-

While industry consolidation remains slow compared with previous years, certain regions are humming along with strong volume and improved pricing. Here’s a look at each region based on June 30 data from KBW and S&P Global Market Intelligence.

July 14 -

Oregon-based CU increased its loan portfolio by $17.5 million.

April 25 -

TriMet, the regional transportation system based in Portland, Ore., recently began a test of a reloadable fare system and later this year it will add Near Field Communication-based payments via bank cards and smartphones to its pilot.

March 9 -

Oregon-based CU now can serve the licensed insurance industry nationwide.

March 1 -

Rogue Credit Union is growing rapidly, but insists it is not pursuing growth.

February 13 -

Real estate loans have been growing over the last few years despite a number of headwinds, but can CUs build on that trend as interest rates rise?

February 7 -

CUs’ impact in Oregon/Washington is equivalent to the annual revenue of Hershey, Mutual of Omaha.

February 3 -

If underwriting standards at other lenders begin to fall, how will CUs respond?

January 27 -

An influx of new people to the Pacific Northwest and Southeast could have big implications for banking, from M&A to de novo efforts.

January 10 -

Columbia Banking System in Tacoma, Wash., landed the first sizeable deal of the New Year with an agreement to buy Pacific Continental in Eugene, Ore.

January 10 -

The phony-accounts scandal at Wells Fargo illustrates how sales quotas can incent bad behavior. Is your bank effectively mitigating the risk of 'managing to metrics'? Or could it be in danger of becoming a 'cargo cult'?

January 2 -

Ray Davis is stepping down as Umpqua's CEO at yearend and transitioning to a new role as head of its year-old innovation lab. In his 22 years, he built Umpqua from a sleepy local bank into a regional powerhouse and internationally recognized brand.

December 5 -

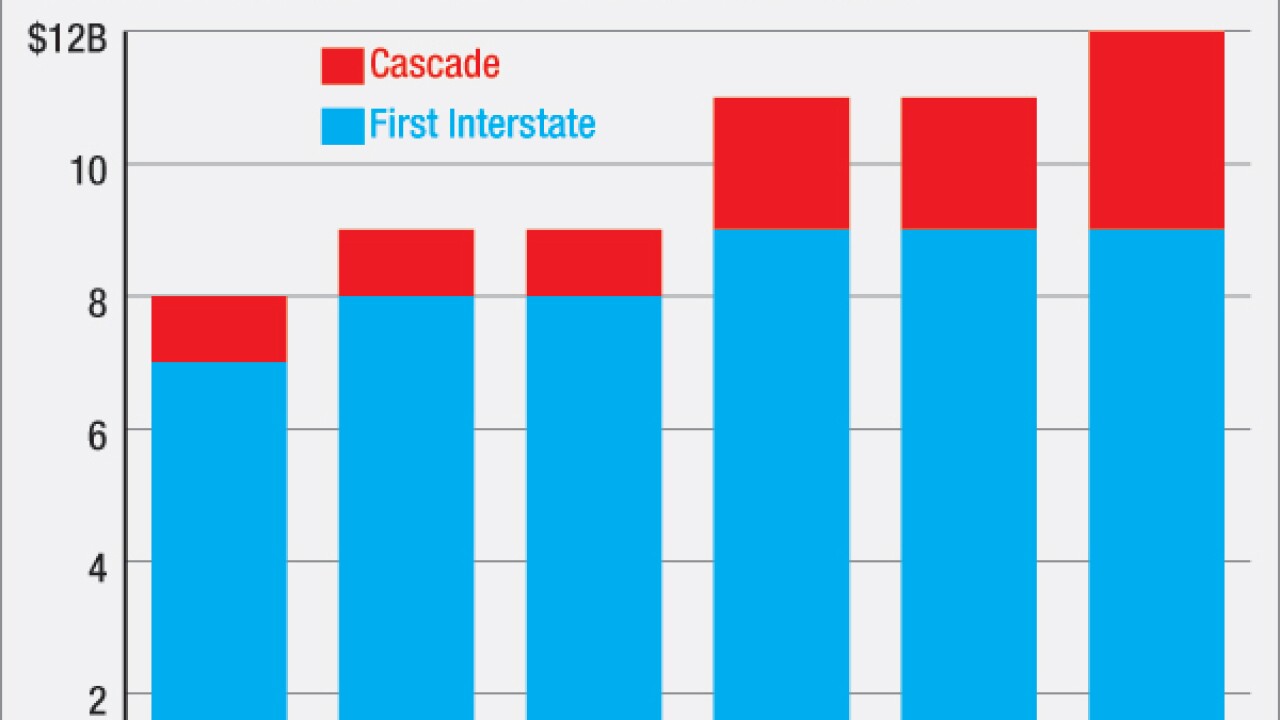

Montana's biggest bank will have to compete in cities such as Seattle and Portland, Ore., after buying Cascade Bancorp. But the company is arguably more excited about its chances to grow in central Oregon and Idaho, which are more like its existing markets.

November 18 -

Sen. Jeff Sessions is one of the marijuana industry's staunchest foes. He could upend efforts by the Obama administration to persuade banks that it is safe to work with cannabis firms.

November 18 -

The Klamath Falls, Ore.-based CU said Olney, a native of Southern Oregon, is a graduate of George Fox University and the Atkinson Graduate School of Management at Willamette University.

October 12 -

Umpqua Holdings in Portland, Ore., has formed a corporate lending office and hired Richard Cabrera to oversee it.

October 5 -

Pacific Continental in Eugene, Ore., has found a key position for an executive from a bank it recently bought.

September 8 -

Pacific Continental in Eugene, Ore., has appointed two former directors of a bank it bought to its own board.

September 7 -

Four years after the first states legalized marijuana, most bankers still want nothing to do with it.

July 31 -

His title may be changing, but Ray Davis' goal of altering the banking landscape remains the same. Davis, who will step down as Umpqua's CEO, will still run its innovation unit with a hope of influencing digital banking in the same way that he shook up retail banking.

June 23