-

The Nashville, Tenn., company had opposed a request by Gaylon Lawrence to boost his ownership to 15%.

November 9 -

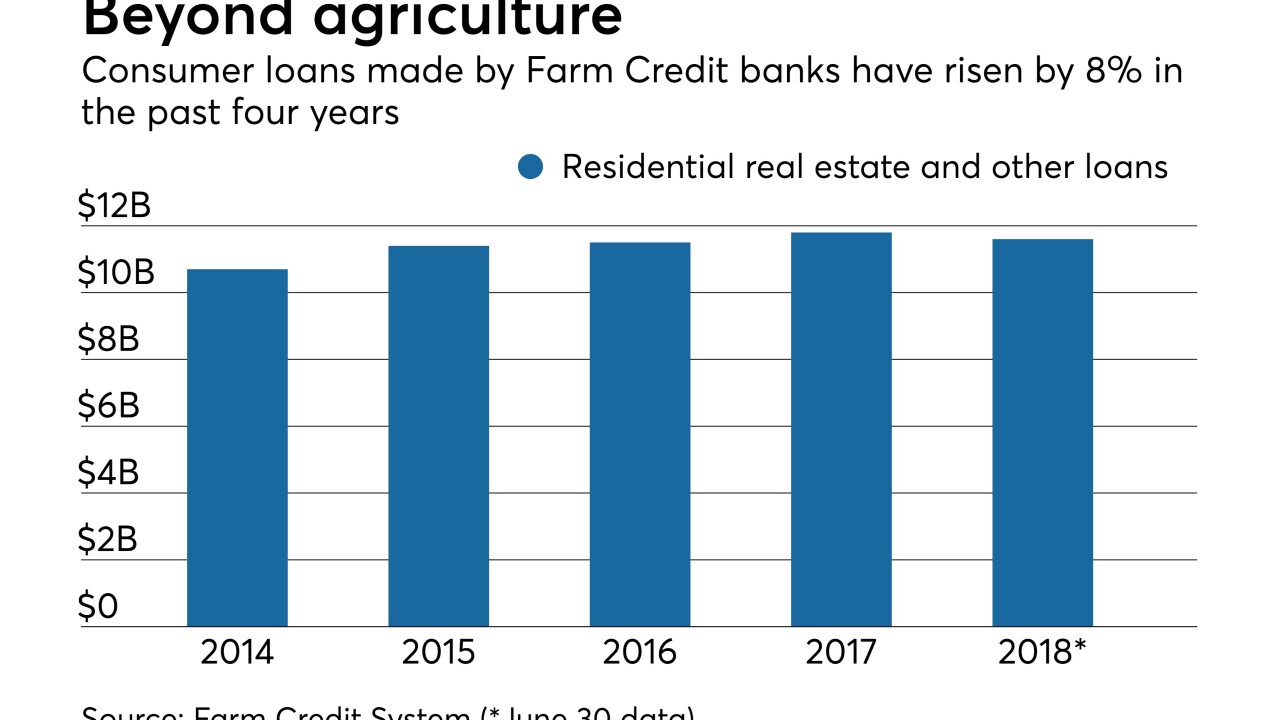

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

This is the first special dividend the Oak Ridge, Tenn., credit union has given out since 2005.

October 22 -

The Tennessee regional said the sale should boost quarterly profit by $160 million.

September 12 -

The Tennessee-based CU is issuing a $3 million special dividend and plans to make donations to local nonprofits in celebration of its 70th anniversary.

August 22 -

One-time items included $43.2 million of second-quarter expenses related to the Capital Bank acquisition, but First Horizon executives forecast sizable savings from the deal.

July 17 -

P. Byron DeFoor, who already has majority stakes in two community banks, is planning to buy First Columbia Bancorp.

July 16 -

FNS Bancshares has agreed to buy Catoosa Bancshares in Fort Oglethorpe, Ga., in all-cash deal.

June 28 -

SmartFinancial has agreed to buy Foothills Bancorp for $36 million. It would be SmartFinancial's fifth bank acquisition since 2012.

June 28 -

The company will pay $114 million to gain 10 branches and $482 million in assets.

June 11 -

Studio Bank is set to become Nashville's first new bank since 2008. Organizers raised $46 million earlier this year.

June 11 -

Credit unions in Tennessee and Ohio were singled out by the U.S. Small Business Association.

June 4 -

Fulton Financial, Univest Corp. of Pennsylvania and Franklin Financial Services disclosed a total of $75 million in exposure to the commercial relationship.

May 31 -

As other banks de-emphasize mortgage lending, Citizens is spending half a billion dollars to buy a large originator with a big servicing portfolio.

May 31 -

James Ayers' stake in the Tennessee company will drop below 50% after a planned stock offering.

May 22 -

The Nashville company significantly reduced the 2018 earnings projection for its mortgage business.

May 21 -

Organizers of Studio Bank in Nashville have raised more than $40 million, satisfying the minimum amount set by regulators.

April 18 -

The company, which completed a major acquisition last year, said tax reform will help it generate a higher return on average assets.

April 17 -

The Alabama bank agreed to buy Peoples Bank for $23 million as part of a plan to target new Southeastern markets.

April 17 -

First Horizon CEO Bryan Jordan said the bank is still on track to meet cost-cutting targets from its November acquisition of Capital Bank in North Carolina.

April 13