-

It is important that all parties involved in construction projects not only be aware of these regulation updates and how they will impact their projects, but also what they can do to prepare for when the legislation inevitably reaches them, writes Matt Johnner, president and co-founder of BankLabs.

October 29 BankLabs

BankLabs -

Orrstown will pay $59 million in cash and stock to gain seven branches and $409 million in deposits.

October 24 -

The $380-billion asset company will soon join the parade of big banks and tech companies that are migrating online to meet the demands of business owners.

October 22 -

David Reed, a Republican, is stepping down as a state legislator after redistricting cost him a shot at a congressional seat.

October 17 -

BankMobile will remain part of Customers for at least two years after regulatory snags derailed a plan to transfer the unit to a Florida bank.

October 16 -

Citizens & Northern will pay $43 million for the $348 million-asset Monument.

October 1 -

It will also invest in mortgage and small-business lending and in neighborhood revitalization efforts there. The moves are part of a nationwide expansion by the largest U.S. bank.

September 24 -

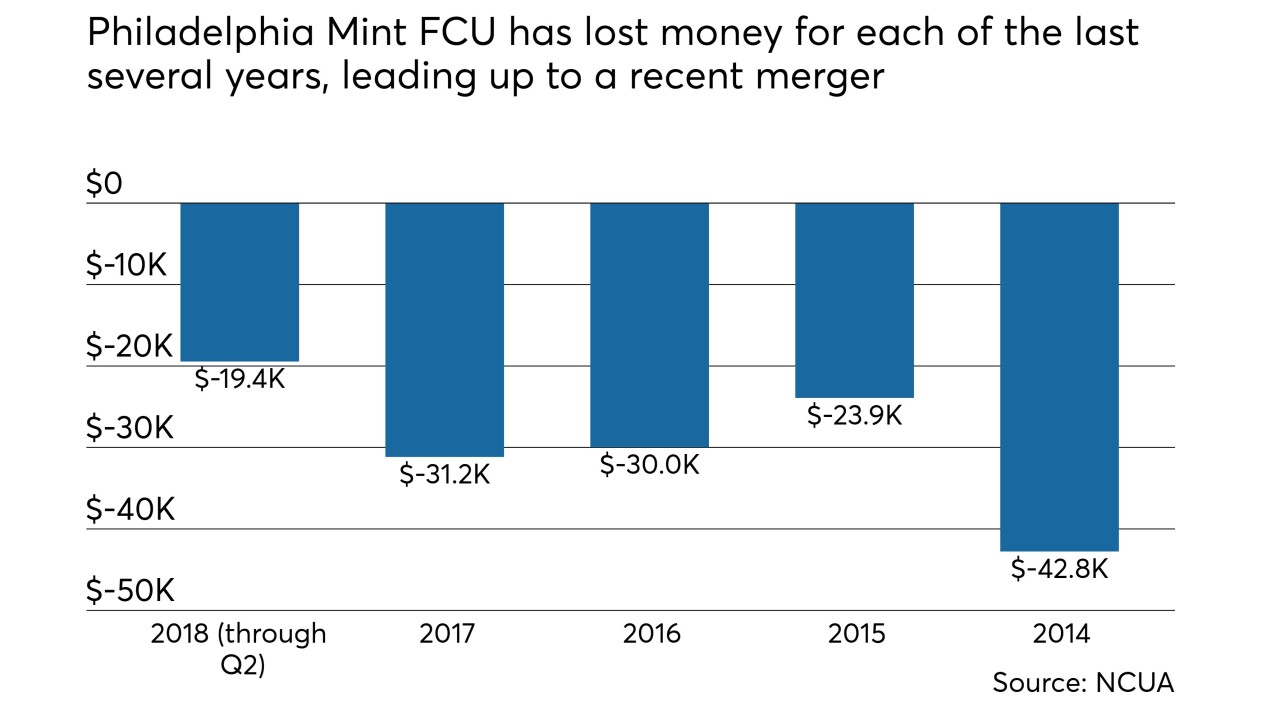

Philadelphia Mint FCU has lost money for each of the last several years.

September 13 -

After working to restore profitability and re-instituting growth policies, one CEO looks back on what it took to help a credit union change course.

August 23 Riverfront FCU

Riverfront FCU -

Craig Kauffman had been a regional executive for Susquehanna Bancshares and BB&T.

August 17 -

More than 100 staffers at the Allentown, Pa.-based credit union took to the picket lines in a dispute with management over compensation and benefits, forcing the credit union to temporarily close at least two branches.

August 16 -

Merger announcements typically follow a tried-and-true formula of cutting costs to boost profit. WSFS, however, plans to reinvest $32 million in new tech initiatives after buying Beneficial.

August 10

-

Customers Bancorp said Flagship Community Bank has temporarily withdrawn its application with the FDIC to acquire the digital bank.

August 10 -

While most acquirers are content to let cost savings trickle down to the bottom line, WSFS will use the purchase of Beneficial to reinvent itself.

August 8 -

The Delaware company plans to reinvest savings from the $1.5 billion acquisition to upgrade technology and delivery channels.

August 8 -

Once a hotbed of activity, the region has reported the fewest bank mergers since the financial crisis.

July 30 -

The industry continues to push for leniency as the clock ticks toward adoption of the drastic change to how banks account for expected loan losses.

July 27 -

The 2017 acquisition of Yadkin Financial was cited as a driver of growth for several fee-based businesses.

July 24 -

Brentwood Bank’s purchase of Union Building and Loan would give it a larger presence around the Steel City.

July 19 -

Matthew Prosseda, former president and CEO of First Keystone Community Bank, was hired by Kafafian Group to advise banks on strategic planning.

July 17