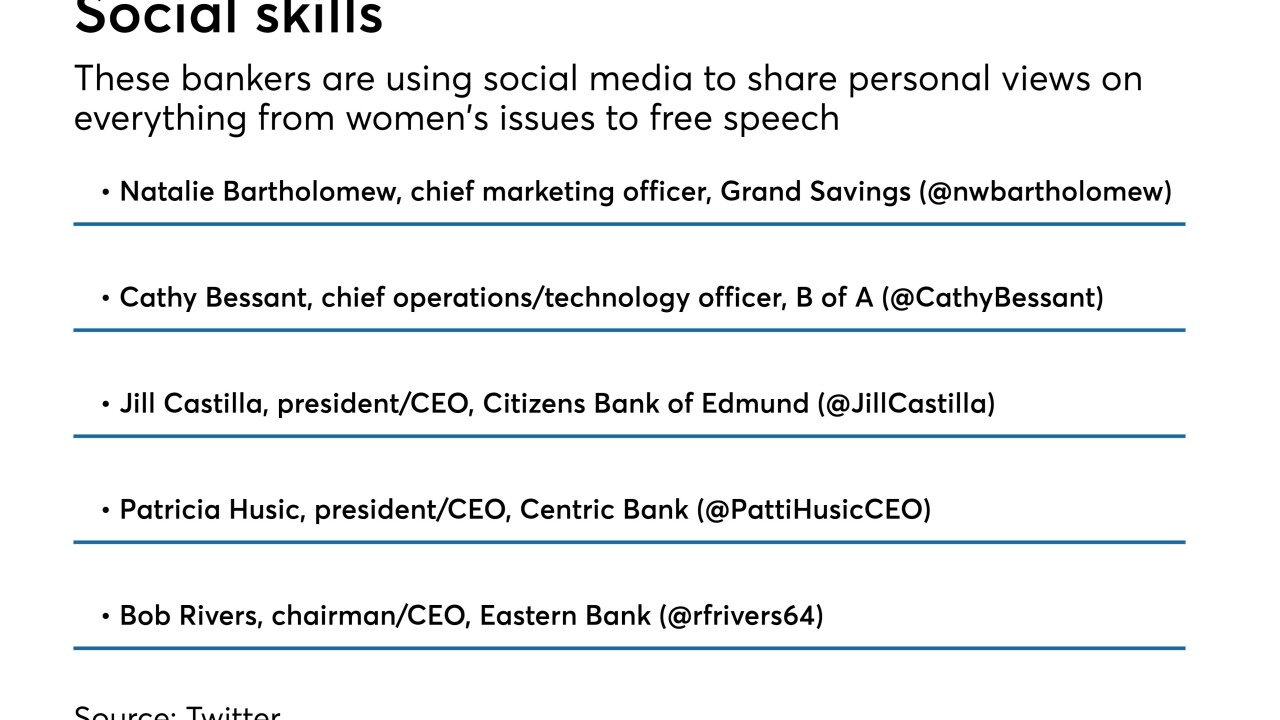

Bob Rivers, CEO of Eastern Bank, was praised and criticized after he called out a Boston sports radio station whose on-air personalities made insensitive remarks. The incident underscores why bankers must be mindful about the positions they take.

February 20 -

Cambridge Bancorp in Massachusetts is looking to prove to entrepreneurs that it is in the business for the long haul.

February 9 -

Capital One has been rolling out coffee shops where it can offer banking services — but are not considered branches. The cafes have been especially effective at gathering deposits, putting more pressure on community banks that have already been losing deposits to their larger rivals.

February 8 -

Credit unions across the country are making the most of American's passion for football and, in particular, the big game coming this Sunday.

February 2 -

The Massachusetts bank — and former credit union — bought Cumberland County Mortgage in Maine.

January 31 -

Scholarship programs for high schoolers and college students can also promote banking as a viable career option and serve as a channel for bringing in new business.

January 29 -

The new tax law took a one-time bite out of fourth-quarter results, but higher rates strengthened yields and new business boosted fee income.

January 23 -

BNY Mellon plowed some of its tax law savings into restructuring efforts.

January 18 -

The Boston mutual touted Deborah Jackson's role in promoting social justice and sustainability causes.

January 9 -

Attorney General Jeff Sessions’ decision to rescind an Obama-era directive that helped foster the marijuana sector’s growth raises new risks for banks and credit unions that do business with growers and dispensaries.

January 4